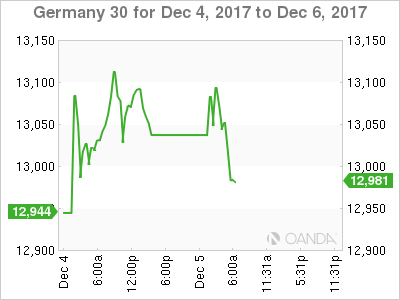

The DAX index has losses on Tuesday, erasing the small gains seen on Monday. Currently, the DAX is at 13,000.00, down 0.45% on the day. On the release front, German Final Services PMI edged lower to 54.3, short of the forecast of 54.9 points. Eurozone Final Services improved to 56.2, matching the forecast. On Wednesday, Germany releases Factory Orders and the Eurozone publishes Retail PMI.

Talks between Britain and the European Union appear to be back on track, after Prime Minister May essentially agreed to Europe’s demands over the Brexit bill, which could reach up to EUR 50 billion. Still, a breakthrough on the non-trade issues has been elusive. There were hopes that a breakthrough would be announced on Monday, following talks between Prime Minister May and European Commission President Jean-Claude Juckner, but the gaps on two issues remain, for now. One thorny issue is that of northern Ireland and its border. The UK will clearly not remain in a customs union with the EU, but Ireland is insistent that there not be a hard border with the North, while the DUP, which is propping up the May government, is strongly against any border between the UK mainland and Northern Ireland. The second issue is whether the European Court of Justice will have a role protecting European citizens in the UK. The EU is in favor of a role for the court, while many British lawmakers feel that such a move would impinge on British sovereignty. The EU holds a meeting on December 12, and May is anxious to wrap up the non-trade sticking points and move on to trade talks by that date.

The DAX continues to enjoy the view around the symbolic 13,000 level, as global stock markets have been fueled by the quick progress of tax reform legislation in the US. The Senate passed a tax reform bill on the weekend, but the vote was a squeaker, 51-49, as the vote went along party lines, with one Republican voting against the bill. Now that that the House and the Senate have passed tax bills, a conference committee will try and hammer out a uniform bill which can be sent to President Trump and signed into law. If the bill does become law, it will mark the first major tax reform in the US in 30 years, and this would likely receive a thumbs up from investors and send global stock markets upwards.

Economic Calendar

Tuesday (December 5)

- 3:55 German Final Services. Estimate 54.9. Actual 54.3

- 4:00 Eurozone Final Services PMI. Estimate 56.2. Actual 56.2

- 5:00 Eurozone Retail Sales. Estimate -0.6%

- 5:00 Eurozone Revised GDP. Estimate 0.6%

- All Day – ECOFIN Meetings

Wednesday (December 6)

- 2:00 German Factory Orders. Estimate -0.1%

- 4:10 Eurozone Retail PMI

*All release times are GMT

*Key events are in bold

DAX, Tuesday, December 5 at 6:35 EDT

Open: 13,055.75 High: 13,095.50 Low: 12,994.00 Close: 13,000.00