The DAX index is unchanged in the Friday session, trading at 12,297.50, up 0.01% on the day. On Thursday, the index climbed to a high of 12,363.60, its highest level since July 24. On the release front, there is only one event on the schedule. Germany’s trade surplus narrowed to EUR 19.5 billion, short of the forecast of EUR 20.3 billion.

Is the ECB sending out mixed signals about its quantitative easing (QE) program? One could make that argument after the ECB policy meeting on Thursday. The QE program, in which the ECB purchases EUR 60 billion/month, is slated to end in December, and the markets were hoping for some guidance about the ECB’s plans. The rate announcement was surprisingly dovish, as policymakers said that QE would not be tapered before December, and left the door open to further stimulus in 2018, if necessary. However, Mario Draghi presented a more hawkish stance in his follow-up press conference, saying that the ECB would make a decision on how to scale back stimulus in October. In his remarks, Draghi made direct reference to the exchange rate, noting that “the recent volatility in the exchange rate represents a source of uncertainty, which requires monitoring.” Draghi & Co. are clearly concerned by the euro’s appreciation, as the EUR/USD has soared 14 percent in 2017. The stronger euro has made imports less expensive, thus reducing inflation and hampering the ECB’s efforts to raise inflation levels. The ECB has now cut its inflation forecast to 1.2 percent in 2018 and 1.5 percent in 2019, well short of its target of just below 2 percent.

Germany’s economy has been robust in 2017, and economic indicators have generally pointed upwards. However, this week’s numbers have been unexpectedly soft. Earlier this week, Factory Orders declined 0.7%, well off the forecast of a 0.2% gain. This marked a 3-month low. German Industrial Production followed suit, as the reading of 0.0% missed the estimate of 0.5%. On Friday, Germany’s trade surplus dropped to EUR 19.5 billion, the smallest surplus since January. Why the downturn? Global demand, which had been very strong in the first half of 2017, is showing signs of softening, and this had a negative impact on the manufacturing sectors in Germany and throughout the eurozone. This has also had a negative impact on exports, which was reflected in the Germany’s smaller surplus in July.

Economic Calendar

Friday (September 8)

- 2:00 German Trade Balance. Estimate 20.3B Actual 19.5B

*All release times are EDT

*Key events are in bold

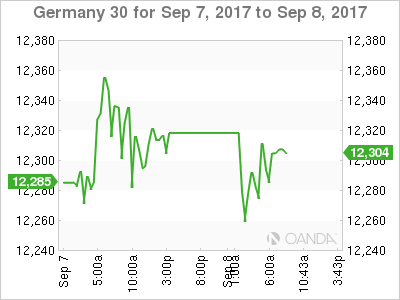

DAX, Friday, September 8 at 7:40 EDT

Open: 12,260.50 High: 12,322.00 Low: 12,244.50 Close: 12,304.90