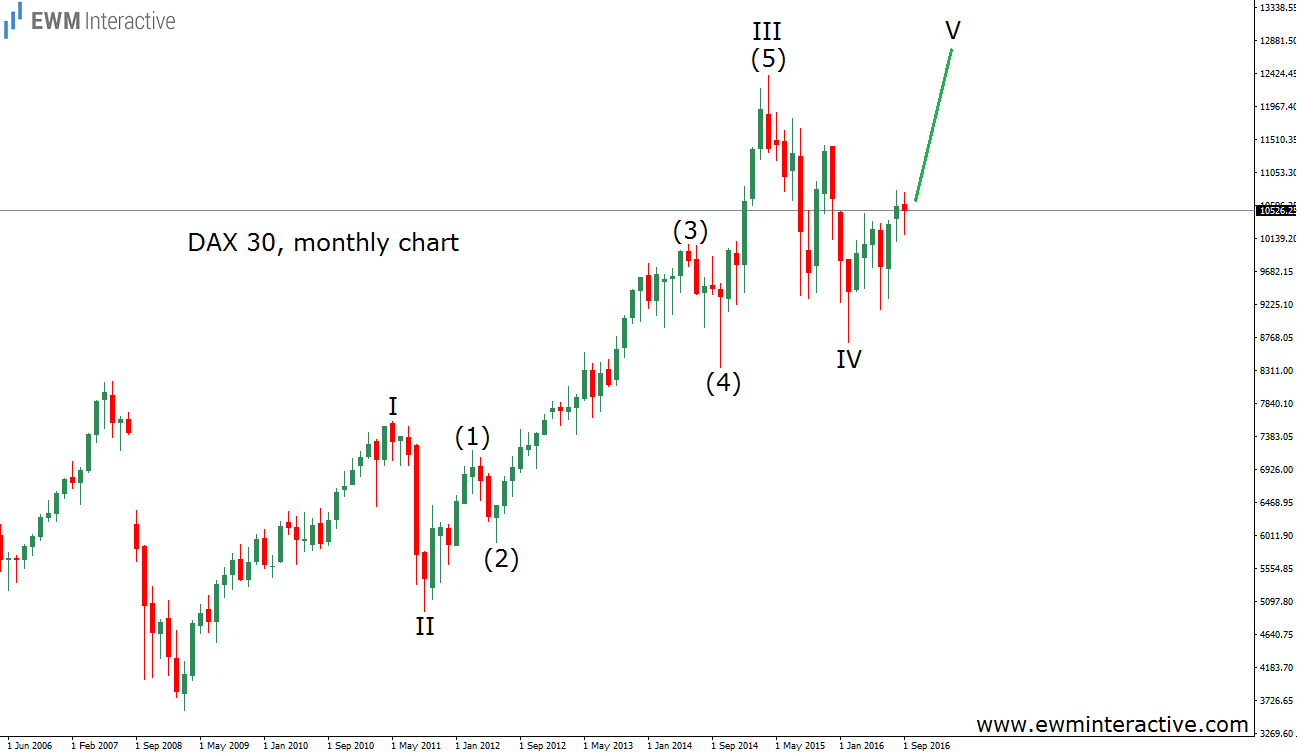

DAX 30: Stage is Set for a New All-Time High was published on October 3rd, 2016. While the German benchmark index was trading close to 10 530, Elliott Wave analysis of its monthly chart made us believe the bulls are going to succeed at lifting it above 12 400 in the months ahead. That was over a month before the so-called “Trump rally”, which proves that Ralph Nelson Elliott was right when he said that “the habit of the market is to anticipate, not to follow.”

That is how the German DAX 30 looked like eight months ago. The logic behind the bullish outlook was simple: trends tend to develop in the form of a five-wave pattern, called an impulse. Since the fifth wave – V – of the post-March 2009 uptrend was missing, we assumed the bulls were not done just yet. In 99 out of 100 times, the fifth wave would exceed the extreme of the third wave of the same pattern. Therefore, the DAX 30 was supposed to rise to a new all-time high.

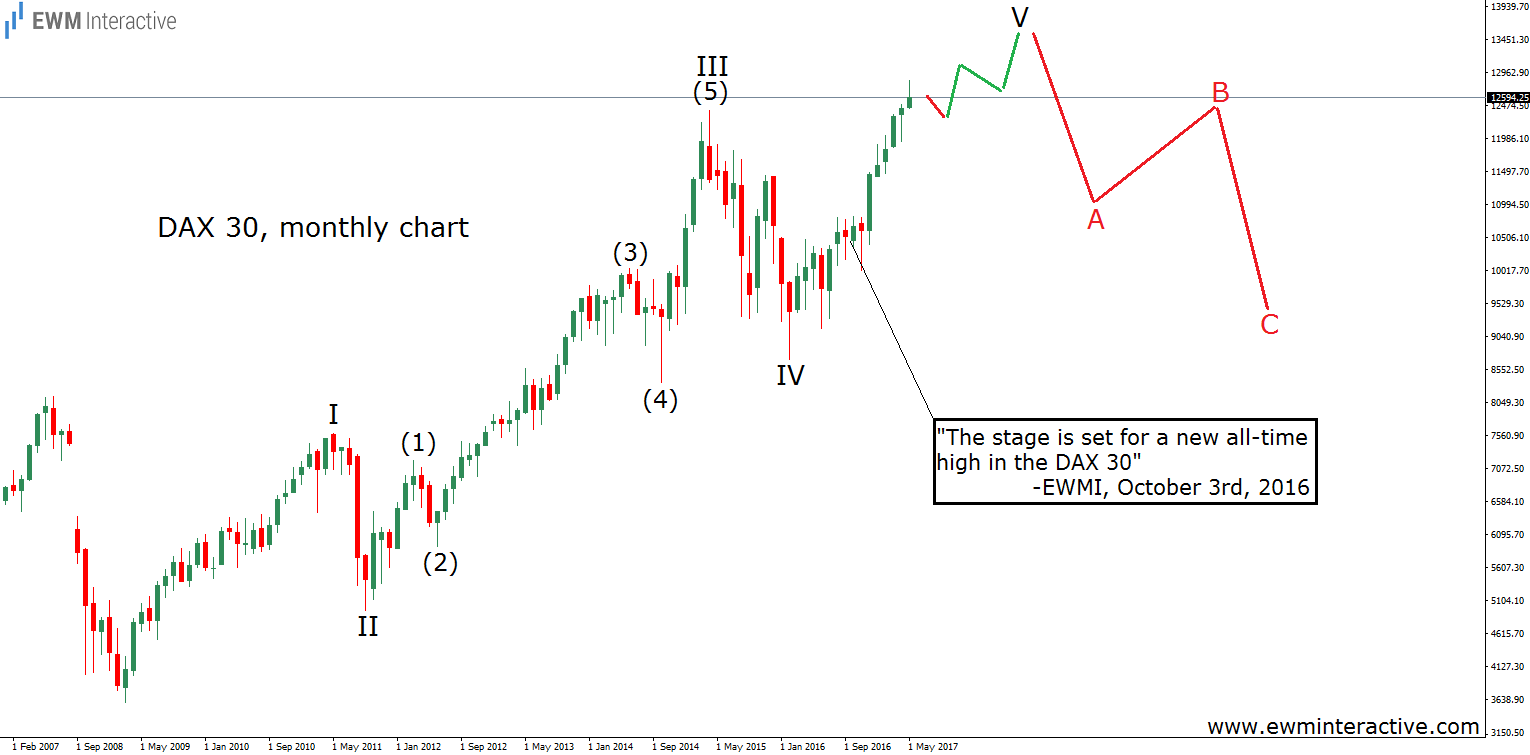

On May 16th, 2017, it climbed to as high as 12 841, which is exactly 444 points higher than the top of wave III. Well done, now what? According to the theory, every impulse is followed by a correction of three waves in the opposite direction, which normally retraces back to the termination area of the fourth wave. This means that once wave V ends somewhere between 13 000 and 14 000, the bears should return to cause a 30%-35% pullback in the German blue chip index. From a technical standpoint, it is too late to buy and too early to short, so staying aside appears to be the best thing to do.