S&P 500 Futures have just touched all-time highs at 2945. USD and Brent are one step back from last week highs. In anticipation of the data-rich with potentially high volatility.

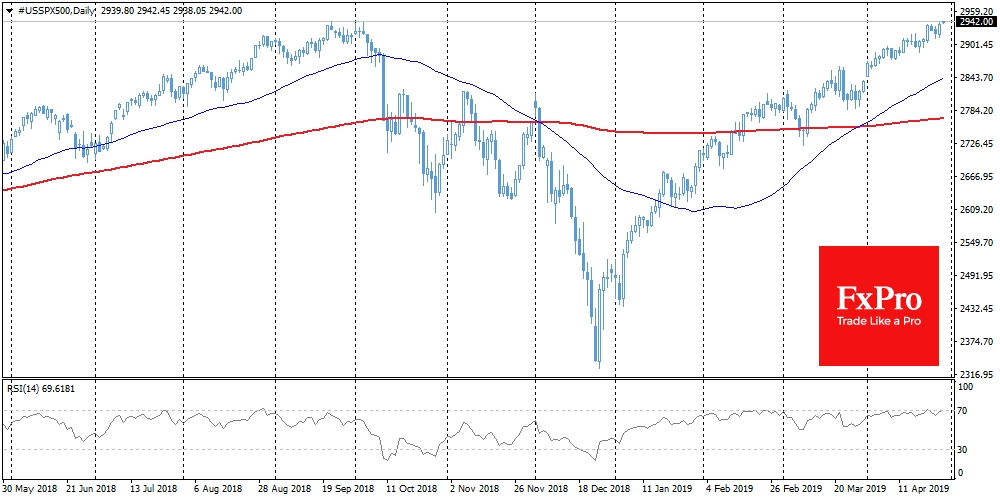

Stocks

S&P 500 and Nasdaq continue their climb to the historic highs. Particularly encouraging that this growth has intensified by the end of the trading session on Friday. This dynamic indicates demand from professional market participants and, often, sets the tone for the next trading day. It works this time as the Shanghai’s China A50 index has jumped by 2.5%, while S&P 500 futures have just touched all-time highs at 2945. Monday trading is usually calm but traders should pay attention to the fact that the coming days may turn out to be the turning points on the markets, due to the extremely high concentration of macroeconomic events: from FOMC and BoE meetings to US Payrolls and EU PMI and CPI.

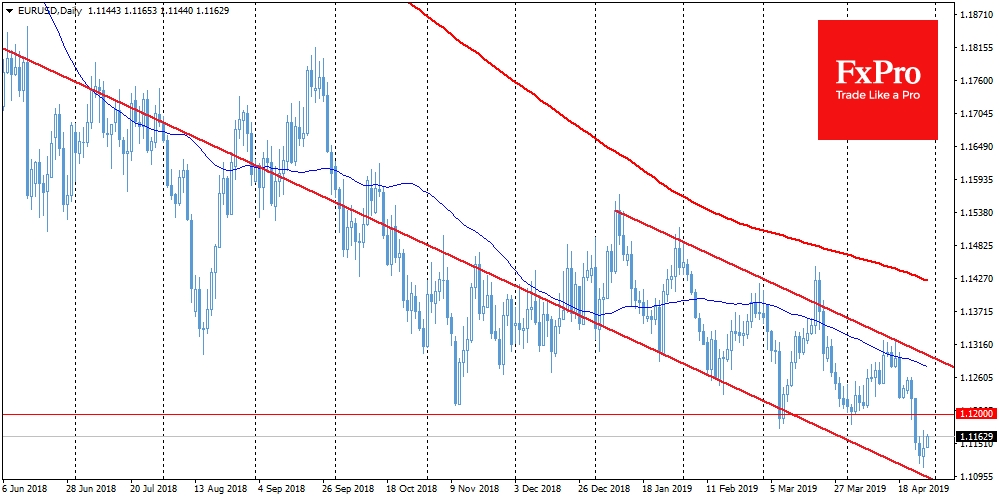

EUR/USD

On Monday morning, the pair is near 1.1160, showing attempts to turn to growth after touching levels near 1.1100. Weak European statistics have contributed to the downtrend in EUR/USD, which even managed to break through support at 1.1200. Nevertheless, the current trend has to pass an important test this week. Further softening of the Fed tone and a weak labour report are able to reverse the USD upward trend. It is also worth to remember about Trump’s possible pressure on the Fed’s actions that can cause the dollar growth.

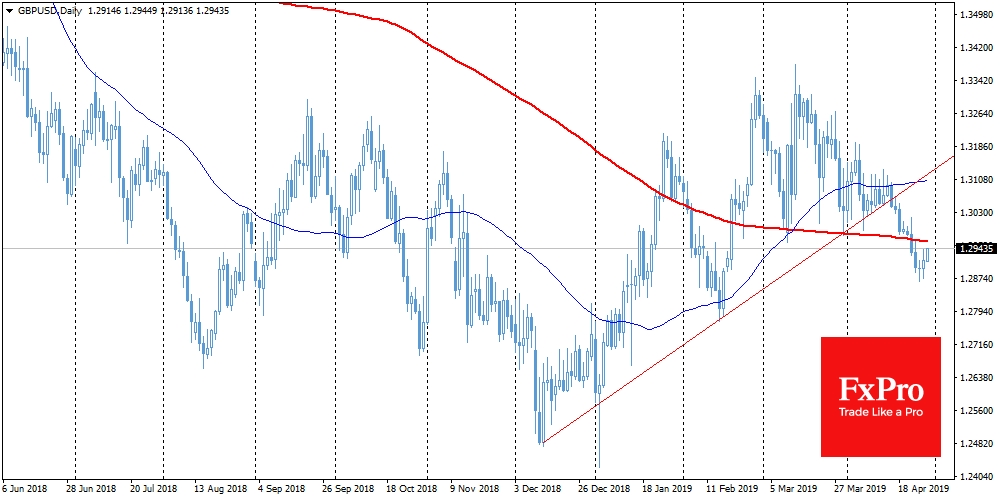

GBP/USD

The British pound is growing cautiously Monday morning, trading at 1.2940. Fans of technical analysis should pay attention to the pair’s dynamics near 1.2960, through which the 200-day moving average passes. The return to the area above this level can increase purchases, making investors confident that GBP/USD can consolidate above 1.30.

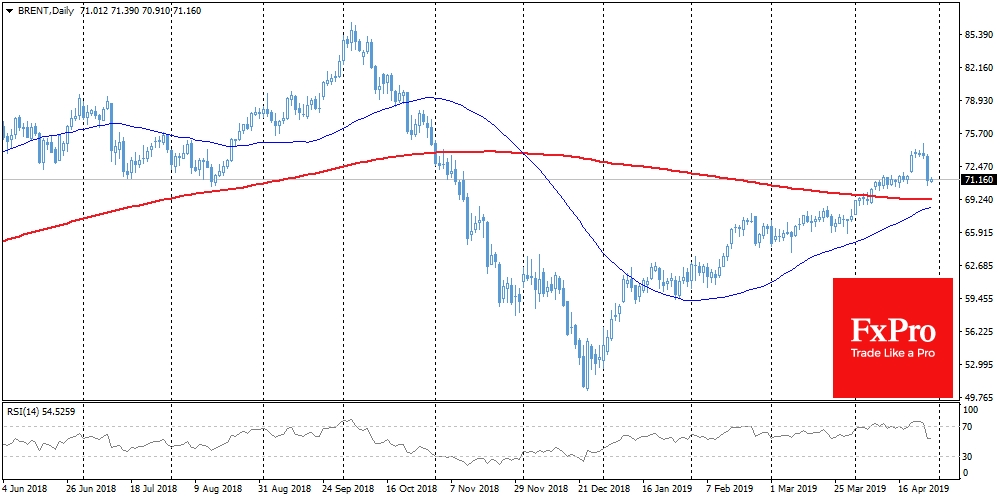

Brent

On Friday, oil declined by 5% against Thursday’s levels. It is equally important that the pressure on Brent persists this morning. By the time of writing, Brent is trading near $71, against peak levels of $74.70. It seems that now investors are waiting for the new impulses of growth above $75.