It looks as though we finally have a deal in place between the Eurogroup and Greece. Under the agreement, Greece will be getting a third bailout of €86 billion - a "bridge" facility. In return Greece agrees to have the parliament pass legislation on a number of harsh concessions.

The outcome of this mess for Greece is not pretty.

1. The nation is humiliated, forced to accept austerity measures that are harsher than what the Greeks voted against in the referendum.

2. Greece will be deeper in debt, with outstanding balances going above €400 billion.

3. Greek banks are still unable to function and will need to be massively recapitalized. It's not clear where the funds will come from as the €86 billion will be needed to run the government and pay existing debt.

4. Capital controls will stay in place for months to come.

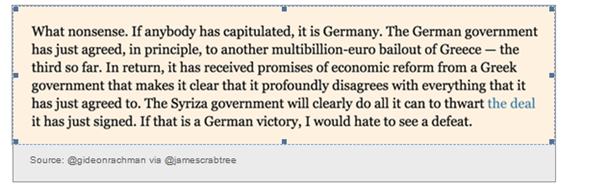

5. Economic confidence has been completely destroyed; investment, consumer spending will shrink sharply. So much for renegotiating the deal with troika. And that's assuming Tsipras actually gets this through the parliament. On the other hand some argue that it's the Eurogroup who go the raw end of the deal.

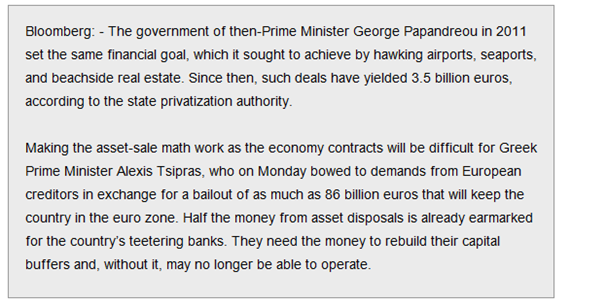

Indeed the Greek implementation of these measures is likely to look like a "slowdown strike". And some of these measures are simply not implementable. For example the €50 billion of asset sales is a joke - it's been tried before with little success.

Whatever the case, we are going to be back here in a matter of months as the current or more likely some other Greek government attempts to renegotiate the deal - again. Moreover, the backlash against the Eurogroup in Greece will continue to become more acute.

The markets loved this deal. Here is the Greek government short-term note yield - it's as if nothing happened.

German (and other) shares globally rallied sharply on the news.

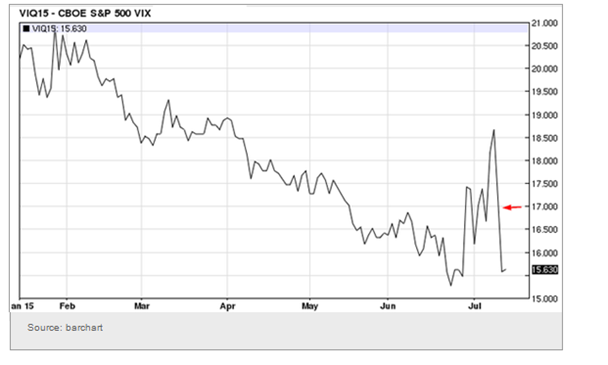

VIX had a massive single-day decline - I don't recall seeing a move like this on VIX futures in years.

The Nasdaq Composite had a couple of good days.

The euro on the other hand declined 1%, as market participants reenter the carry trade. "Risk-on" is back.

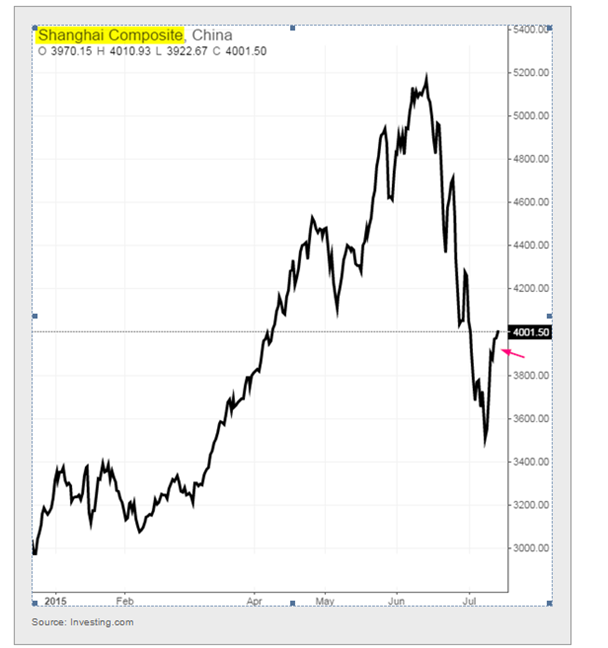

Turning to China, here is the Shanghai Composite. With short-sellers and large investors mostly prohibited from selling, the market is now "safe". Enjoy!

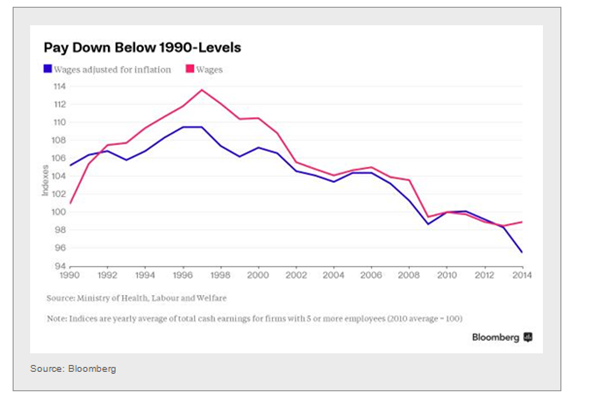

Now on to Japan, where we see wages continue to decline. This is not a great development for the Abenomics efforts.

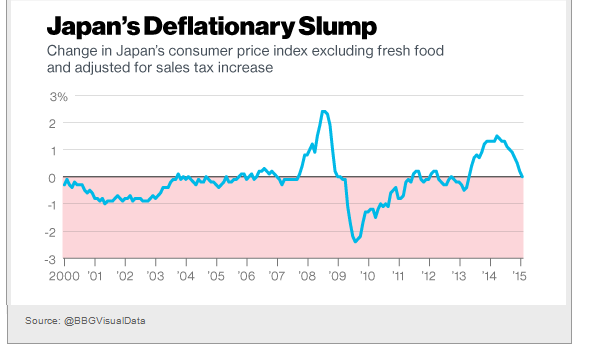

Moreover, Japan's economy is looking disinflationary again - what happened to the 2% CPI target?

Disclosure: Originally published at Saxo Bank TradingFloor.com