Investing.com’s stocks of the week

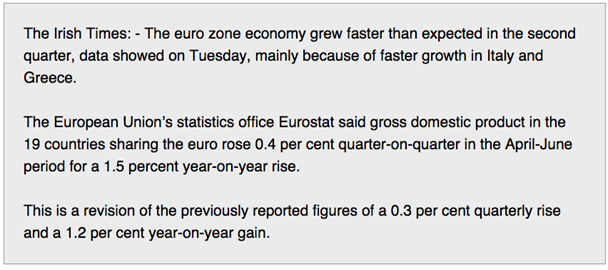

- Italy and Greece speed up Eurozone GDP growth

- French economy continues to struggle

- China's trade surplus is deceptively strong

- Netherlands and Germany heavily exposed to EM

- Copper and Aluminium lead the commodity revival

Let's start with the Eurozone where the latest GDP report beat economists' estimates.

France continues to struggle to get its economy moving.

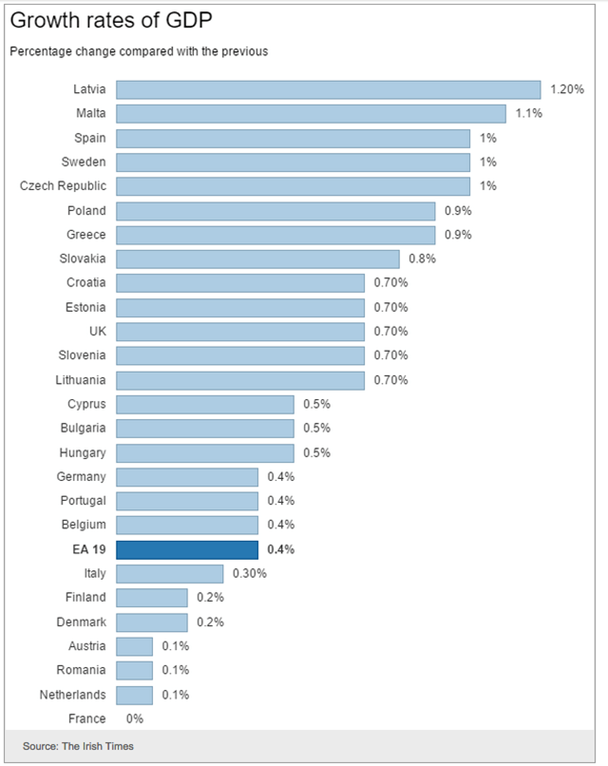

Some are suggesting that this ongoing improvement in the euro area is likely to be temporary. The chart below for example points to the divergence between the Eurozone economic surprise index and the cyclical/defensive equity ratio. The divergence is due to some of the corporate sector's exposure to emerging markets.

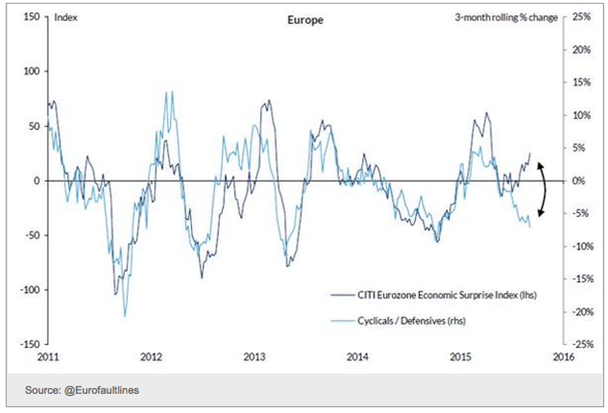

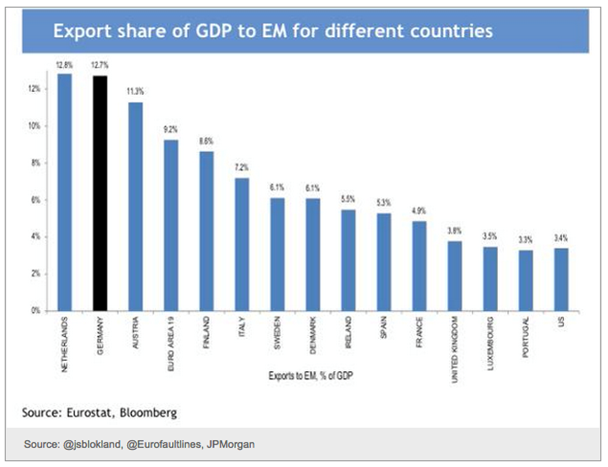

Below is the breakdown by country showing where the exposure is most pronounced. This is why, for example, the emerging markets' impact on the US will be limited.

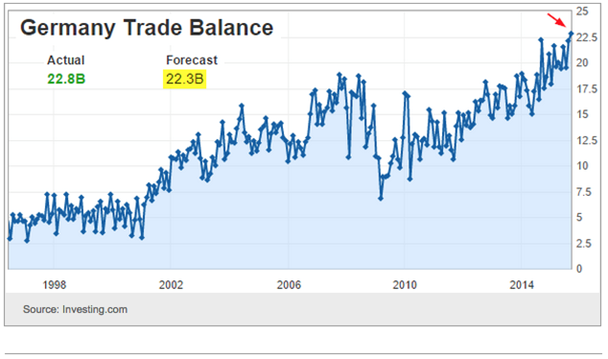

So far however we haven't seen much of an impact in the Eurozone. The latest data from Germany shows that the nation's trade surplus is at record levels. On a separate note, Germany needs to increase spending because such growing imbalances are not great in the long run.

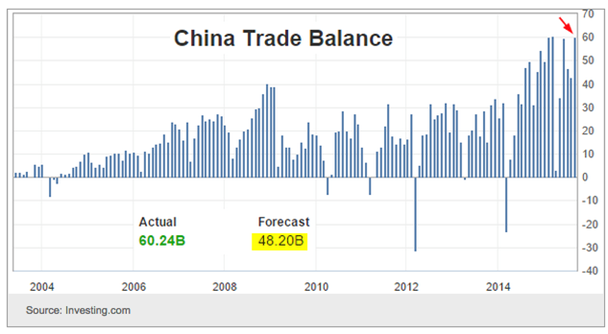

Turning to China, the latest trade data from that nation also shows the trade surplus near record levels.

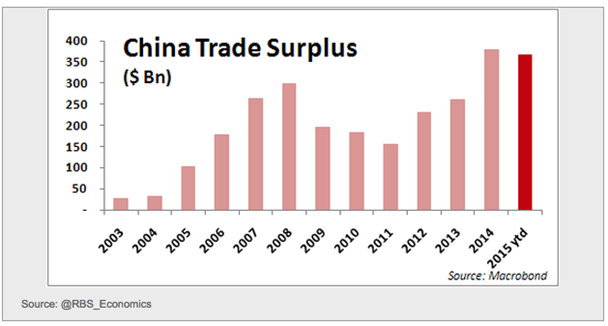

Here is the same chart annualised - 2015 year-to-date is already almost as large as the whole of 2014.

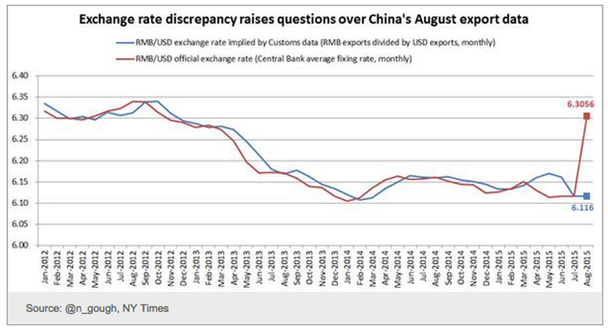

Some are questioning the veracity of the nation's export data however. It seems that China Customs may have used the wrong exchange rate (ignoring the devaluation) in determining China's exports.

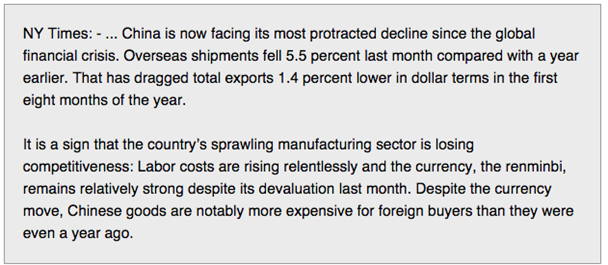

A deeper look suggests an ongoing slowdown across the nation's industrial complex. With the currency remaining relatively strong, and domestic wages rising, China is becoming less competitive.

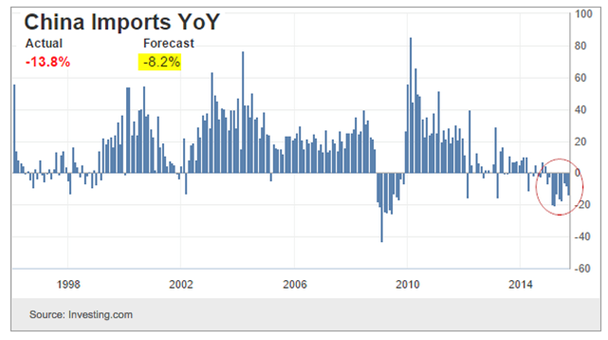

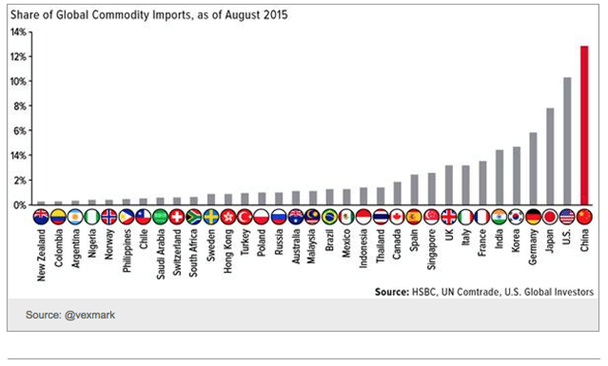

The sharp decline in imports, especially commodities, has been the main reason for the spike in China's trade surplus. Here is why global commodity producers are hurting.

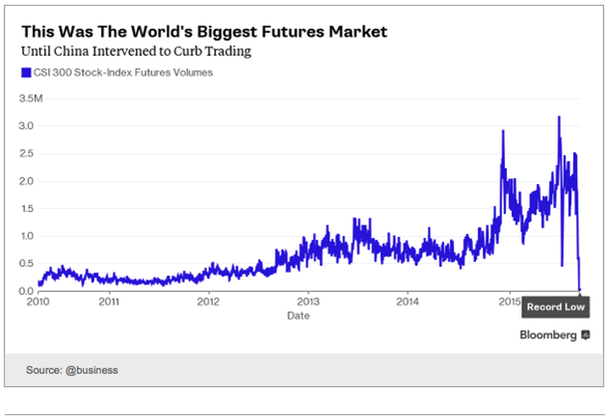

China's equity futures market became the biggest in the world recently. But Beijing's latest efforts to stem the selloff ended up reversing that growth. In futures trading, for every long position there is a short position. And since shorting became "unpatriotic", so went the futures market.

By the way, China's equity markets had quite a rally in the last hour of trading on Tuesday, Shanghai Composite close, below. The "Beijing put" is back. Markets across Asia are rallying this morning.

Speaking of Asian markets, the Nikkei 225 gains for the year were wiped out as foreign investors exit Japan. This looks like a good time to get in.

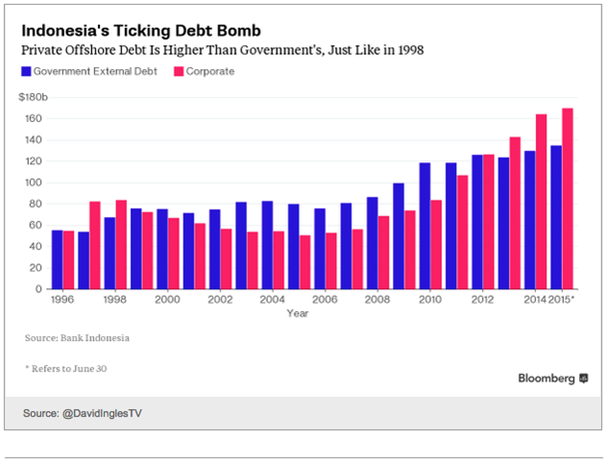

One emerging economy in Asia that will be watched closely in the coming months is Indonesia. The currency, the rupiah, is off sharply relative to the dollar, increasing the nation's debt burden. That's because a great deal of private sector debt is denominated in US dollars.

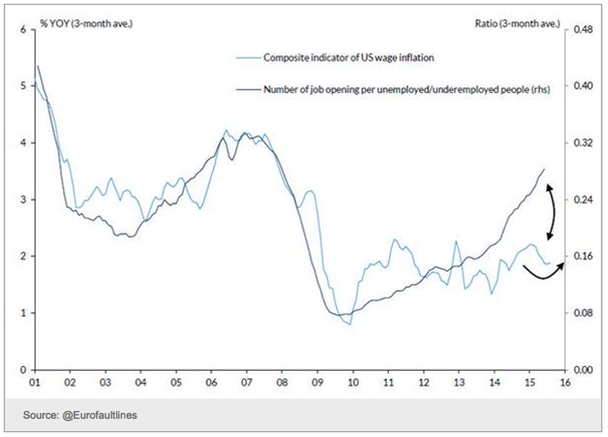

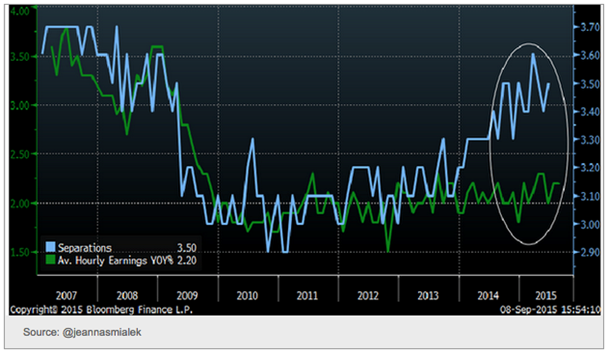

Back in the United States we see debate continuing about the following divergence. Job openings and the numbers of people voluntarily quitting have been on the rise but wage growth remains subdued. According to many economists this means that wage growth is about to accelerate.

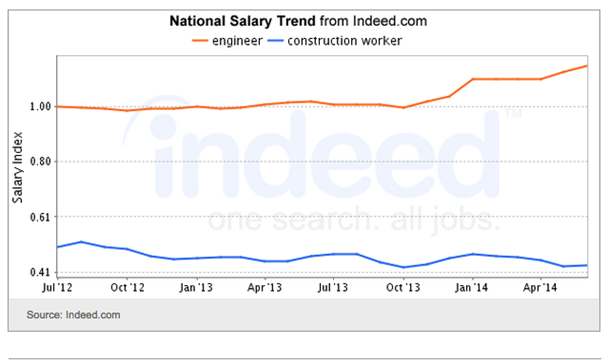

But we've heard this story before and still no "wage pressures". So what's going on here? One simple answer is the skills gap. Yes there is pressure in a number of specialised skills markets. But that doesn't necessarily translate into the broader workforce. Here is an example showing two national salary trends.

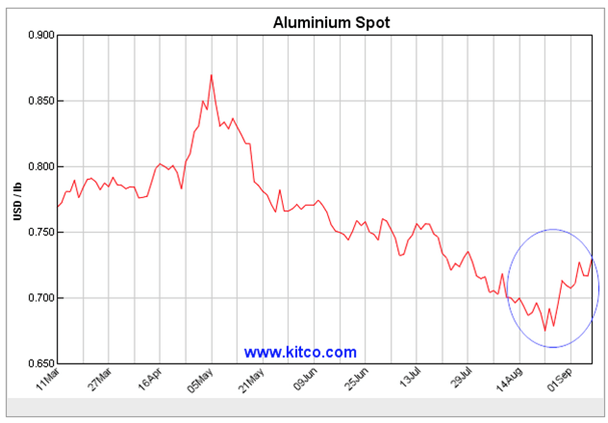

In the commodities markets we see signs of stabilisation - for now. Here is copper and aluminium for example.

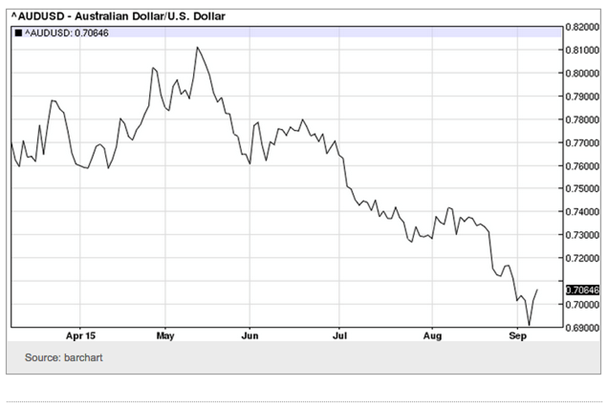

Related to the above, the Australian dollar seems to have stabilised as well. The "risk-on" sentiment is back..

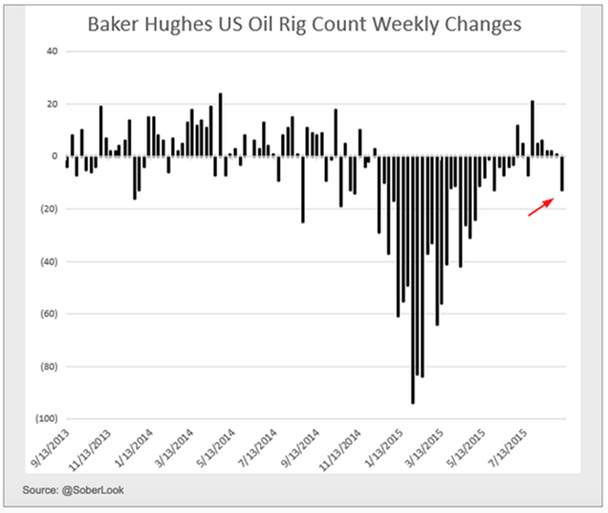

Crude oil markets remain highly volatile. One thing that's clear however is that US production will continue to gradually decline at current prices.

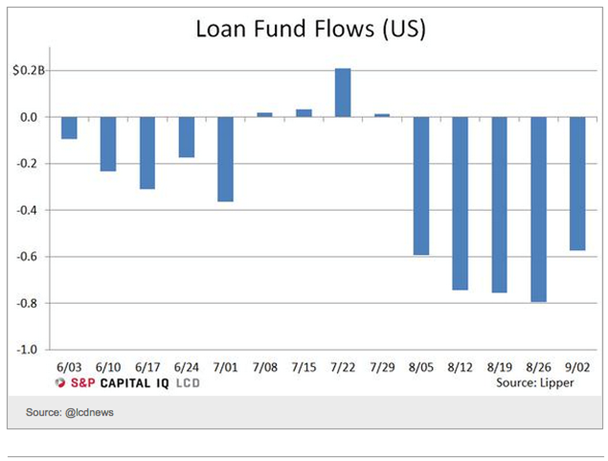

In credit markets we see another redemption streak from leveraged loan funds. Some of this is overdone - driven by the energy markets. Outside of energy and mining, this asset class remains healthy with default rates at multi-year lows.

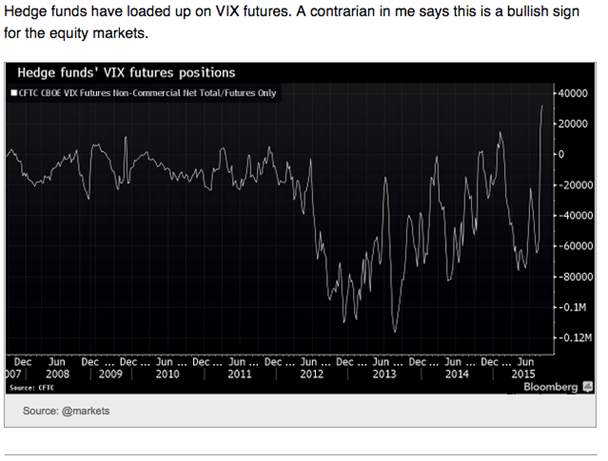

Hedge funds have loaded up on VIX futures. A contrarian in me says this is a bullish sign for the equity markets.

Disclaimer:The Saxo Bank Group entities each provide execution-only service and access to Tradingfloor.com permitting a person to view and/or use content available on or via the website is not intended to and does not change or expand on this. Such access and use are at all times subject to (i) The Terms of Use; (ii) Full Disclaimer; (iii) The Risk Warning; (iv) the Rules of Engagement and (v) Notices applying to Tradingfloor.com and/or its content in addition (where relevant) to the terms governing the use of hyperlinks on the website of a member of the Saxo Bank Group by which access to Tradingfloor.com is gained. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Tradingfloor.com or as a result of the use of the Tradingfloor.com. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. When trading through Tradingfloor.com your contracting Saxo Bank Group entity will be the counterparty to any trading entered into by you. Tradingfloor.com does not contain (and should not be construed as containing) financial, investment, tax or trading advice or advice of any sort offered, recommended or endorsed by Saxo Bank Group and should not be construed as a record of ourtrading prices, or as an offer, incentive or solicitation for the subscription, sale or purchase in any financial instrument. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws. Please read our disclaimers: