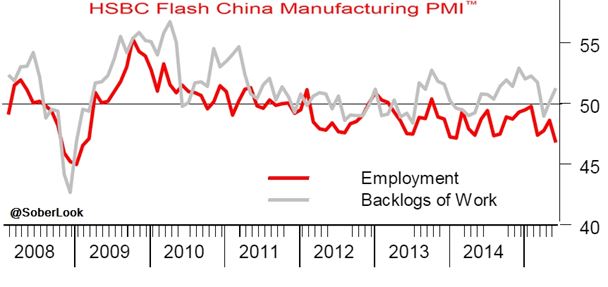

Let's begin with China where the HSBC manufacturing PMI report came in better than expected. China's manufacturing is still contracting but the results are mixed. New orders seem to have picked up, but manufacturing employment is declining.

Source: Markit

China's stock market ignored the better-than expected PMI number and continued its sell-off. The market is not only decoupled from global events but also from domestic developments. The Shanghai Composite is down over 15% from the peak - the worst decline since 2008.

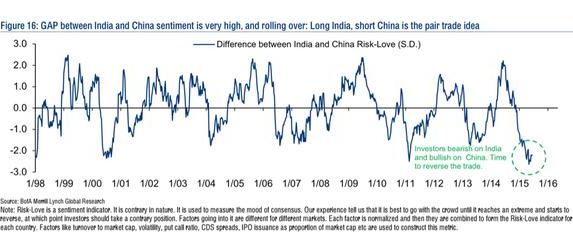

By the way, Merrill Lynch says that investor sentiment has been too positive on China and too negative on India. The chart below shows the difference between the two sentiment indicators.The trend should soon reverse. Perhaps.

Speaking of global events, the markets are pleased with the latest news out of the Eurozone/Greece. It seems that Greece may be playing ball. Time to kick the can down the road. Again. The Euro Stoxx 50 index jumped 4% on the news.

The Portuguese 10-Year government bond yield dropped below 3%.

And an index of Greek banking shares is up 20% in one day.

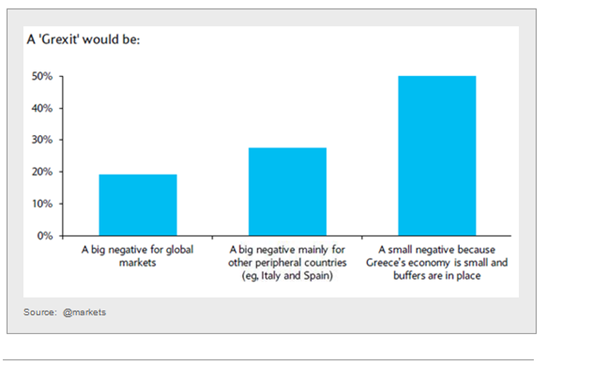

According to the latest Barclays survey, investors are not too worried about Greece.

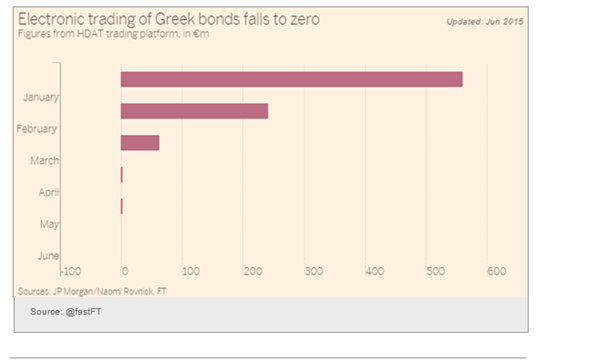

By the way, Greek bonds have become extremely illiquid since the beginning of this year. The lower bond liquidity is a global phenomenon which has been particularly acute for Greek paper.

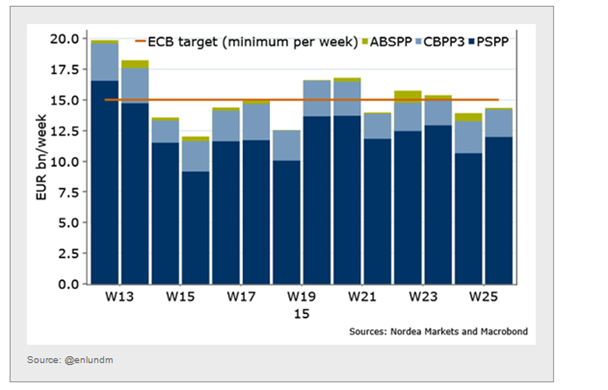

In other Eurozone developments, the promised summer acceleration of QE is nowhere to be found. The idea was to buy more bonds during early summer in order to be less disruptive to the European markets during August when liquidity disappears.

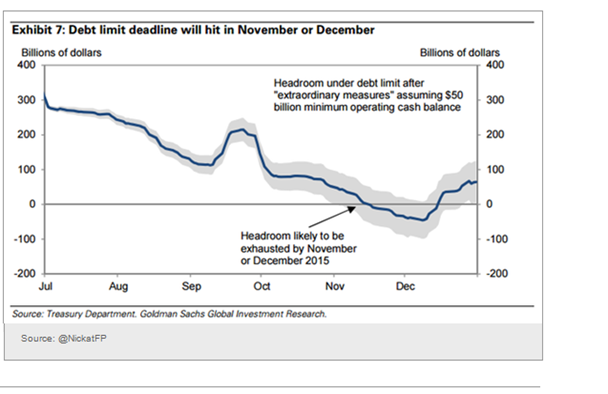

In the US we are likely to revisit the old debt ceiling mess this fall. Again.

Disclosure: Originally published at Saxo Bank TradingFloor.com