Market Summary

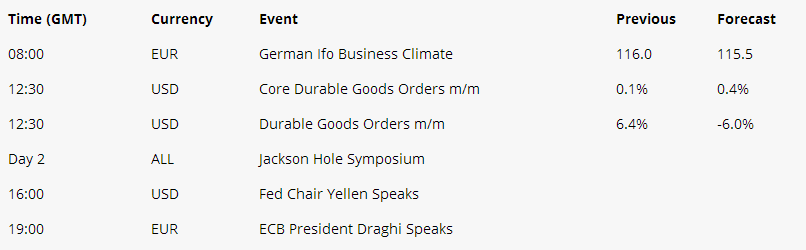

There was still caution on Thursday ahead of the Jackson Hole summit expected to begin later in the day, but investors seemed hopeful that news from that event would help dissipate risk-off sentiment. Throughout the week, market participants were unable to establish a direction ahead of the Jackson Hole meeting. Federal Reserve chair Janet Yellen and ECB President Mario Draghi are scheduled to later today, which could mean another directionless day in the markets.

Asian markets ended Thursday modestly higher. Hong Kong led the region as the Hang Seng played catch-up after Wednesday’s closure due to typhoon Hato. Australia’s S&P/ASX 200 continued climbing on strength from mining shares, but Japan’s Nikkei ended the day lower on investor caution.

European markets were slightly higher, ending the day mixed on a country specific basis. German and Spanish markets rose, while the French CAC40 was slightly lower. In the U.K. sentiment improved despite lackluster GDP and consumer spending reports, FTSE100 gaining 0.33%.

U.S. markets ended Thursday lower after swinging between gains and losses. The markets got a boost after House Speaker expressed optimism over the passage of a tax-reform bill, but the recovery was short-lived. Markets are on track to post weekly gains, which would snap a four week losing streak for the Nasdaq and a two week losing streak for the Dow and S&P 500.

Today’s Expectations

EUR/USD

The pair saw little movement on Thursday, trading in a tight range around the 1.1800 level and only seeing a 34 pip difference in the daily high and low levels. Traders are understandably awaiting the speeches of Fed chairwoman Janet Yellen and ECB president Mario Draghi, which are scheduled for Friday at the Jackson Hole summit.

Metals

Precious metals ended Thursday mixed as mixed sentiment ahead of Friday’s speeches by Fed chair and ECB president at Jackson Hole kept traders from making any large moves. Both gold and silver edged lower by 0.2% and 0.5% respectively, while platinum and palladium gained 0.2% and 0.3% respectively on continued belief in strengthening automotive demand for the metals.