Yesterday was day three of the current ride on the daily upper band. These rides are where there is a strong trend in either direction using either the daily upper or lower band as the anchor for the daily candles. Yesterday was a decent example, closing within 0.20 points of the daily upper band. These band rides vary widely in length, it isn’t uncommon to end after three or four days and they can extend to seven or eight. The last two band rides on this chart lasted nine and five days respectively.

SPX daily chart:

The next obvious target on the SPX chart is the rising wedge resistance in the 1930 area. If the daily upper band ride continues then that could be reached on Mon/Tues of next week, or tomorrow on a very strong push. Key uptrend support is the breakaway gap from last Friday’s close at 1900.53. That should not fill until SPX has finished the current move so if the gap should fill the current uptrend might well have topped out. I am concerned about the negative divergence on the 60min RSI.

SPX 60min chart:

On the weekly chart, the upper band is now at 1920 and could close as high at 1925 by the end of this week. A break of five points or less wouldn’t be a serious break so the 1930 rising wedge resistance trendline is in possible range tomorrow. A very strong primary rising channel resistance is in the 1940 area, and I’m not expecting to see that broken, though it is rising at about 15 points per month.

SPX weekly chart:

There is also negative divergence on the 60min RSI on the NDX chart which I am watching. There is a possible uptrend fail area at the retest of the current all time highs, so I’m watching this area carefully.

NDX 60min chart:

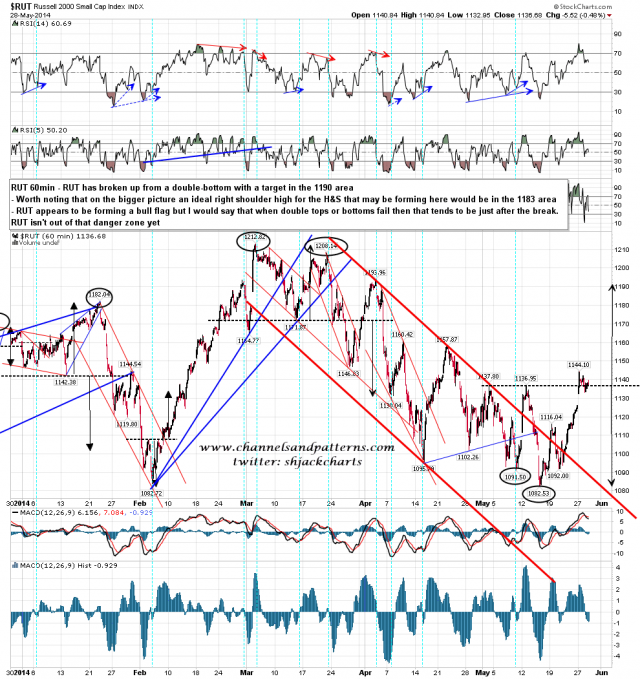

There is no negative divergence on RUT but it is still lagging other indices, despite the bargain basement P/E now all the way back down to the 75 area. RUT appears to be forming a bull flag here and needs to push, as when double bottoms fail, it tends to be just after they break up.

RUT 60min chart:

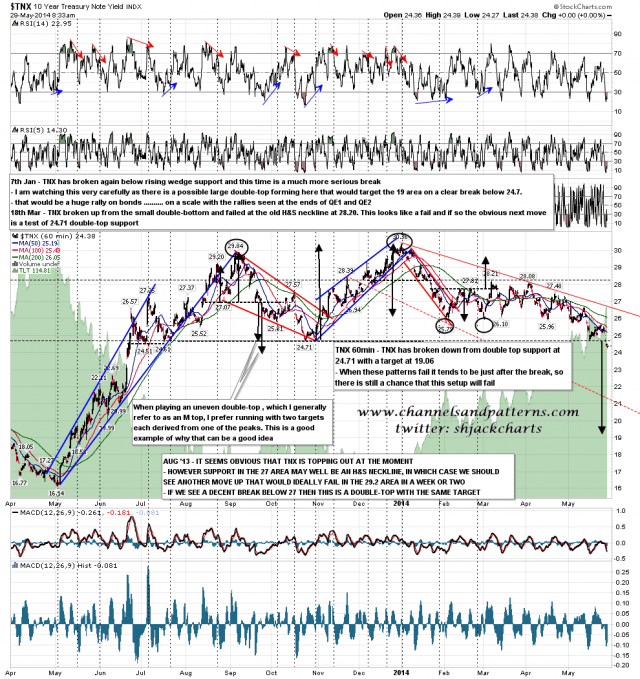

Bonds had a strong day yesterday and on TNX we saw the break below double-top support that I have been looking for. If this break holds then the double-top target is at 19.06 which is the endpoint of the bear scenario I posted as my end of QE3 scenario on TNX on 7th January.

TNX 60min chart:

On iShares 20+ Year Treasury Bond (TLT) we also saw the break that I have been looking for with a gap over falling megaphone resistance on my January projection. I haven’t moved any arrows on this projection since January but I think I’m going to have to move my break up arrow across slightly next time I post this. If the break holds then the megaphone target is a retest of the 2012 high at 125.43.

TLT daily chart:

The SPX and NDX 60min RSIs are suggesting weakness here. A strong ongoing trend will steamroller those sell signals, so if that is what we still have here then those should be easy to overcome. If not, then SPX needs to stay over 1900.53 to preserve Tuesday morning’s breakaway gap. If that gap can be filled the bears may get a shot.