Market Brief

Asian equity markets were broadly higher after two regional central banks cut interest rates. The Reserve Bank of New Zealand (RBNZ) cut its official cash rate by 25bps to 3.25% in reaction to weak inflation expectations, while the Bank of Korea cut its benchmark rate, the 7-day repo rate, by 25bps to 1.50% in an attempt to revive weak exports. RBNZ’s Governor Wheeler added that the rate cut was justified to adjust the exchange rate to the downside. The RBNZ remains in easing mode and is ready to debase further the NZD to ensure that inflation converges toward the 2% target rate before 2017. The Governor made clear that further rate cuts will be data dependent. The NZD fell sharply against the dollar, down almost 2 figures to $0.7015, slightly above the 0.70 support level. If broken, the next target is $0.6950. However, our favourite currency pair to play the NZD weakness remains AUD/NZD. The Aussie jumped 3 figures to 1.1050 from 1.0750 after the decision, next target being the highs from the last months of 2014, around 1.13.

In Australia, unemployment rate fell in May to 6% from 6.1% in April (revised downward) versus 6.2% consensus. In our opinion, the big picture is not that bright, as the apparent improvement in the job market is mainly due to the unexpected increase in part time employment. The Australian economy created only 14.7k full time job positions compared to 27.3k part time jobs. AUD/USD jumped half a figure to the upside and is currently trading around 0.7760. The next resistance stands around 0.78/0.7820 (Fib 38.2% on May-June debasement and psychological threshold), while the closest support remains at 0.76 (previous low). On the equity front, Australian shares were buoyant, up 1.42% while in New Zealand, equities added 0.94% on the session.

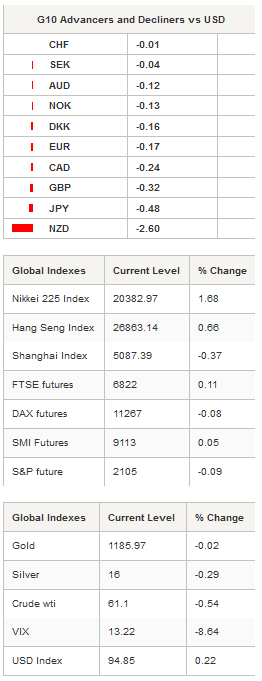

In Japan, the Nikkei gained 1.68% to 20,382.97. The popular index added almost 17% since the beginning of the year. USD/JPY consolidates slightly above the 123.05 level (Fib 38.2% on April-June rally). On the downside, a support can be found around 1.22.18 (Fib 50%), while a resistance stands at 125.86 (previous high).

EUR/USD presents a positive bias as traders are getting impatient with the lack of US data the last couple of days. Their patience will be soon rewarded as US retail sales figures for May are no later than this afternoon, as well as import price index, initial jobless claims and Bloomberg consumer comfort index.

In Europe, equity returns are mixed this morning with the Footsie up 0.11%, as investors cheer the surprisingly good industrial production figures from UK (1.2%y/y versus 0.6% expected for May). GBP/USD lost momentum in Tokyo, and is heading toward the 1.54 strong support after the UK Parliament voted in favour of a referendum on EU membership, highlighting profound divisions between David Cameron and its party. EUR/GBP is also taking advantage of the current sterling’s weakness and will test soon the resistance standing at 0.7320 (Fib 61.8% on May debasement).

In Brazil, the war against inflation is not over yet as the IPCA rose to 8.47% in May compared to 8.17% previous month, and above market’s expectations of 8.30%. This is the highest read since early 2004; we should get further details in the quarterly inflation report due at the end of the month. It definitely increase the odds of a 50bps increase of the Selic rate at the next Copom meeting at the end of July. Minutes of the last meeting are due this afternoon.

Today's Calendar Estimates Previous Country / GMT TU Apr Current Account Balance -2.90B -4.96B TRY / 07:00 CH May Money Supply M0 YoY 3.60% 3.70% CNY / 07:05 CH May Money Supply M1 YoY 4.00% 3.70% CNY / 07:05 CH May New Yuan Loans CNY 850.0B 707.9B CNY / 07:05 CH May Aggregate Financing CNY 1132.5B 1050.0B CNY / 07:05 CH May Money Supply M2 YoY 10.40% 10.10% CNY / 07:05 SW May Average House Prices - 2.165M SEK / 07:30 SW May CPI MoM 0.20% 0.00% SEK / 07:30 SW May CPI YoY -0.10% -0.20% SEK / 07:30 SW May CPI CPIF MoM 0.20% 0.20% SEK / 07:30 SW May CPI CPIF YoY 0.80% 0.70% SEK / 07:30 SW May CPI Level 313.65 313.16 SEK / 07:30 BZ Jun 7 FIPE CPI - Weekly 0.58% 0.70% BRL / 08:00 SW Sweden's ESV publishes forecasts - - SEK / 08:00 SA Apr Gold Production YoY - 3.30% ZAR / 09:30 SA Apr Mining Production MoM 0.40% 7.10% ZAR / 09:30 SA Apr Mining Production YoY 7.40% 18.80% ZAR / 09:30 SA Apr Platinum Production YoY - 132.20% ZAR / 09:30 SA Apr Manufacturing Prod SA MoM 0.40% 1.20% ZAR / 11:00 SA Apr Manufacturing Prod NSA YoY 0.70% 3.80% ZAR / 11:00 BZ Jun IGP-M Inflation 1st Preview 0.35% 0.51% BRL / 11:00 BZ COPOM Monetary Policy Meeting Minutes - - BRL / 11:30 CA 1Q Capacity Utilization Rate 83.00% 83.60% CAD / 12:30 US May Retail Sales Advance MoM 1.20% 0.00% USD / 12:30 US May Retail Sales Ex Auto MoM 0.80% 0.10% USD / 12:30 CA Apr New Housing Price Index MoM 0.20% 0.00% CAD / 12:30 US May Retail Sales Ex Auto and Gas 0.50% 0.20% USD / 12:30 CA Apr New Housing Price Index YoY - 1.20% CAD / 12:30 US May Retail Sales Control Group 0.50% 0.00% USD / 12:30 US May Import Price Index MoM 0.80% -0.30% USD / 12:30 US May Import Price Index YoY -10.00% -10.70% USD / 12:30 US Jun 6 Initial Jobless Claims 275K 276K USD / 12:30 US May 30 Continuing Claims 2190K 2196K USD / 12:30 US Jun 7 Bloomberg Consumer Comfort - 40.5 USD / 13:45 US Apr Business Inventories 0.20% 0.10% USD / 14:00 US 1Q Household Change in Net Worth - $1517B USD / 16:00

Currency Tech

EUR/USD

R 2: 1.1534

R 1: 1.1385

CURRENT: 1.1331

S 1: 1.0882

S 2: 1.0521

GBP/USD

R 2: 1.5879

R 1: 1.5800

CURRENT: 1.5441

S 1: 1.5191

S 2: 1.5090

USD/JPY

R 2: 135.15

R 1: 125.64

CURRENT: 123.42

S 1: 122.03

S 2: 118.18

USD/CHF

R 2: 0.9712

R 1: 0.9573

CURRENT: 0.9331

S 1: 0.9072

S 2: 0.8986