By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

The main focus for Tuesday's forex market was the decline in USD/JPY and GBP/USD. Typically when the dollar falls, the yen and British pound see gains simultaneously. But that didn't happen on Tuesday. When it does, it's generally caused by risk aversion and a drop in stocks but the S&P 500 and NASDAQ climbed to record highs before settling the day unchanged, so there were clearly other factors at play. Tuesday’s second-tier U.S. economic reports had very little impact on the dollar with nonfarm productivity falling 0.5% in the second quarter and consumer sentiment improving according to the IBD/TIPP index. No comments were made by U.S. officials leaving the small decline in U.S. yields as the only explanation for the dollar's pullback. The Bank of Japan, on the other hand, released a summary of opinions from its July meeting and the most notable takeaway was that one member saw the need for additional easing to prepare for downside risks while another said 6 trillion yen buys would be excessive, making an exit harder. This division made it difficult to justify more aggressive easing last month. Yet their recent stimulus is boosting sentiment with the Eco Watchers survey rising sharply in July. We are still looking for the BoJ to ease further and the Fed to grow less dovish, which is why we see USD/JPY eventually rising to 103. Wednesday is another quiet day for the U.S. dollar as Japan only has machine orders and producer prices scheduled for release.

Sterling traded lower against the U.S. dollar for the fifth consecutive trading data. The decline started in Asia when the London Times published an op-ed from MPC member McCafferty. As reported by our colleague Boris Schlossberg, “McCafferty noted that if UK economic data turns down the central bank could slash rates further taking them towards the zero level while increasing QE at the same time. Mr. Mccafferty is considered to be one of the more hawkish members of the committee and was one the four votes against raising the target of QE at the last BoE meeting", which explains why his comments had such a significant impact on the currency. Data was also weaker than expected with manufacturing production missing expectations, the trade deficit widening and NIESR issuing a lower GDP estimate for July. There was one piece of good news -- the British Retail Consortium reported a sharp increase in consumer spending. Economists anticipated a -0.7% drop but instead it rose more than 1% on the back of discounting. This is important because it shows that consumer demand did not contract post Brexit. The BRC report has a strong correlation with the broader retail sales index.

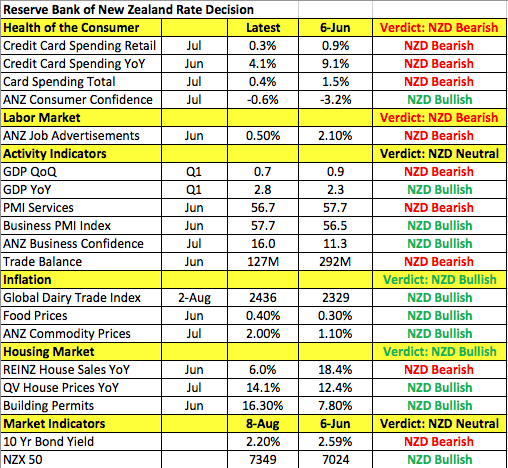

Wednesday's main focus will be on the New Zealand dollar and the upcoming monetary policy announcement. Three weeks ago, the Reserve Bank held a special economic assessment update where it said “further policy easing will be required.” The strong currency is making it incredibly difficult to reach its inflation target and the central bank made it very clear that additional action needs to be taken to stop inflation from falling. In response to its July 20 assessment, economists have rushed to adjust their forecasts with many calling for 2 more rate cuts before the end of the year and some even targeting 75bp of easing. Since then the value of AUD/NZD has been roughly the same but NZD/USD is up more than 1.5% so there’s been no relief from the pressure created by the strong exchange rate. This argues for a 25bp cut with a hint of more to come -- or 50bp of easing. However the following table shows that there’s been just as much improvement as deterioration in New Zealand’s economy since June. Consumer spending is weaker and job ads are fewer but business and consumer confidence improved and the business PMI index ticked up. Commodity prices, food prices and the Global Dairy Trade index are also on the rise while house prices remained firmed. The strong housing market is one of the main factors preventing a more aggressive move from the RBNZ.

New Zealand’s economy hasn’t weakened enough to warrant more than a 25bp rate cut but the exchange rate, which is the central bank's primary cause for concern, has only strengthened. If the RBNZ wants to be proactive, it could send a strong message to the market with a 50bp cut, but we believe it will go for a 25bp move (to avoid invigorating the housing market) with a warning of more to come. NZD/USD should sell off although some volatility may be possible if there are investors positioned for a larger move. Ultimately, the currency should settle lower.

The Australian and Canadian dollars extended their gains despite weaker Australian business confidence and lower oil prices. Canadian housing starts dropped less than expected. Oil inventories are scheduled for release Wednesday, which will be the main catalyst for CAD flows. AUD, on the other hand, will take its cue from the RBNZ and AUD/NZD demand along with Tuesday night’s consumer confidence report.

It was a quiet day for the euro but it is worth noting that the currency found support above the 200-day SMA at 1.1080. We have been watching this level for a sustained break but Tuesday’s bounce shows how important technical levels can be. The euro received a boost from slightly better-than-expected data. Germany’s trade balance was reported at EUR24.9b versus EUR23.0b expected. The current account balance was reported at 36.3b euros besting the estimated 23.0b euros. After months of back and forth between EU governments, a resolution has finally been reached regarding Spain and Portugal. Members of the European Council had until midnight on Monday to object to an earlier proposal to give more time to Spain and Portugal to meet budget targets. Both countries were granted leniency for their repeated offenses against EU budget rules and will not be fined. With that in mind, Spain is “required” to cut the deficit from last year’s 5.1% of GDP, to 4.6% in 2016, 3.1% in 2017 and 2.2% in 2018. Portugal was told to fully implement measures, which would bring its deficit down from 4.4% 2015 to 2.5% this year. There are no major Eurozone economic reports scheduled for release on Wednesday.