Market Brief

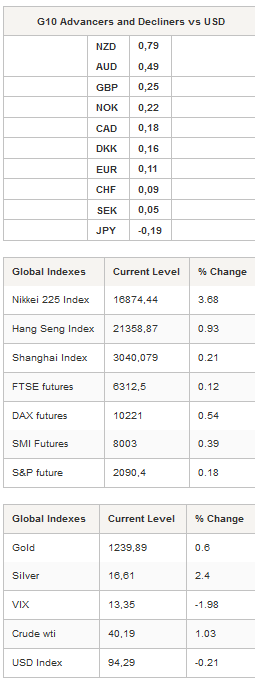

As expected, the crude oil debasement, which was triggered by the failure of the Doha meeting, proved to be short-lived. The West Texas Intermediate almost completely erased Monday’s early losses as it bounced back slightly below the $40 threshold after hitting $37.61 at the opening. Similarly, the Brent crude filled the gap and returned to around $43. Gold was also buoyed this morning as it surged 0.60%. Silver was up 2.40%, platinum rose 1.20% and palladium jumped 1%. Finally, iron ore futures on the Dalian commodity exchange were up 2.40% after gapping higher at open.

In such an environment, commodity currencies were buoyed during the Asian session with AUD, NZD, NOK and CAD recovering significantly. The NZD rose the most among the G10 currencies, rising 0.79% against the US dollar. NZD/USD broke the 0.6966 resistance (high from March 31st) and held ground above the 0.70 threshold; its highest level since mid-June 2015. The kiwi received a strong boost from the commodity rally and the improving risk sentiment, however we prefer to remain cautious as the country’s economic outlook is still uncertain as there is no clear evidence of a solid recovery.

The Australian dollar also continued to rally in overnight trading and finally broke the $0.7720 resistance to the upside. The pair is now heading towards the next resistance at 0.7849 (high from June 18th last year), and the release of the RBA’s minutes earlier this morning did not allow any room for doubt on further Aussie strength as we found no solid evidence of an easing bias in the RBA’s minutes. The Aussie should continue to ride the positive trend as commodities strengthen further; however the pair is extremely vulnerable to renewed Fed rate hike expectations and negative signals from the Chinese economy.

On the equity market, most equity indices were trading in positive territory on improving risk sentiment. Japanese shares rose the most among the Asian markets with the Nikkei 225 and the Topix index surging 3.68% and 3.25% respectively. In mainland China, the Shanghai and Shenzhen Composite rose 0.21% and 0.28% respectively. In Australia, shares jumped 1.01%, while in New Zealand the S&P/NZX was up 0.32%.

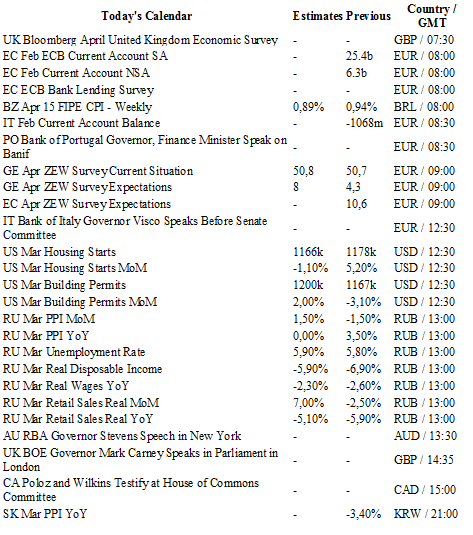

Today traders will be watching ECB current account from the euro zone; ZEW survey from Germany (current situation expected at 50.8 and expectations at 8.0); housing starts and building permits from the US; today RBA’s governor Stevens will speak in New York and BoE Governor Carney will speak before the UK Parliament, while BoC governor will testify before the House of Commons Committee; PPI, unemployment rate, real wages and retail sales from Russia.

Currency Tech

EUR/USD

R 2: 1,1714

R 1: 1,1465

CURRENT: 1,1332

S 1: 1,1144

S 2: 1,1058

GBP/USD

R 2: 1,4591

R 1: 1,4348

CURRENT: 1,4320

S 1: 1,4006

S 2: 1,3836

USD/JPY

R 2: 112,68

R 1: 109,90

CURRENT: 108,93

S 1: 107,63

S 2: 105,23

USD/CHF

R 2: 0,9913

R 1: 0,9788

CURRENT: 0,9627

S 1: 0,9476

S 2: 0,9259