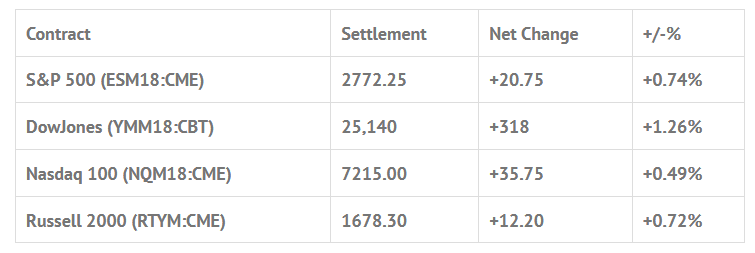

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 8 out of 11 markets closed higher: Shanghai Comp -0.20%, Hang Seng +0.81%, Nikkei +0.87%

- In Europe 11 out of 13 markets are trading higher: CAC +0.26%, DAX +0.20%, FTSE +0.42%

- Fair Value: S&P +2.55, NASDAQ +26.23, Dow +2.83

- Total Volume: 1.32mil ESM & 4,699 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Weekly Bill Settlement, Jobless Claims 8:30 AM ET, Bloomberg Consumer Comfort Index 9:45 AM ET, Quarterly Services Survey 10:00 AM ET, EIA Natural Gas Report 10:30 AM ET, Consumer Credit 3:00 PM ET, Fed Balance Sheet and Money Supply 4:30 PM ET.

S&P 500 Futures: #ES Short Squeeze, All Buy Stops And Buy Programs

I have had a saying for the last several years that the S&P tends to take bad news and make good of it. Well, guess what? That’s what’s going on now. After we see one bad news headline after another, and traders selling into the weakness and running the sell stops under 2700, the S&P 500 futures (ESM18:CME) finally did what it does best, it started taking out the upside buy stops over the last two days.

Yesterday’s trade started with an uptick in the Asia-Pacific stocks, and the European Stoxx 600 flat at midday. On Globex, the S&P 500 futures had an 8 handle trading range, 2750.00 to 2758.00, with 137,000 contracts traded. The first print of the day on Wednesday’s 8:30 futures open was 2755.00.

The ES made an early high at 2757.00, and then sold off 1 handle under Tuesday low, down to 2748.50, rallied up to 2752.75, then sold off down to a new low at 2758.00 at 9:50 AM. After that, in came a big buy program that pushed the future up to 2761.75 going into 11:00. Once the early high was in, the ES back and filled between 2761.50 to 2758.25 for the next 2 1/2 hours.

Around 1:30 PM, in came another buy program as the MiM went from $635 million to buy $1.38 billion to buy, pushing the ES all the way up to 2768.75. On the 2:45 cash imbalance reveal, the MiM flipped to only $145 million to buy, and traded 2771.50 on the 3:00 cash close. The futures went on to end the day on another new high at 2772.50, up +21 handles, or +0.76% on the day.

In the end, it was a ‘head banger’ on the upside. After the initial selloff down to 2748.50, it was a basically straight up. Yes, there was over 2 hours of back and fill, but that was just a prelude to the late day rip. In terms of the days overall trade, over 1.1 million contracts traded. In terms of the ES’s overall tone, it was just one big buy program.

Demand For US Government Bonds Continues To Shrink

From the Wall Street Journal

One of the largest sources of demand for U.S. government bonds continues to shrink.

Foreign investors purchased 12.7% of the $193 billion of notes and bonds sold to the open market in the Treasury Department’s April auctions, according to Treasury Department data, down from 15.8% of the $182 billion of notes and bonds sold in March. That was the weakest monthly demand since September.

The decline continues a trend. Purchases at auctions by foreign investors fell to 16.7% in 2017, a four-year low, the Treasury data shows. Foreign holdings of U.S. Treasury debt, which rose to a record $6.294 trillion in March, are still only $7 billion higher than they were two years ago.

The fall in foreign demand comes as the Treasury — which sold roughly $2 trillion of notes and bonds at auctions last year — is ramping up the size of its debt issues in order to pay for the $1.5 trillion tax cut package passed in December. The U.S. increased the amount of notes and bonds it sold in the period from February through April by $42 billion, announced an additional $27 billion for the May-July period, and analysts forecast additional increases in August and November.

This year, as auction sizes have increased, demand has drifted lower.

At the same time, the gap has widened between government bond yields in the U.S., which have been rising, and in Europe, where they have been falling. With 10-year Treasury yields at 2.917% Tuesday and 10-year German yields at 0.364%, the spread is the widest in almost 30 years. The widening gap has contributed to this year’s gains in the dollar against the euro, making it more expensive for investors in Europe and Asia to hedge their currency risk when buying the debt.

If foreigners continue to reduce their purchases, that could force domestic investors to take up the slack, analysts said. If they don’t, the yield on the benchmark 10-year Treasury note could push further above its current levels near 3% — something that could increase borrowing costs for consumers and businesses, and even dent stock markets.

“Higher Treasury yields could syphon off some demand from the stock market,” said Chris Rupkey, chief financial economist at MUFG. “This is going to be a big test coming up.”

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.