London Forex Report: Risk sentiment continued to recover Friday with WTI having its biggest two-day gain in seven years, trading back above $32. European equity bourses bounced 2%, except for the FTSE which was up 1.6%, underpinned anticipation of more stimulus from ECB. US indices also had a strong session, supported by stellar PMI and housing data. Expect volatility to remain heightened with the FOMC rate decision on Wednesday followed by Q4 GDP and PCE on Friday.

EUR/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR fell below 1.08 Friday, nearing a two-week low. European Central Bank chief Mario Draghi said the bank would need to review its policy in March, which was read by markets as a promise of further easing. The rebound in global equity markets played a major role in the USD’s lift against the EUR. World stocks recorded their biggest rise in a month and the S&P 500 followed the lead, lifting around 2.03 %.

Technical: Expected rotation to retest bids at 1.08, a sustained breach of 1.08 bids opens 1.07 range lows. A breach of 1.0990 trend resistance opens a broader 1.1240 symmetry corrective objective.

Interbank Flows: Bids 1.08 stops below. Offers 1.0950 Stops above.

Retail Sentiment: Bullish

Trading Take-away: Play the range, buy dips to 1.07, sell rallies to 1.10

GBP/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: GBP rallied as traders regained some risk appetite comforted by a break in the oil slide and a sign that the European Central Bank will ease policy further in March. Mixed figures showing UK government borrowing dropped sharply in December while retail spending suffered its biggest year-on-year fall in over six years. GBP/USD hit a seven-year low of 1.4079 earlier in last week.

Technical: While 1.4230/10 caps downside reactions expect a retest of Friday's 1.4360’s high. Over 1.44 eases immediate downside pressure and sets up a broader correction.

Interbank Flows: Bids 1.42 below. Offers 1.44 stops above.

Retail Sentiment: Bullish

Trading Take-away: Sell a retest of Friday’s highs

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: USD rose to a two-week high against the JPY, offsetting nearly half of year-to-date losses versus the JPY over the past few days. Bank of Japan Governor Haruhiko Kuroda said there is further room for the BoJ to expand its quantitative easing program if inflation continues to diminish.

Technical: While 117.90 caps downside attempts expect a retest of 119 offers. Only above 119.30 eases immediate downside pressure.

Interbank Flows: Bids 117.50 stops below. Offers 119 stops above.

Retail Sentiment: Neutral

Trading Take-away: Buy pullbacks to 117.90/70 for 119

EUR/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: BOJ meets this week and the recent run-up in the EUR/JPY, last seen above 128, is likely no coincidence. There could be some expectations for the central bank to act - uncertainties on their next move could keep EUR/JPY in broader range. The press conference by Governor Kuroda will be eyed along with data releases that day including CPI and industrial production.

Technical: While 128.50 caps upside reactions, expect a retest of bids at 127.50. Only over 129.50 eases immediate downside pressure.

Interbank Flows: Bids 127 stops below. Offers 128.50 stops above.

Retail Sentiment: Bearish

Trading Take-away: Buy pullbacks to 127.60/40 for 129

AUD/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: AUD finally recorded a weekly gain after a bounce in oil prices and the improved appetite for risky assets. The Australian dollar closed at 0.7000 after traded a seven-year low of 0.6824 last week and left the currency on track for the biggest weekly gain since October.

Technical: While .6950 caps intraday downside, expect a test of .7050 lows. Only a breach of .7150 eases immediate downside pressure.

Interbank Flows: Bids .6950 stops below. Offers .7050 stops above.

Retail Sentiment: Neutral

Trading Take-away: Sidelines

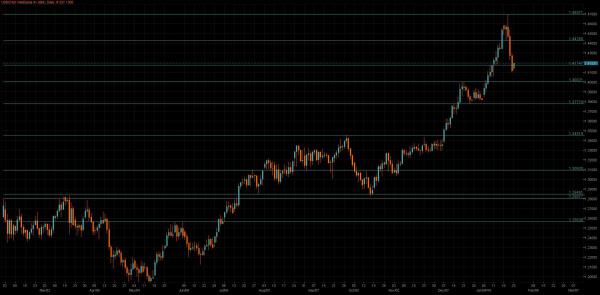

USD/CAD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Fundamental: CAD rallied against the USD, extending gains after the Bank of Canada’s steady rate decision while the crude oil prices rose as a cold snap boosted demand for heating oil across the United States and Europe. The markets reduced expectations for Bank of Canada rate cuts after the central bank decided to leave its policy rate at 0.50 percent, putting the responsibility on federal authorities to raise spending.

Technical: While 1.4310/30 caps upside reactions, expect a broader corrective phase to test 1.40 support. Only above 1.44 eases immediate downside pressure and opens a retest of 2016 highs.

Interbank Flows: Bids 1.4050 stops below. Offers 1.4350 stops above.

Retail Sentiment: Bullish

Trading Take-away: Sell pullbacks to 1.43 for 1.40