Yesterday, the World Health Organisation declared COVID-19 a pandemic, as the number of people infected surpassed 120000 across the globe. The global equity market was once again in turmoil and one of the main surprises yesterday was from the Bank of England, after it unexpectedly decided to cut its rates by 50 bps, bringing the number to +0.25%. Today the spotlight falls on the ECB’s monetary policy decision and then Lagarde’s press conference 45 minutes after that. Also, Sweden is set to release the country’s inflation numbers for the month of February.

COVID-19 IS DECLARED A PANDEMIC

Yesterday, the World Health Organisation declared COVID-19 a pandemic, as the number of people infected surpassed 120000 across the globe. The number continues to grow, as countries are still working on a vaccine, which, for now, is nowhere in sight. Although China has shown signs of slowing in the amount of people getting infected, Europe keeps picking up pace on that front, with Italy leading the way. Italy’s infected numbers have surpassed 12000 with a total of 827 deaths currently registerd. Italy is followed by Iran, which recently overcame South Korea. South Korea is taking strong measures in trying to contain the spread of the virus and so far, the country is showing good results.

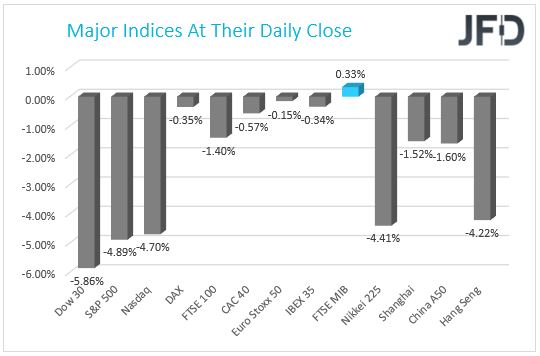

The global equity markets were once again in turmoil, as COVID-19 was declared a pandemic. The DJIA closed yesterday’s trading session with almost a 6% loss, whereas the S&P 500 and Nasdaq Composite fell not a full 5% each. Although the European indices closed just fractionally in the red, their futures continued to slide during US hours. The indices are already oversold, but we believe there are still a lot of headwinds in the near future. The service sector is taking a major hit and certain supplies are already on the lower end, as Chinese manufacturing has decreased.

BOE SURPRISES WITH A CUT; BRITAIN DELIVERS AUTUMN BUDGET

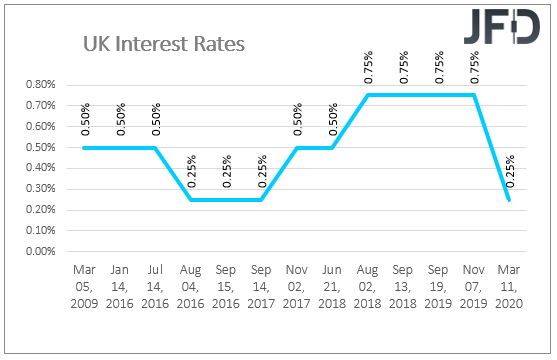

One of the main surprises yesterday was from the Bank of England, after it unexpectedly decided to cut its rates by 50 bps, bringing the number to +0.25%. The announcement was delivered outside of a scheduled meeting, which took the market by surprise. However, the analogy here is the Federal Reserve, which also announced a 50 bps cut last week, without waiting for its scheduled meeting. The Banks are trying to maintain business and consumer confidence at current levels during times like these, but only time will tell if this proves successful or not.

In addition to the BoE trying to help the economy, yesterday, the British Government delivered its belated Autumn Statement, where the Chancellor Rishi Sunak has unveiled a GBP 30bn package boost to help combat the ongoing economic issues the Coronavirus. The pound was seen lower against its major counterparts at the end of the day yesterday. The British currency is not the strongest one out there and it may continue being one if the UK economy starts feeling more heat from the virus. However, GBP might still perform better against the commodity linked currencies, such as CAD, AUD and NZD, which continue to suffer from falling oil prices and Chinese supply disruptions.

GBP/CAD – TECHNICAL OUTLOOK

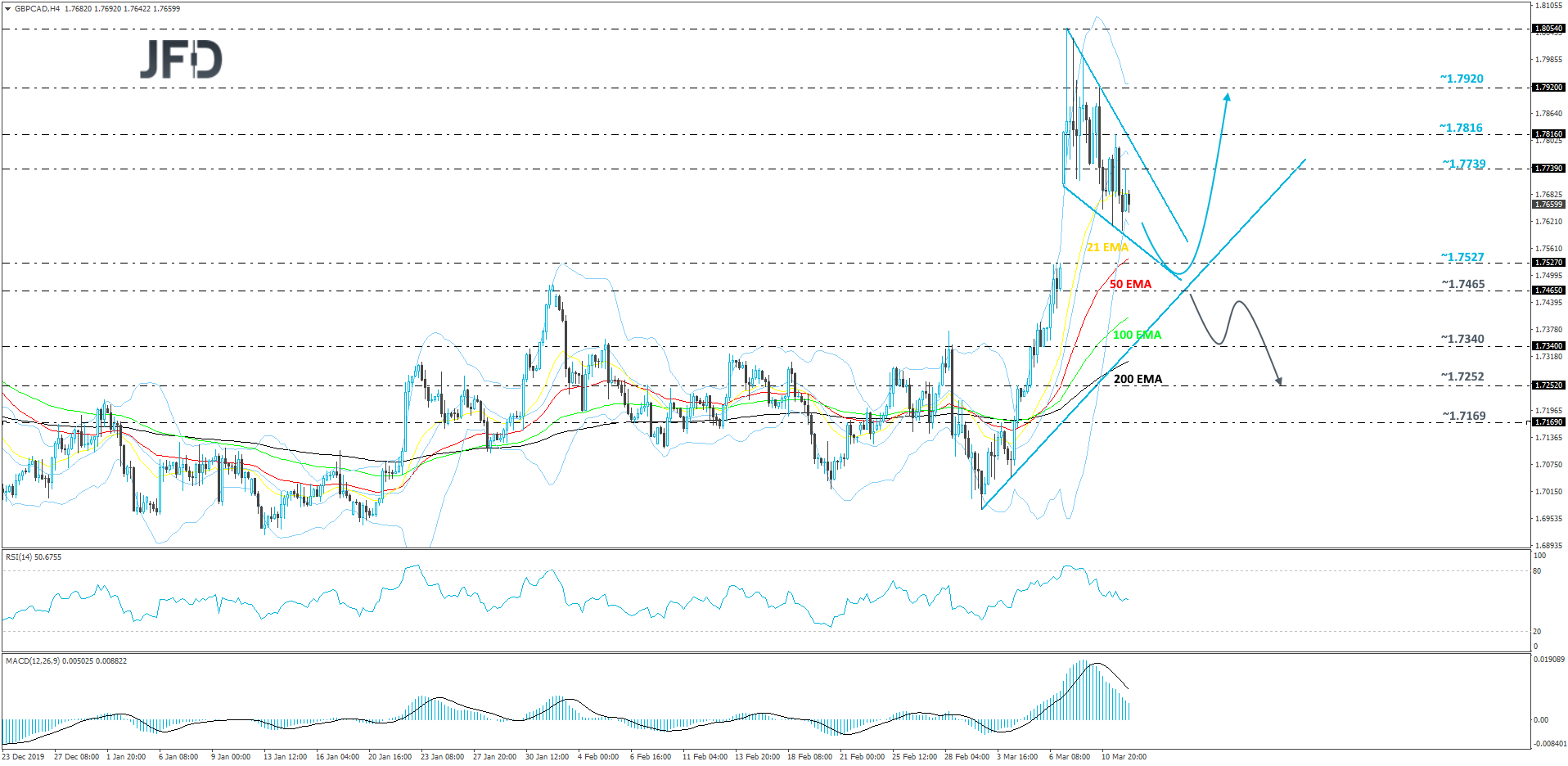

After Monday morning’s explosion to the upside and testing the 1.8054 barrier, GBP/CAD started retracing lower, forming a possible falling wedge pattern. According to TA textbooks such formations tend to be bullish. Another technical aspects which might support the upside is the short-term tentative upside support line drawn from the lowest point of March. Although we may see a bit more downside, as long as that line stays intact, we will remain positive overall.

As mentioned above, a small drift lower towards the upside line is very much possible. That said, if the aforementioned line stays intact and the rate breaks above the upper side of the previously-mentioned falling wedge pattern, this may lead the pair to some higher areas again. That’s when we will aim for the 1.7739 hurdle, a break of which could clear the way to the 1.7816 level, marked by yesterday’s high. If the buying doesn’t stop there, a break of that level may send the rate to the 1.7920 zone, which is the high of March 10th.

Alternatively, if the previously-discussed upside line gets broken and the rate falls below the 1.7465 zone, which is an intraday swing low of March 6th. Such a move could attract more sellers into the game and increase pair’s chances of drifting further south. GBP/CAD could then travel to the 1.7340 obstacle, a break of which may lead the way to the 1.7252 level, marked by the high of March 4th.

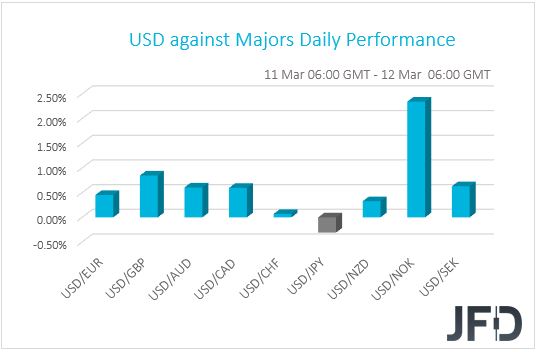

The major gainers in the currency sphere are the safe-haven yen and Swiss franc. These two currencies could continue being under buying interest if the risk-off environment remains. The US dollar was also seen as a gainer against its major counterparts, except for the yen. That said, this morning the greenback is taking a U-turn and is seen moving lower, as investors get spooked by Trump’s travel ban, which imposes restrictions on travellers coming from Europe to the US. The restriction will apply for 30 days, which means that the main affect will be on the tourism industry and airline companies. The only European country on which the ban will not apply is the UK. Trump was also quick to clarify that trade will not be affected by this restriction, quote: “The restriction stops people, not goods”.

SWEDEN’S INFLATION FIGURES ARE IN FOCUS

Sweden is set to release the country’s inflation numbers for the month of February. The headline CPI figure on a MoM basis is expected to have improved significantly, going from -1.4% to +0.6%. If so, this might work in favour of the Swedish krona, which might strengthen slightly. But that could be a temporary reaction, especially if the headline YoY number comes out as expected, at +1.3%, which is well below the Riksbank’s target of +2.0%. Another set of inflation metrics will be delivered as well, which is carefully monitored by the Riksbank, and that is the CPIF indicator on a MoM and YoY basis for February. These are the CPI figures with a constant household mortgage interest rate. Although the MoM reading is forecasted to have improved from -1.5% to +0.4%, the YoY number is believed to have declined fractionally from +1.2% to +1.1%.

The Swedish central bank might keep its focus on the global situation in regards to the COVID-19, the equity and oil markets. The Bank might also consider lowering rates to support the economy together with its other counterparts. If so, this would place Riksbank’s interest rate into negative territory again, after jumping out of it in December 2019.

INVESTORS AWAIT THE ECB DECISION

Today the spotlight falls on the ECB’s monetary policy decision and then Lagarde’s press conference 45 minutes after that. Since the last meeting of the Governing Council in the end of January a lot has happened. During the last gathering the main concerns were tensions in the Middle East and the signing of “phase-one” deal between China and US. However now, these two have moved aside by the rapid decline in the equity markets and the ongoing problem of containing the COVID-19, also known as the Coronavirus.

The focus will be on whether ECB will follow other major central banks in further easing its policy in order to help the economy. Unlike that other central banks, which have already slashed their rates significantly, the European Central Bank doesn’t have much room to manoeuvre. With the deposit rate already in the negative territory, at -0.50%, the expectation currently sits as unchanged. That said, given the recent cuts, the ECB could cut their deposit by just a tenth of a percent, bringing it to a possible -0.60%. The interest rate, together with the marginal lending facility rate, are expected to have remained the same at 0.00% and 0.25% respectively. The small potential decline in the ECB’s deposit rate could already be already priced in by market participants, so it may not come as a huge shock for EUR traders. Although the common currency might lose some of it gains, it may stay on the higher end against some commodity-linked currencies.

EUR/AUD – TECHNICAL OUTLOOK

Looking at the technical picture of EUR/AUD, we can see that at the time of writing, the pair is balancing slightly below its key resistance, at 1.7550, marked near yesterday’s high. Overall, the pair is still floating above its short-term tentative upside support line taken from the low of February 19th. For now, we will take a cautiously-bullish approach and wait for a break above the 1.7550 barrier, before aiming for higher areas.

Eventually, if we see a clear break above the 1.7550 barrier, this would confirm a forthcoming higher high from the very short-term perspective and may lead the rate to the next potential resistance zone, at 1.7668, which is the high of July 16th, 2009. Initially, the pair could get a hold-up around there, but if the buying continues, the next possible resistance zone to consider might be the 1.7833 level, marked by the high of June 23rd, 2009.

On the other hand, if the rate slides all the way down, breaks the aforementioned upside support line and the 1.07095 hurdle, which is near the low of March 9th, this may totally spook the bulls from the field and allow more bears to dictate the rules for a bit. EUR/AUD may then drift to the 1.6930 obstacle, a break of which might clear the path to the 1.6775 level, marked by the lows of March 4th and 5th.

AS FOR THE REST OF TODAY’S EVENTS

The US is set to deliver some of their economic data. The US initial jobless claims are forecasted to have decreased to 1723k from the previous 1729k. The core MoM and YoY PPI figures are expected to have either decreased or remained the same. The MoM number is believed to have fallen to +0.1% from +0.5%, but the YoY is expected to have stayed unchanged, at +1.7%. The headline PPI readings for February on a MoM and YoY basis are expected to have dropped, going from +0.5% to -0.1% and from +2.1% to +1.8% respectively.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Coronavirus Is A Pandemic, BoE Cuts Rate, ECB In Focus

Published 03/12/2020, 05:15 AM

Updated 07/09/2023, 06:31 AM

Coronavirus Is A Pandemic, BoE Cuts Rate, ECB In Focus

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.