Inverse Exchange-Traded Funds (ETFs) use derivatives to bet against the direction of financial markets. These are known as short or bear ETFs and will make money if markets decline in value. They will lose money, however, if markets move against the bet. Covered call writers who have a bearish market outlook may find these funds useful. Inverse ETFs will UNDERPERFORM in normal market conditions. In extreme bear market environments, covered call writers and put-sellers may want to utilize these securities to generate income from both option sales and security appreciation.

Popular Inverse ETFs with adequate option liquidity (associated benchmark)

- N:PSQ: Short O:QQQ (Nasdaq 100)

- N:DOG: Short Dow 30 (DJIA)

- N:SH: Short S&P 500 (S&P 500)

- N:RWM: Short Russell 2000 (Russell 2000)

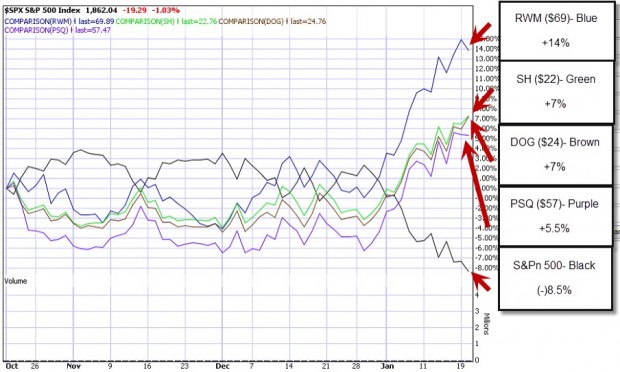

S&P 500 comparison chart (as of 1/20/2016)

Comparison Chart: S&P 500 vs. Inverse ETFs

Note that the inverse ETFs have appreciated in value over the past three months while the S&P 500 has declined by 8.5%.

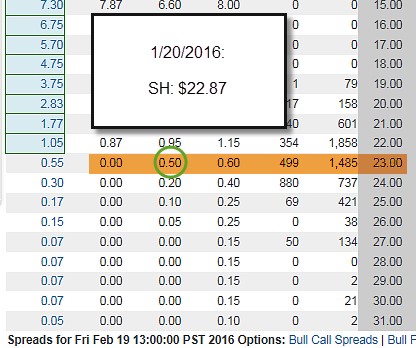

Covered call writing example: Options chain for SH (Short the S&P 500)

Options Chain for SH as of 1/20/2016

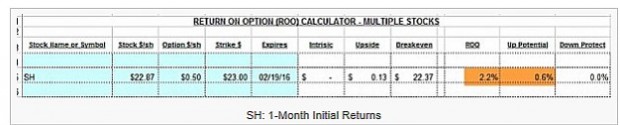

1-month calculations

Using the Basic Ellman Calculator, we see that initial 1-month returns calculate to 2.2% with a possibility of an additional 0.6% if share price moves to the $23.00 strike. This would result in a potential 2.8%, 1-month return. As always, we must be prepared with our exit strategies if a trade turns against us.

Earnings season

As we enter another earnings season, exchange-traded funds (including inverse ETFs) offer the advantage of not managing earnings reports since ETFs are baskets of stocks with some having positive and others negative results.

Discussion

Inverse ETFs are securities available to us when selling options. They are most appropriate in extreme bear market environments as they will allow us to generate both option profit and share appreciate as markets decline. We must be prepared with our exit strategy arsenal and have the flexibility to change to more conventional securities when markets turn positive. Historically, markets go up.