The leadership group from the October ’22 lows – mainly the tech sector, and the mega-cap 10, or what are the top 10 market-cap weighted names in the S&P 500 index have been lagging since the summer.

Tougher compares for the AI trade through 2025, and the fact that capex increases are sizable and are a drag on valuation, may have hampered the sector.

With the S&P 500 making a new all-time-high this week, it was interesting to note that of the mega-cap 10 names, only META (NASDAQ:META) closed the week above its June – July ’24 high, to reach a fresh all-time high.

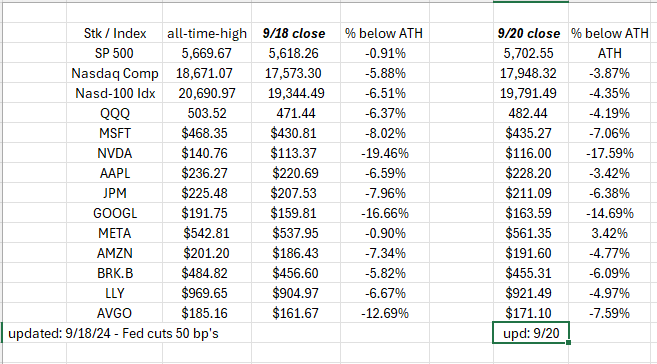

Here’s an updated list as of 9/20/24 that was initially published Wednesday night after the 50 bp rate cut by the FOMC:

Apple (NASDAQ:AAPL) is within striking distance being just 3% shy of its former high, while Nvidia (NASDAQ:NVDA) and Alphabet (NASDAQ:GOOGL) are still down mid-teens.

Amazon (NASDAQ:AMZN) spiked to $200 in early July ’24, which technically was an all-time high, but the lasting resistance level has been the August ’21 highs between $188 – $190 that have my attention.

Every time Amazon has traded up here to its current level, those ’21 all-time-highs have been formidable resistance.

Like Oracle (NYSE:ORCL) a few weeks ago, Micron Technology’s (NASDAQ:MU) fiscal Q4 ’24 earnings release will be telling for the AI trade and tech in general since the semis have been key to the tech and AI trades off the ’22 lows.

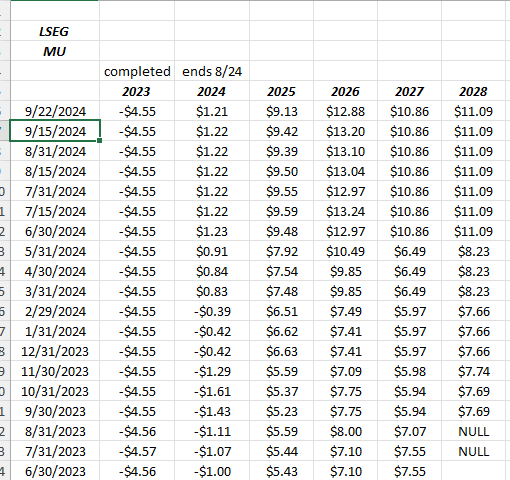

Micron EPS Estimate Revisions:

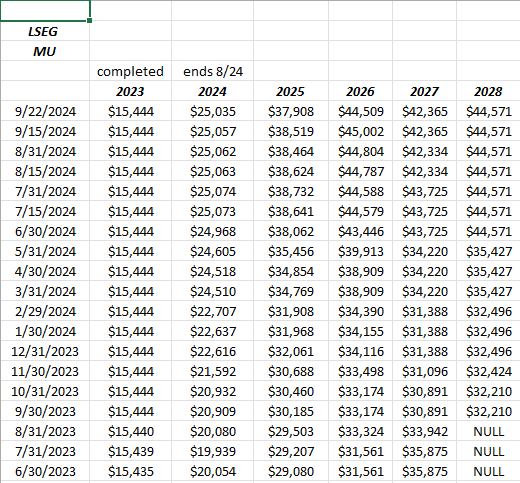

MU Revenue Estimate Revisions:

Source: LSEG

When Micron reports earnings Thursday night after the closing bell, the DRAM giant will face a very easy compare with Q4 ’23.

Here’s a quick look at the expected numbers:

- Revenue: $7.6 billion consensus vs $4 billion a year ago for expected y-o-y growth of 90%;

- Operating income: Consensus expected at $1.57 billion vs a loss of ($1.2 billion) a year ago;

- EPS: Consensus expected at $1.13 versus a loss a year ago of ($1.07) per share;

What’s real interesting is the “expected” growth in fiscal ’25, where full-year revenue jumps to an expected $37.9 – $38 billion versus the expected $25 billion in fiscal 24, as operating income jumps to an expected $11.5 billion in 2025, versus the $1.7 billion in ’24, and EPS is expected at $9 per share versus the $1.21 expected for fiscal year ’24.

Sizable EPS and revenue gains are expected in fiscal ’25 for MU, which began September 1, ’24.

Here’s a chart of Micron from TrendSpider this weekend:

That chart looks tempting.

A word of caution to readers: as someone who traded the stock in the late 1990s, the volatility on Micron can be breathtaking. In the late 1980s, early ’90’s MU traded around $5 per share after the Japanese were caught dumping semis in the US market, but by the end of the decade, and in early 2000, leaked between $90 – $98, (MU peaked at $97.50 in August ’00) as the demand for DRAM peaked around PC’s, servers and ultimately the internet, and then the nuclear winter that followed for DRAM saw the stock drop to $28 by the end of 2000. Since then, that $97.50 high wasn’t taken out or traded above until January ’22, before it (again) traded back down to $50, before it’s latest run higher.

While the current CEO and Board have taken pains to reduce Micron’s cyclicality, the fact is before the May ’24 quarter, where MU generated $1.8 billion in free-cash-flow, MU experienced 6 consecutive quarters where it lost a cumulative $6.6 billion in free-cash-flow over 18 months.

Micron is a no-moat stock with enormous capex demands, like an airline. Semiconductor cycles still experience long periods of “capital destruction”.

Know what you own.

S&P 500 Data

- The forward 4-quarter estimate for the S&P 500 was $258.76, versus last week’s $259.80, for a slight sequential decline in the estimate;

- The PE with this week’s rally in the S&P 500 jumped to 22x versus last week’s 21.7x;

- The S&P 500 earnings yield has slipped back down to 4.54%, versus last week’s 4.62% and August 2nd’s 4.87%;

- As was mentioned in last week’s S&P 500 Earnings Update, there is little happening with earnings over the last 10 days in September and probably the first 10 days of October.

Conclusion

From an S&P 500 earnings perspective, little will happen in terms of index revisions, even though Micron will report this week, and Nike (NYSE:NKE) is scheduled to report October 1 ’24.

The banks and financials kick off earnings season every quarter, and they should start reporting October 10 ’24.

The oldest investment maxim is “Don’t fight the Fed”.

***

None of this is advice or a recommendation, but only an opinion. Past performance is no guarantee of future results. Investing can and does involve the loss of principal even for short periods of time. All S&P 500 and Micron EPS and revenue data is sourced from LSEG.

Thanks for reading.