Ahead of upcoming earnings, the consumer discretionary sector has seen some volatility as many retailers issued new guidance once the holiday shopping season came to an end. Overall it’s been a mixed bag, with much of the weakness appearing to be concentrated in clothing and department stores.

Macy’s Inc (NYSE:M), Nordstrom (NYSE:JWN), Men’s Wearhouse and Tailored Brands Inc (NYSE:TLRD), and Ann Taylor parent Ascena Retail Group Inc (NASDAQ:ASNA) were just a few of the names that lowered guidance after their holiday quarter apparently came up short of what they were expecting.

For some time, different pockets of the consumer discretionary sector have faced challenges amid a competitive environment. For example, sporting goods retailers had a string of bankruptcies over the past few years, resulting in a more consolidated industry with a few major companies like Dick’s Sporting Goods Inc (NYSE:DKS). Toy stores have faced similar challenges: Toys “R” Us filed for bankruptcy, although a group of their lenders has decided to try to revive the brand.

Despite the challenges that have faced some consumer discretionary companies, there are still many that have thrived over the past several years. And there are a number of macro reasons that have likely provided a positive backdrop for the sector.

Overall, the health of the U.S. consumer has been strong. The labor market remained strong in recent readings, with the unemployment rate coming in at 3.9% in December, up slightly from November’s 49-year low of 3.7%, according to the Bureau of Labor Statistics. Even though unemployment ticked up in December, analysts weren’t too worried because the report showed that roughly 400,000 additional people started to look for work again.

At the same time, average hourly earnings in December increased by 3.2% over the previous year, above the 3.1% growth seen in October and November. Inflation has also been muted in recent readings, indicating consumers aren’t seeing too much of their wage gains being eroded.

Outside of the positives, there have been some concerns among analysts regarding the impact of rising rates denting consumer spending and borrowing. And consumer confidence remained high in December, although it slipped compared to previous months.

From an earnings perspective, the consumer discretionary sector is expected to deliver earnings growth of 11.6% year over year (YoY) and revenue growth of 4.6% YoY in the fourth quarter, according to FactSet. Looking at 2019, FactSet’s earnings growth estimate is pegged at 9.4% YoY and revenue growth is expected to come in at 5.5% over last year—better than the S&P 500's (SPX) expected 6.9% earnings growth and in line with its forecasted 5.5% revenue growth.

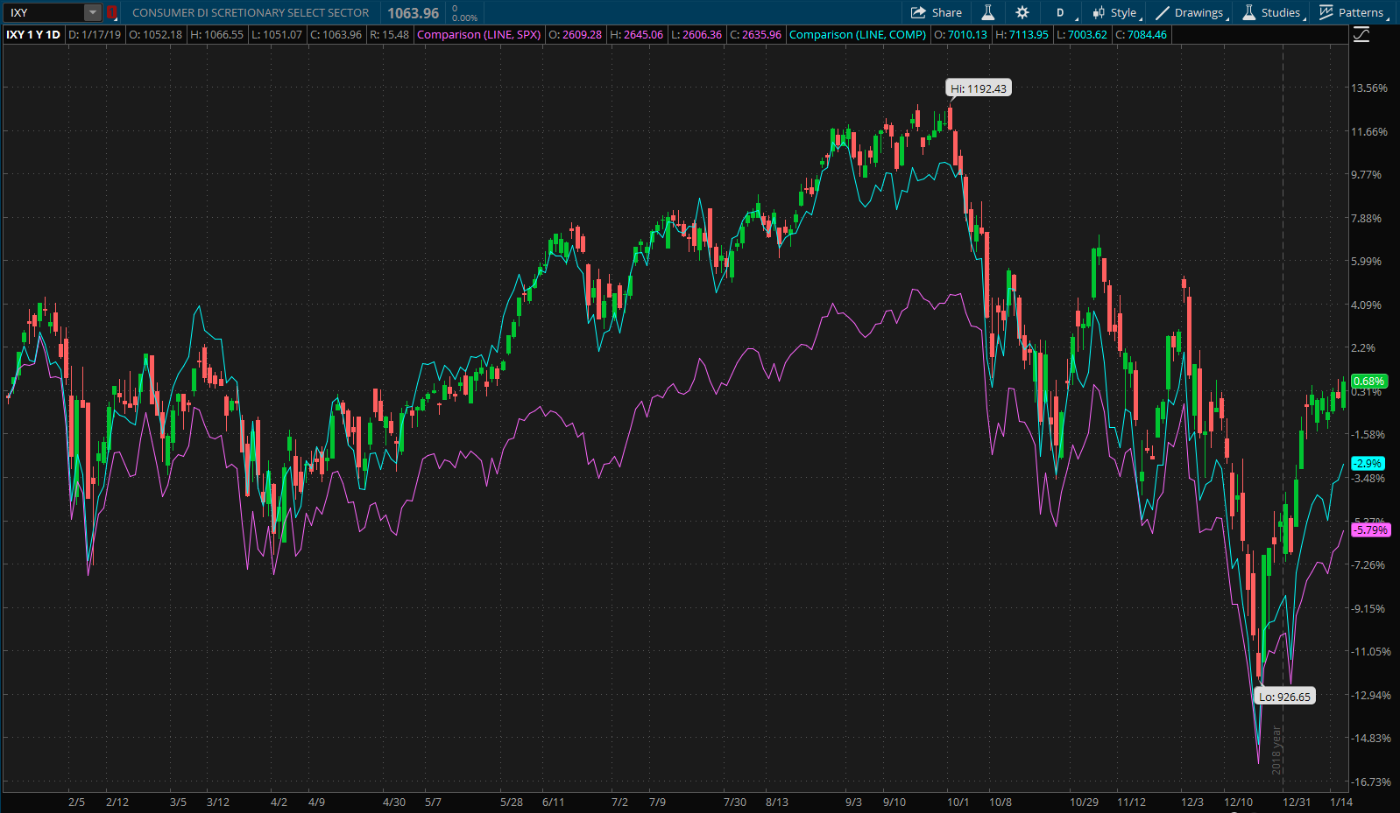

Bouncing Back. The S&P Consumer Discretionary Select Sector Index (IXY) over the past year is charted above. After the broad selloff in December, the sector has been bouncing back and has returned to positive territory, outperforming both the Nasdaq Composite (COMP, teal line) and the S&P 500 (SPX, purple line). Chart source: thinkorswim® by TD Ameritrade. Not a recommendation. For illustrative purposes only. Past performance does not guarantee future results.

Tariffs and Geopolitical Uncertainty

The back and forth between the U.S. and China regarding tariffs has added to an already uncertain global environment. The effect of tariffs, combined with softening economic data in China and other regions, has varied from one company to another.

Apple (NASDAQ:AAPL) recently lowered its guidance, with CEO Tim Cook saying “we did not foresee the magnitude of the economic deceleration, particularly in Greater China.” In addition, Cook pointed to increased consumer uncertainty in China resulting from heightened trade tensions as a cause.

Out of the few companies that have reported results so far, some have acknowledged challenges in the region while others were more optimistic. AutoZone Inc (NYSE:AZO) indicated it will continue to work with industry associations to express their concerns about the negative impact of increased tariffs. When Nike (NYSE:NKE) reported in late December, management said they hadn’t seen any impact on their business there, which posted its 18th consecutive quarter of double-digit revenue growth.

Data Delay

Investors looking for data have been left a little empty handed lately due to the government shutdown, which has delayed reports that the Census Bureau puts out, such as U.S. retail sales. Their latest report covered November and showed U.S. retail sales were $513.5 billion, up 0.2% over October and 4.2% YoY. Excluding auto-related and gas station sales, retail sales were up 4.6% YoY.

Those results painted a mixed picture. Department store sales were down 0.2% compared to the previous year, whereas online retailers were up 10.8%. Electronics and appliance stores saw a 4% increase while sporting goods, hobby, musical instrument and bookstores were down 8.8%. The divergence among different classes of retail has been going on for some time.

Labor Inflation and Other Costs

Labor inflation and transportation costs have been two areas that both company execs and analysts expressed concerns about over the course of 2018.

Regarding the former, the labor market can be a double-edged sword for retailers. On one hand, wage growth and a tight labor market typically help support consumer spending. On the other, it can make it more challenging to attract and retain qualified workers, common issue companies have expressed lately. Labor cost inflation was commonly cited on retail earnings calls as a source of margin pressure in 2018.

Freight costs denting margins was another common refrain heard regularly on earnings calls in 2018. There are varied opinions among analysts about where transportation costs will go in 2019, but many retailers have indicated they still expect them to negatively impact bottom-lines in 2019.

Disclaimer: Charts For illustrative purposes only. Past performance does not guarantee future results.TD Ameritrade® commentary for educational purposes only. Member SIPC. Options involve risks and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options.