The earnings season is in full swing with about 183 S&P 500 companies reporting this week. About 97 S&P 500 companies have already released their results till Jul 21, reconfirming broad-based expectations of better-than expected earnings. Total earnings for these 97 companies (accounting for 28.1% of the index’s total market capitalization) are up 8.4% year over year on 5.1% higher revenues, with 78.4% beating earnings estimates and 72.2% surpassing top-line expectations. Based on the hitherto observed pattern, the second quarter is anticipated to register high single-digit percentage earnings growth on a year-over-year basis.

Per the latest Earnings Preview, overall second-quarter earnings for all the S&P 500 companies are expected to be up 8.6% on 4.7% growth in revenues. Although it represents a slightly tempered growth projection compared with the double-digit growth rate of the first quarter, the dollar amount of the total earnings is likely to be on par or even better than the all-time high achieved in fourth-quarter 2016. The relative improvement in the quarterly performance is largely due to a turnaround in the economy, better job market scenario and rising oil prices. Experts widely believe that earnings growth is likely to be in double digits in 2018 and beyond.

For the second quarter as a whole, about five of the 16 Zacks sectors are expected to witness an earnings decline, with Autos, Conglomerates and Utilities being the biggest drag.

The Conglomerates sector appears to be a major decliner. For the sector, earnings are expected to decline 19.2% year over year while sales are touted to fall 6.1% due to a likely disappointing performance by some of the leading players in the industry.

Let’s have a sneak peek at three major Conglomerates scheduled to report second-quarter 2017 earnings tomorrow to see how things are shaping up for the upcoming results.

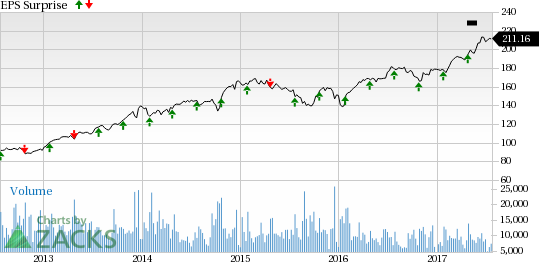

3M Company (NYSE:MMM) is scheduled to report results before the opening bell. 3M expects to deliver sustainable increase in earnings and free cash flow, driven by benefits from long-term strategy of investment in high-growth programs. Further, the company has been investing in innovation as well as research and development. This includes addition of extra resources to bring the company’s scientists and application engineers closer to customers. These investments are expected to support its organic growth and deliver premium margins. (Read more: Is 3M Likely to Beat Q2 Earnings on Organic Growth?)

In the second quarter, the company’s earnings are expected to rise 24.3% year over year on 2.8% higher revenues. For the impending quarter, the company has an Earnings ESP of +1.16%, and Zacks Rank #2 (Buy), making an earnings beat likely. A stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 or 3 (Hold) for a likely earnings beat. You can see the complete list of today’s Zacks #1 Rank stocks here.

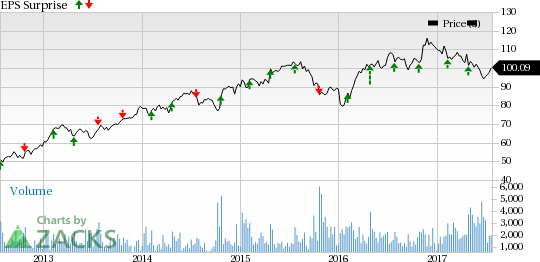

United Technologies Corporation (NYSE:UTX) is slated to report results before the opening bell. The company continued to secure various deals across all of its segments, which will have a positive impact on its revenues. Despite a challenging macroeconomic environment and continuous investments in the aerospace segment, the company expects to generate significant cash from operations to reward its shareholders with a risk-adjusted return. We remain certain on an earnings beat this quarter as it has an ESP of +2.26% and a Zacks Rank #3. (Read More: United Technologies Q2 Earnings: Is a Beat in Store?)

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Carlisle Companies Incorporated (NYSE:CSL) will report results after the closing bell. Although the company expects its sales to improve gradually, foreign currency headwinds and challenging commercial aerospace market remain concerns. We remain inconclusive on an earnings prediction this quarter as it has an ESP of +1.24% and a Zacks Rank #4 (Sell).

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

3M Company (MMM): Free Stock Analysis Report

United Technologies Corporation (UTX): Free Stock Analysis Report

Carlisle Companies Incorporated (CSL): Free Stock Analysis Report

Original post

Zacks Investment Research