Market Brief

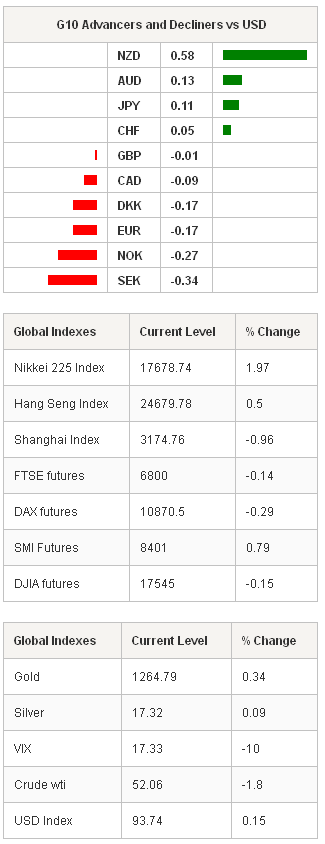

Risk appetite returned marginally in the Asian session but profit-taking looks to be the core driver rather than positive news. The Nikkei 225 rose 1.98% while the Hang Seng rallied 0.38%. The rest of Asia shares gained with the exception being the Shanghai composite which fell -0.96%. European and US equities futures are pointing to a flat to slightly lower open. In the forex markets, the USD continues to be on the back footing, however, the EUR was unable to maintain its earlier gains. Yesterday, EUR/USD rallied to 1. 1536 before trending lower to 1.1460 range area. Initially USD/JPY climbed to 118.01 before sellers pushed the pair back down to 117.48. AUD/USD was back to 0.7847, able to reverse all of the RBAs driven loses. AUD/USD traders will be watching key resistance at 0.7860. Asian FX complex rallied back against the USD, with KRW, TWD, INR and CNY all higher. Commodity prices further improved led by big moves in oil. However, with no structural change in fundamental backdrop, the correction looks be driven by profit-taking. Therefore any recovery should be limited in scope.

The struggle around the Greek governments new rescue plan continues. Overnight the FT reported that the ECB will not allow Greece to issue new debt at the end of this month. Potentially leaving Greece well short of cash as the international bailout expires at the end of the month. Yanis Varoufakis, Greek finance minister, had proposed to European officials (still will not negotiate with the “troika”) that Athens would find short term funding through at €10bn treasury bill sale. This “bridge” financing would cover the next three months while a new bailout plan is hammered out. However, according to sources, the ECB which controls terms of any national debt issuance, will not approve an increase in the current cap. Currently, EUR/USD has reverse short-term bearish trend taking out critical high at 1.1425 and 1.1525 23.6% Fibo retracement from Oct 2014. This suggests a further extension of current correct phase to 1.1775.

On the data front, China’s January HSBC services PMI fell to its lowest level since July 2014 at 51.8 from 53.4 in December while the composite PMI read fell by 0.4 points to 51.0 in January. Coming off yesterdays near highs, the PBoC fixed USD/CNY 51 pips lower to 6.1318. From Japan, data released showed that labor cash earnings increased by 1.6% y/y in December in line with estimate but higher then revised 0.1% rise in November. With Japanese wages earners income rising while the fall in real wages slowed, is a positive sign for policymakers, yet we suspect that prospects for sustained growth in wages, without real structural changes, are limited. Finally, Australia’s NAB business confidence dropped to 2 in 4Q. While. AIG performance of services index improved to 49.9 in January verse a prior contraction of 47.5.

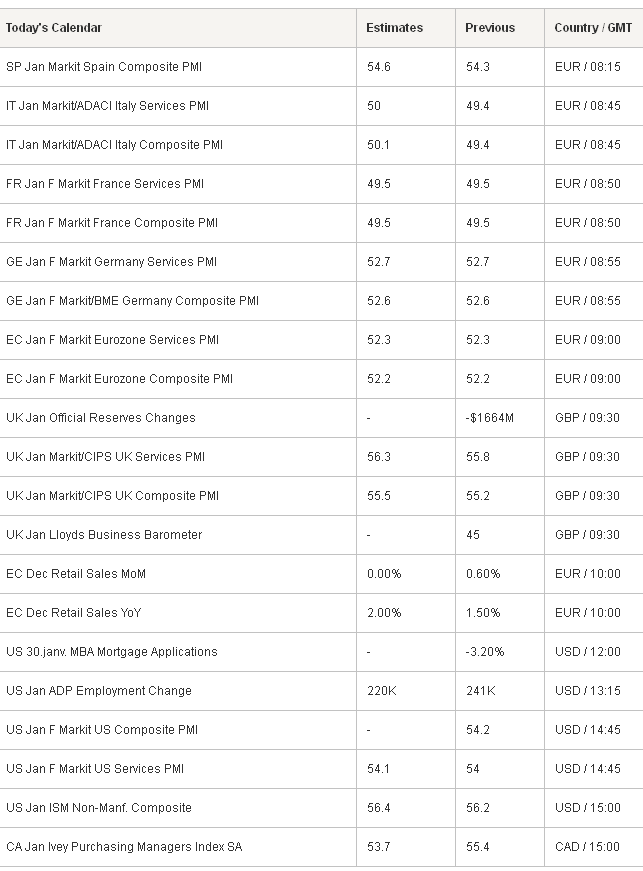

On the docket today, traders will be watching, Euro area final PMIs which are likely to be generally unrevised from the flash estimate with January services at 52.3, and composite at 52.2. UK services PMI are expected to rise marginally to 56.6 to 56.2 in January. GBP/USD’s recovery rally will target top of the range at 1.5280 where were serious supply awaits. In the US, ADP which is expected to have added 220k new jobs (indicating 230k for Friday’s payrolls). ISM non-manufacturing should decelerate in January, to 54.5.

Swissquote SQORE Trade Idea:

Commodity + Index Trend Model: Sell OILUSD at 51.99

For forex trade details & more great trade ideas,

Currency Tech

EUR/USD

R 2: 1.1541

R 1: 1.1460

CURRENT: 1.1334

S 1: 1.1224

S 2: 1.1098

GBP/USD

R 2: 1.5351

R 1: 1.5224

CURRENT: 1.5016

S 1: 1.4989

S 2: 1.4952

USD/JPY

R 2: 119.32

R 1: 117.74

CURRENT: 117.22

S 1: 116.66

S 2: 115.86

USD/CHF

R 2: 0.9500

R 1: 0.9368

CURRENT: 0.9262

S 1: 0.9170

S 2: 0.8936