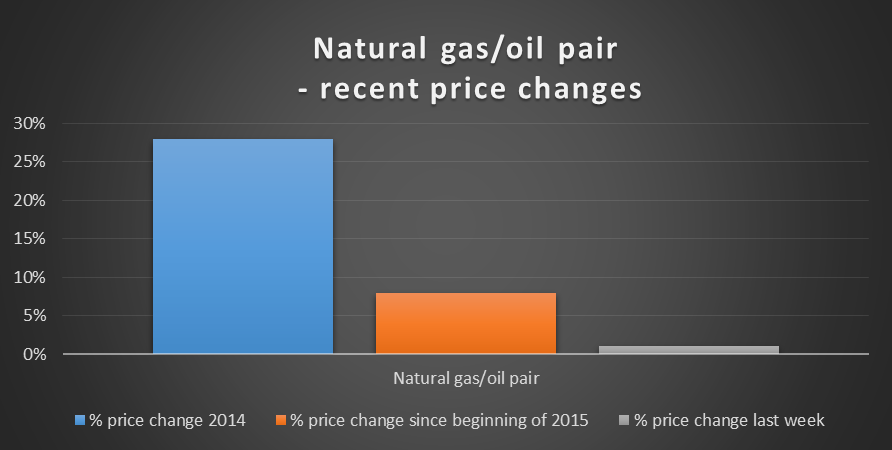

For some time, the crude oil price has significantly underperformed the natural gas price. The result has been an increasing price of the commodity pair: long natural gas, short crude oil. The graph below shows the performance of a pair ratio of 10 Mmbtu natural gas (long) to 1 bbl oil (short).

Both commodities have been declining in price; the increase in the price of the pair has reflected steeper falls in the price of crude.

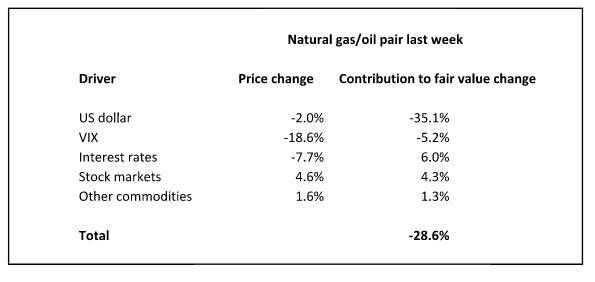

Over the last week, the crude oil price rose 3.7% (to $46.58) whilst natural gas firmed 4.8% (to $2.82) to give a 1.1% increase in the price of the pair. This was accompanied by a 29% fall in its fair value, largely driven by the weakness of the US dollar. The table below analyzes the move:

The disparity between price increase and fair value decrease would normally be a signal to sell or go short the pair (short natural gas, buy oil). Following this signal over the last 90 days would have provided an annualized gain (on gross – long plus short - exposure) of 57.5% with volatility of 43.9%.

We have also applied this methodology to a number of other pairs of related securities – silver/gold, DAX/S&P 500,palladium/copper, ASX 200/FTSE and CAC 40/Nikkei. The portfolio of all these pairs traded using the disparity between price and fair value change (as above) has returned an annualized 28.6% with volatility of 8.6% over the 90 day backtest period.

We find a fair value of the natural gas/oil pair above the current price, suggesting that the pair is undervalued and providing the opposite signal to that analyzed above. Trading the pair using this indicator over the 90 day backtest period showed a 19% annualized return with volatility of 44%. For the portfolio of pairs described above, the annualized return was 5.8% with volatility of 9.1%. Hence we note the signal, but tend to discount it in favor of the stronger performing price/fair value change disparity indicator.

Relationship to USD and volatility

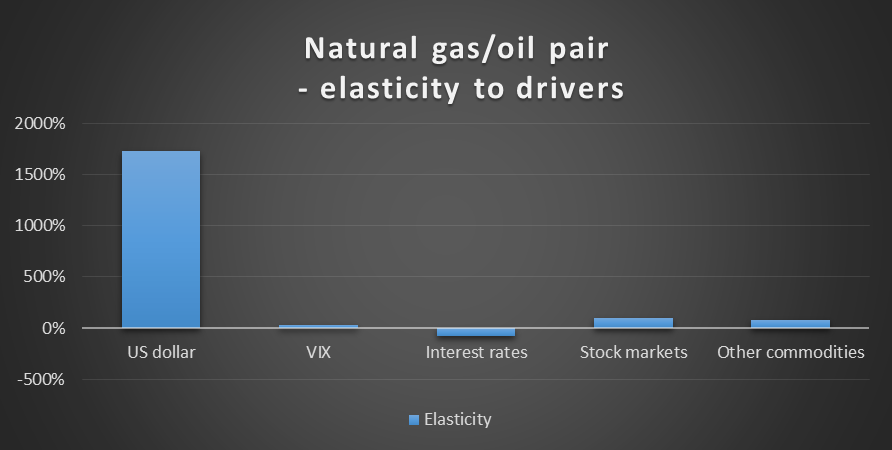

The graph below shows the sensitivity of the pair’s fair value to its drivers –

As can be seen, the natural gas/oil pair is highly positively correlated to the US dollar. Our fair value indicators suggest some short term upside in the US dollar index which would pose a risk to the pair trade recommended above.

The USD may undergo some volatility this coming week if any of the US February CPI, durable goods orders and/or Q4 GDP reads come in some distance from consensus. Given the high sensitivity of the pair to the USD evident in the above graph, this could translate into volatility in the natural gas/oil pair price.

The historical volatility of the pair over the last 90 days, at 44%, is lower than the volatility for either natural gas (72%) or oil (47%) individually. This reflects some positive correlation between the two commodities and hence risk netting by pairing them.

Held in combination with a US equity portfolio, lower volatility and higher return may be achieved. A portfolio of 5% allocated to the pair (traded as recommended in this article) and 95% allocated to the S&P 500 index had a volatility of 11.9% over the last 90 days vs 12.8% for 100% in the S&P 500. The annualized returns were 10.7% (5% allocated to pair) vs 8.2% (100% S&P 500).

However, on its own the volatility of the pair is still high and confidence in predictions of price direction and position sizing, should be tempered accordingly.