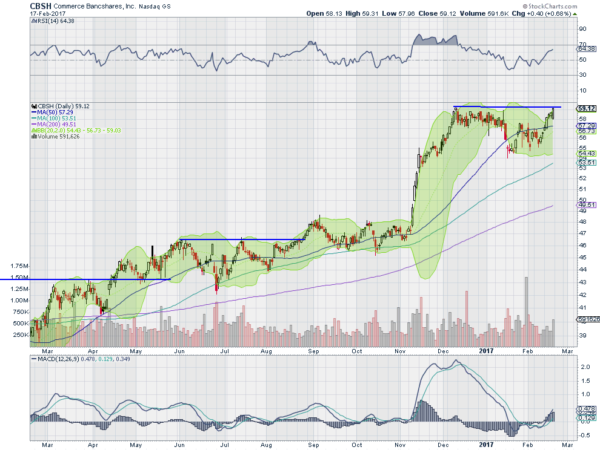

Commerce Bancshares Inc (NASDAQ:CBSH)

Commerce Bancshares, CBSH, went through a long consolidation ahead of the election. Like many financial stocks it jumped quickly afterwards, continuing into mid-December, before stalling. It has not done much since. A small pullback reversed higher in January and it is now back at resistance. The RSI is rising in the bullish zone the MACD is moving up and positive. Look for a break to a new high to participate higher…..

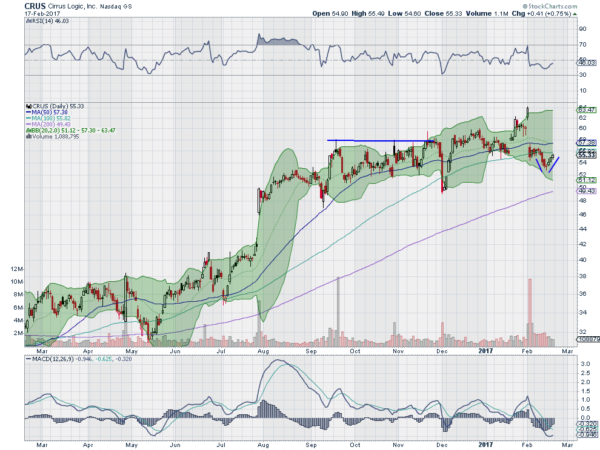

Cirrus Logic Inc (NASDAQ:CRUS)

Cirrus Logic, CRUS, dropped fast at the start of December, and recovered almost as fast. It then tried a move to the upside in January and spiked outside of the Bollinger Bands® but was sold off quickly. Last week it started moving back higher again. The RSI is also moving back up and the MACD is turning up towards a cross. Look for continuation to participate higher…..

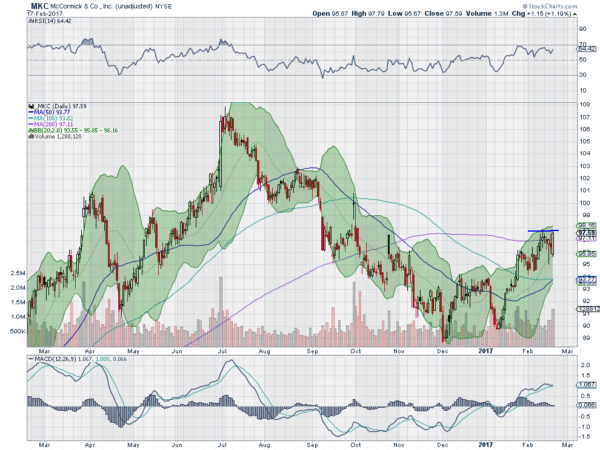

McCormick (NYSE:MKC)

McCormick, MKC, shot higher from April low to a top in early July. But it started dropping as soon as the Fireworks ended, finding a bottom in December. A quick bounce fell back to a higher low to start the New Year and it has moved higher ever since. Recently it touched the 200 day SMA and pulled back. But Friday it printed a large bullish engulfing candle, a sign of strength. The RSI is in the bullish zone and the MACD is rising after avoiding a cross down. Look for continuation to participate to the upside…..

Ulta Beauty Inc (NASDAQ:ULTA)

Ulta Beauty, ULTA, had a long run higher until it topped out in August over 275. Since then it has pulled back and reversed higher twice, continuing onward to the prior high last week. The RSI is in the bullish zone and rising while the MACD is about to cross up. Look for a new high to participate to the upside…..

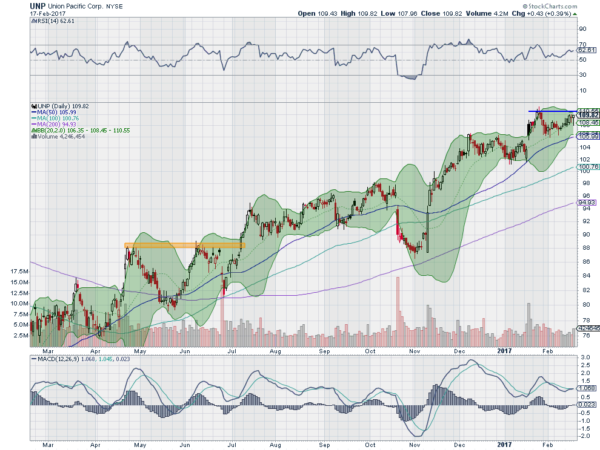

Union Pacific (NYSE:UNP)

Union Pacific, UNP, vaulted higher in November and kept running until stalling near 105 in December, That consolidation ran into the 50 day SMA in mid-January and it jumped again. A new consolidation zone ensued with the 20 day SMA as support. Last week saw a push higher towards resistance with the Bollinger Bands squeezing. The RSI is in the bullish zone and rising and the MACD about to cross up, both supporting more upside. Look for a push through resistance to participate higher…..

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which as the markets head into the holiday shortened week sees the equity markets continuing to look strong on the longer timeframe and getting overheated on the shorter timeframe.

Elsewhere look for Gold to continue to see an easier path higher while Crude Oil churns in a tight range. The US Dollar Index looks ready to reverse back up while US Treasuries are biased lower, should either break consolidation ranges. The Shanghai Composite continues to see a drift higher and Emerging Markets are pausing but also look good for more upside.

Volatility looks to remain at extremely low levels keeping a breeze at the backs of the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). All 3 look strong on the weekly timeframe, despite the moves higher. On the shorter timeframe the SPY and QQQ are moving deeper into overbought territory and may need a pause or pullback, while the IWM is consolidating. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.