5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

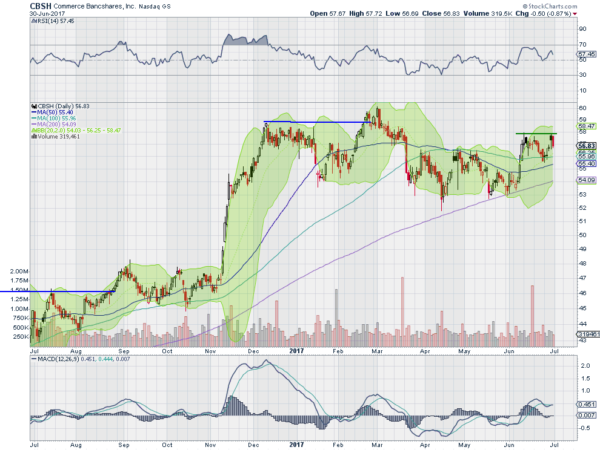

Commerce Bancshares Inc (NASDAQ:CBSH)

Commerce Bancshares, CBSH, jumped quickly following the election but then stalled. It has traded in a range between 53 and 58 ever since. In May the 200 day SMA caught up to up and it started higher from there in early June. Last week it moved higher to resistance after a retest at the 50 day SMA. The RSI is in the bullish zone and the MACD about to cross up. Look for a push through resistance to participate higher…..

Capital One Financial (NYSE:COF)

Capital One Financial, COF, pulled back from a top at the beginning of March finding support in April. It has risen since then in a channel and last week returned to the 200 day SMA. The RSI is about to enter the bullish zone while the MACD is rising and positive. Look for continuation to participate higher…..

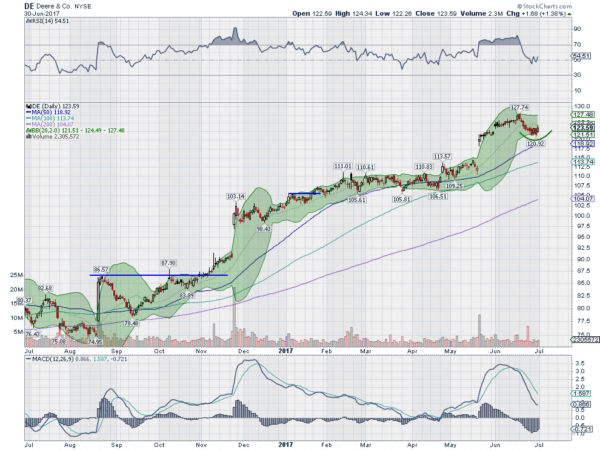

Deere & Company (NYSE:DE)

Deere, DE, started moving higher in September 2016. It gapped up in November and then slowed to pace of advance as it moved into a sideways consolidation. But then a second gap up in May brought the stock to a peak and it started to pullback 2 weeks ago. Last week saw the pullback round out and Friday ended with a move higher. The RSI is holding at the mid line, in the bullish zone, while the MACD is falling. Look for continuation higher to participate to the upside…..

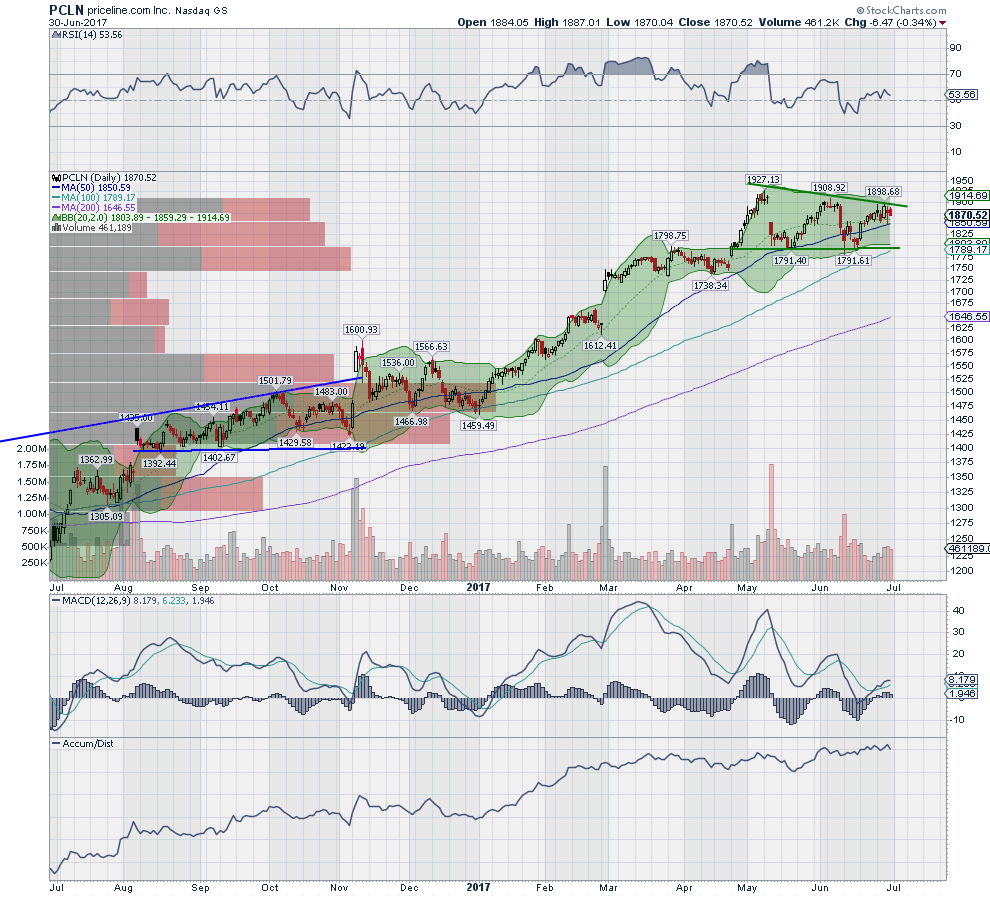

Priceline.com Incorporated (NASDAQ:PCLN)

Priceline, PCLN, started higher in January, and it ran through to the beginning of March. From there it consolidated for 2 months before a break higher that peaked in early May. Since then it has been consolidating in a tightening range. Last week saw it at the top of the range with the RSI holding over the mid line and the MACD level but positive. Look for a push up out of consolidation to participate…..

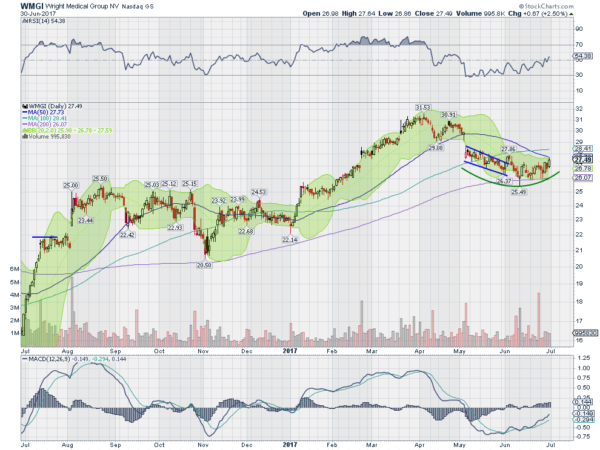

Wright Medical Group NV (NASDAQ:WMGI)

Wright Medical Group, WMGI, started higher out of consolidation in January. It continued higher, reaching a top in April and then started a retracement. It found support in June as it touched the 200 day SMA. Last week the consolidation continued until it started to move higher Friday and closed at the 50 day SMA for the first time since May 1st. The RSI is rising and now over the mid line with the MACD moving up as well. Look for continuation to participate higher….

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which after tying up the second quarter and heading into the Fourth of July Holiday Weekend, sees equities have held up well, but with a first crack in the armor for the QQQ.

Elsewhere look for Gold to consolidate sideways while Crude Oil continues higher short term. The US Dollar Index is weak and looks to continue lower while US Treasuries are also biased lower after a reversal. The Shanghai Composite and Emerging Markets are biased to the upside with risk that Emerging Markets may continue to consolidate in the short run.

Volatility looks to remain at very low levels keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts are more mixed than they have been with the QQQ showing some signs of weakness on both timeframes while the SPY and IWM are still strong. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.