I moved to Cleveland 6 years ago. This is a statement I thought I would never make. I had visited several times as my wife’s family is here. It was always a great trip, but come on, who moves from either Boston or New York to Cleveland? It turned out to be a great move for our family. Cousins living a mile away, no more 90-minute commutes, back to the culture we left behind in Boston, and a whole lot cheaper.

It is a lot of work to try to hold onto an out-of-market team loyalty. And when the players and managers turn over it makes it easy to switch teams. So with the kids growing up I became an Indians and Cav’s fan with them (cant let go of the Patriots). The past couple of years have made that very easy too. Last night was a heartbreak for my kids and the city of Cleveland. Congratulations to the Cubs and their fans, over 100 years is a long time to go without a championship.

For Clevelanders, we will move on to the Cavaliers. It was a great season for the Tribe and next year can’t come too soon. I hope we have a parade to celebrate the accomplishments, and if it happens I suspect over 1 million will come again.

Over these years in Cleveland I have seen a rejuvenation of a city that had been down for a long time. What is really interesting to me though is that as this is happening the rest of the news flooding in to me has become even more jaded and negative. What is becoming of the American Dream? So many people seem to get up every morning and spend their day looking for the worst in the world. When and why did this change. Because of this I have stopped reading all newspapers and watching any televised news or event where it is not live and unscripted so I can make my own conclusions.

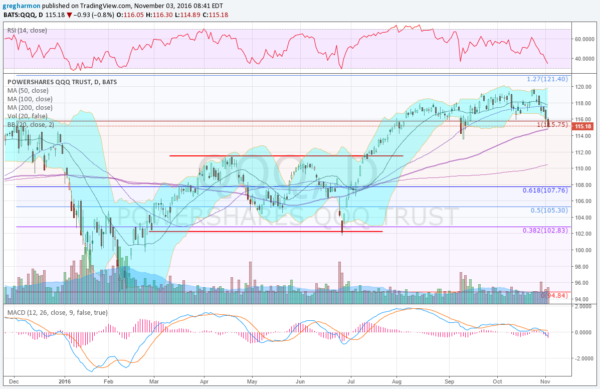

Outside of sports this leaves little besides my day job of watching price action in the stock market. And in this pursuit I try to find a ray of light, a shining light that is being ignored every day. Today that ray of light comes from the Nasdaq 100. While main stream media is focusing on the depths of the of the fall in the S&P 500 and Russell 2000, even invoking the June 27 Brexit lows (still far off by the way), the Nasdaq 100 sits less than 4% from its all-time high level.

PowerShares QQQ Trust

The chart above also shows that the Nasdaq 100 ETF, QQQ, is back at its 100 day SMA and retesting the December highs as support. In the pre-market the price action the ETF is bouncing at this level. here is where the good comes in. A reversal higher here would make for a higher low following the September low. It would also come at a point where AAII bullish sentiment is at bearish levels (HT @RyanDetrick) and strategist everywhere are calling for a recession (despite improving earnings).

The tech sector has been leading over the last 6 months so it would not be a surprise if the QQQ was the index to pull the broad market back higher. At least to me. But maybe it would for the rest of our fear mongering, glass half empty and leaking world. I will continue to follow all price action and not blindly expect a move higher. But continue to count on me to look for the goodness and not the negativity in life and markets. You should too. it helps you smile more.