Citigroup (NYSE:C)

Citigroup, $C, moved higher out of a symmetrical triangle in May, reaching the target move in early July. It pulled back from there to a higher low and then reversed up. Friday it ended the week consolidating testing that high. The Bollinger Bands are opening to allow more upside. The RSI is bullish and the MACD rising. Look for continuation to participate higher…..

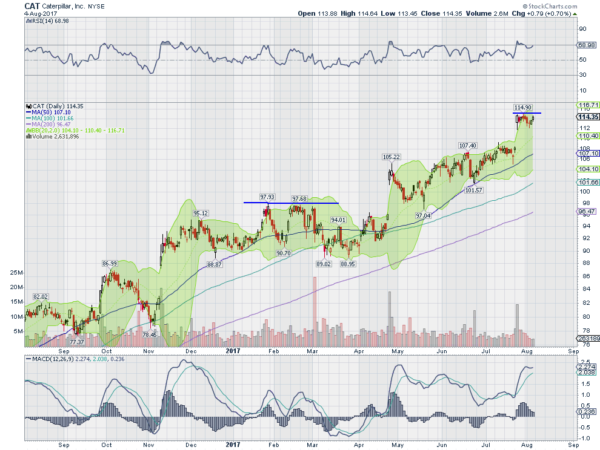

Caterpillar (NYSE:CAT)

Caterpillar, $CAT, moved higher out of consolidation in May with a gap up. it has drifted higher along the 50 day SMA since, with another gap up 2 weeks ago. It has consolidated since that gap. The RSI is strong and bullish and the MACD is bullish. Look for a push over consolidation to participate higher….. R: 115.25 then free air. S: 112.25/109/106.50. SI: 3.4%. Enter long over 115.25 with a stop at 112. As moves over 117 move stop to break even then $3 trail over 118.25 and let the stop take you our of the trade. Options: try September 115 Calls ($2.52). Sell August 25 Expiry 117 Calls (65 cents) to lower the cost.

Celgene (NASDAQ:CELG)

Celgene, $CELG, went through a broad consolidation after a gap up in November that lasted until mid June. The leg higher that started off of the 200 day SMA in June stalled later in the month and has established a trend higher over support. The RSI is bullish and rising with the MACD pulling back. Look for continuation higher to participate…..

Goldman Sachs (NYSE:GS)

Goldman Sachs, $GS, made a high in March and then pulled back. It touched the 200 day SMA in June and has made higher lows since against resistance. The RSI is knocking on the bullish zone and the MACD is crossing up. Look for a push over resistance to participate higher…..

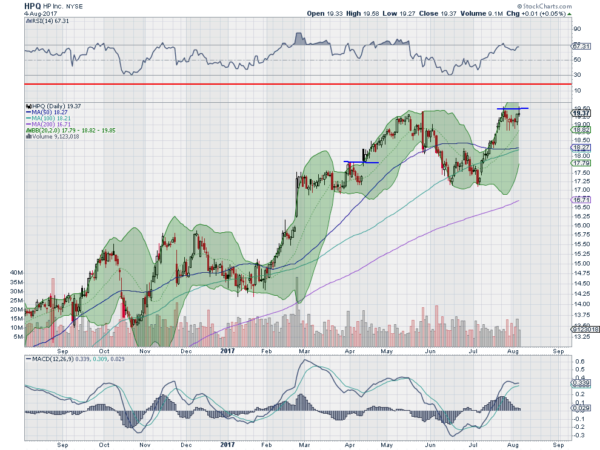

HP Inc (NYSE:HPQ)

HP, $HPQ, started higher in February, paused in March for a month, and then continued to a top in May. It pulled back from there to a double bottom from June to July and is now back at the top and consolidating. The RSI is bullish and the MACD avoiding a cross down. Look for a push over resistance to participate higher…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the first full week of August sees the equity markets are settling and marking time near their highs.

Elsewhere Gold looks to pause or pullback while Crude Oil pauses with a bias higher. The US Dollar Index is slowing in its descent while US Treasuries are broadly consolidating. The Shanghai Composite looks to continue in its uptrend while Emerging Markets pause in their uptrend.

Volatility looks to remain at very low levels keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts show consolidation in the SPY and QQQ with a pullback in the the rising channel for the IWM. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.