- Wall Street closes up but futures slip amid wavering sentiment

- Dollar maintains upward crawl as inflation and growth worries persist

- Yen keeps sinking, loonie outperforms as tight oil supply boosts prices

Stocks lack direction but bargain hunters lurk

Bargain hunters drove Wall Street higher on Tuesday, piling into defensive tech stocks and energy shares. The S&P 500 and Nasdaq Composite both closed up about 1%, but the Dow Jones lagged slightly. Retailers weighed on Wall Street after the department store chain Target (NYSE:TGT) downgraded its expectation for Q2 profit margin for the second time in as many weeks.

Its stock plunged (-2.4%) and Walmart (NYSE:WMT) also came under pressure, dragging the S&P 500 retailing index down by 1%. However, there were some exceptions as Kohl’s surged by almost 10% after the retailer said it was in talks for a possible takeover.

But it was energy and tech stocks that saved the day as Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT) led the advances among the tech heavyweights, while ExxonMobil (NYSE:XOM) was one of the biggest winners in the energy sector.

However, despite some impressive gains and plenty of more attractive valuations, the positive momentum just doesn’t have enough force at the moment to drive the entire market higher. The fact it was the usual tech favourites that did well yesterday and the more convincing rally was confined to energy companies, which stand to profit from the relentless rise in oil and gas prices, is an indication that investors are nervous about the outlook.

Stagflation fears heightened ahead of key events

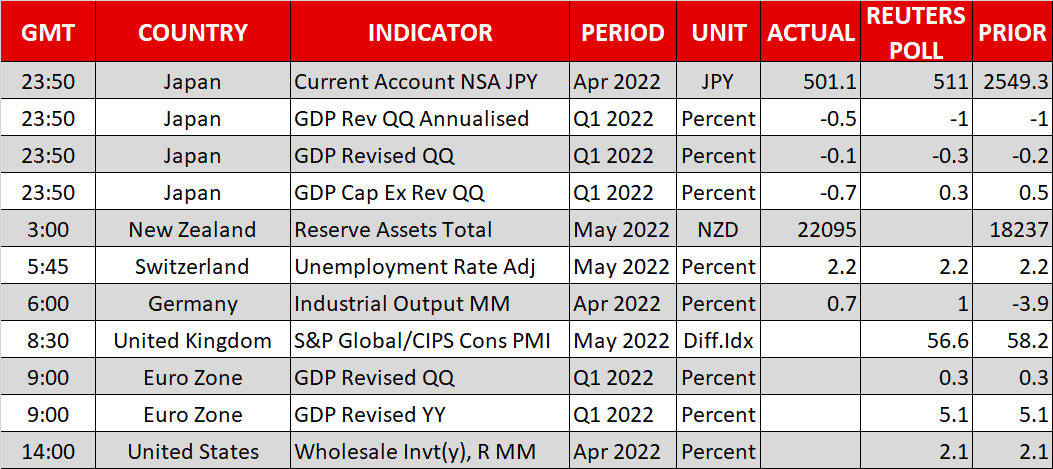

The World Bank yesterday slashed its 2022 forecast for global growth as surging inflation is forcing central banks to sharply raise interest rates, while the ongoing supply shortages from the war in Ukraine and China’s virus curbs are further dampening the outlook.

Those worries are unlikely to go away soon but investors are hoping that policymakers from the ECB, Fed, Bank of England, Swiss National Bank and Bank of Japan will provide some clarity over the course of the next eight days when they meet to set policy. US inflation data due on Friday is also on investors’ radar. But ahead of all that, trading will probably remain quite choppy as Wall Street futures have turned negative today and it’s a mixed session in Europe so far.

Asian markets fared slightly better on Wednesday, though, as tech shares jumped in Hong Kong on more signs that China is easing up on its crackdown of internet companies after authorities approved 60 new video games.

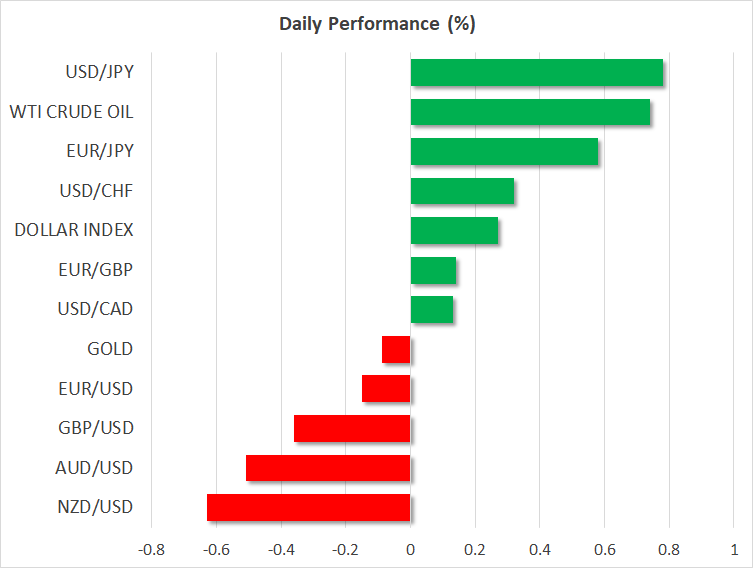

Dollar firms again as yen takes another dive, loonie off highs

In the FX sphere, the US dollar edged up, mirroring the moves of the 10-year Treasury yield. Bond markets have been somewhat unsettled this week as apart from the constantly shifting expectations of monetary tightening, they are being inundated by a fresh supply of US Treasuries. The Treasury Department will issue $33 billion in 10-year notes later today and a 30-year auction is due tomorrow. In the meantime, the 10-year yield is back above 3% after yesterday’s dip.

US and other major bond yields have been spiking higher in June but Japan has been cast out of the rally due to the Bank of Japan’s yield cap. The ever widening yield differentials have battered the yen, which slumped to a new two-decade low of 133.86 per dollar today.

But the euro, pound, aussie and kiwi were all on the backfoot too against the greenback, with only the Canadian dollar performing somewhat better. The loonie hit a seven-week high of C$1.2520 to the dollar on Tuesday as investors grew increasingly doubtful about whether the tight supply in the oil market will ease anytime soon.

WTI futures are trading near three-month highs at just above $120 a barrel on Wednesday, while Brent crude was last quoted at $121.13.