After the signing of the Phase One trade agreement between China and the US, the markets continue to watch the news from China with anxiety. A new wave of risk aversion triggered by reports of a new Chinese virus spreading on the eve of the Lunar New Year. It has quickly revived investors’ memories of the severe economic consequences of the SARS virus in 2003.

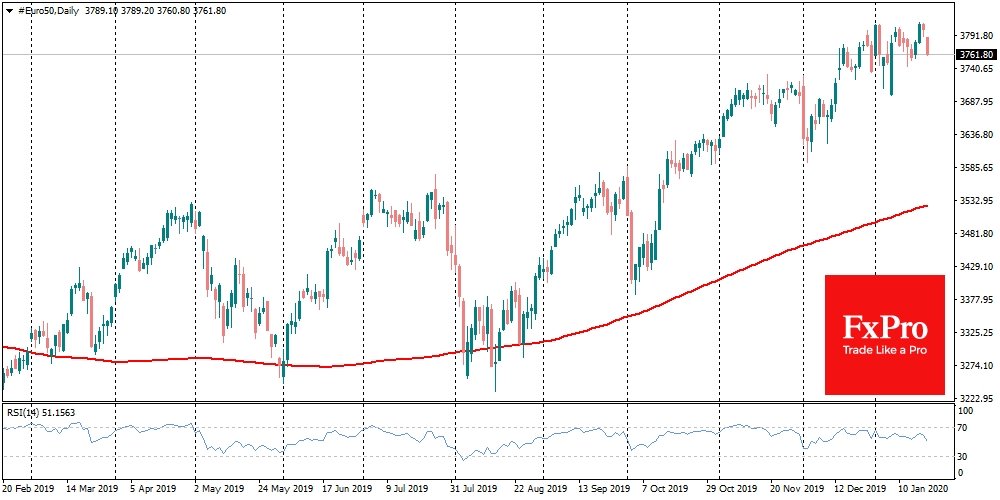

The anxiety heightened by the fact that hundreds of millions of people travel to and from China on New Year’s Eve, contributing to the spread of the disease. At the background of fears about the virus, Japanese Nikkei 225 and Euro 50 lost about 0.8% this morning, while Shanghai’s China A50 blue-chip index down 1.5% and the Chinese yuan has lost 0.6% against the dollar to 6.90

However, the vulnerability of markets to this kind of news is also an essential characteristic of it.

Firstly, it is an indicator that markets are not afraid of serious economic problems at the moment. Otherwise, they would be in the focus of investors, not the virus. It is also worth looking at the most high-profile topics in the media in recent weeks, which have paid increased attention to climate change. De facto, these issues promise to be the most high-profile ones at the economic forum in Davos.

Secondly, the vulnerability of markets to such news is a clear signal of the fragility of the recent stock rally. If the story of potential and so unclear threats can trigger such a significant market reaction, it is explicit evidence that investors are looking for excuses to take profits.

Against this background, it is worth paying attention to the upcoming meetings of major central banks, including the ECB, Fed, and Bank of England this week and next week. Bank of Japan has already issued its policy statement, retaining the previously announced incentives.

The ECB will take comprehensive monetary policy review, that may cause a sharp change in the EUR/USD rate, and have long-term consequences for the trend in this currency pair.

In our opinion, after signing the US-China “Phase One” and in light of the intention to pause further negotiations, the downward trend of EUR/USD is under review. It formed in early 2018 on fears that trade conflicts will lead to a more significant slowdown in Europe than in the US. It proves to be right, but ‘what next’, ask investors.

The FxPro Analyst Team