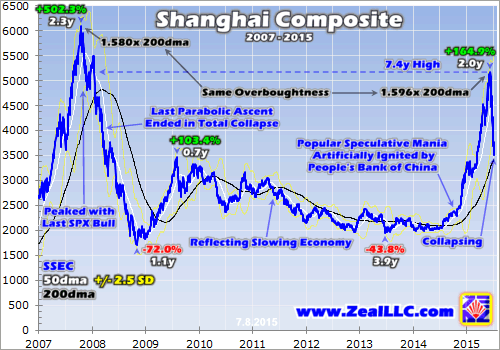

China’s stock bubble has burst, with its stock markets utterly collapsing after rocketing parabolic. The failure of this popular speculative mania has grave implications for the global stock markets. It shatters the universally-believed myth that central banks can nullify normal market cycles. No government has more power over its stock markets than China’s, yet not even it could magically eradicate greed and fear.

Even before their recent calamity, the Chinese stock markets had been the most-interesting financial story of 2015. Having the world’s second-largest economy, China is immensely important in global markets. And its stock markets were soaring, as evidenced by China’s flagship benchmark stock index. It is the Shanghai Composite, the local equivalent of the US S&P 500.

By the ends of March, April, and May, the Shanghai Comp had soared 15.9%, 37.3%, and 42.6% year-to-date! Such gains were astounding, creating the equivalent of trillions of dollars of wealth for Chinese stock investors. And unlike major stock markets in the West, China’s are dominated by its army of retail investors. Ordinary Chinese people account for over 5/6ths of all the national stock-market transactions.

So China’s soaring stock markets truly were a popular speculative mania. And culturally, the Chinese people are especially susceptible to the greed-drenched groupthink necessary to fuel one. Social status among peers is exceedingly important to the Chinese, and that is most visibly manifested in perceived wealth. So as the stock markets powered higher, people couldn’t stand the thought of being left behind.

Their overwhelming desire for upward social mobility, and being seen as successful by their peers, led them to aggressively buy stocks. And this went far beyond normal investing to pathologic extremes of herd behavior. Captivated by the intoxicating dream of fast wealth, many millions of Chinese who had never before invested in stocks rushed to open brokerage accounts. But they were in over their heads.

Just like in the States, these new Chinese investors had to disclose their level of education when they opened their trading accounts. And even back in early spring before this mania really got crazy, fully 2/3rds of all the new investors reported only having a junior-high-level education or less! 1/4th only completed some elementary school, while 1/17th were considered “not literate” with no formal education at all.

So literally “dumb money” fueled the popular speculative mania in Chinese stocks. This isn’t pejorative, as the lower someone’s education level the greater the odds they won’t really understand what drives stock markets and how risky they are. This amazing degree of unsophistication was evident in the way these new Chinese investors bought stocks. Many opened margin accounts to borrow money to do it!

Legally stock margin in China is limited to 2 to 1 just like in the US, and the official levels of margin debt were astounding. They had hit a record equivalent to $194b by mid-April, and kept rocketing even higher to $322b by late May. This compared to a record $507b of NYSE margin debt in US stock markets at the end of April. Relative to China’s smaller stock markets and lower per-capita income, this was incredible.

And the real level of using debt to finance speculative stock purchases was much greater. Another one of China’s many cultural peculiarities is the widespread practice of ignoring all laws and regulations until caught. The legions of Chinese investors were borrowing all the money they could get their hands on from any source they could find to buy stocks, not limiting that to formal margin borrowing from brokerages.

Some of this alternative financing was questionable, gray-market and even black-market venues created specifically to circumvent margin rules. And this extra borrowing certainly wasn’t reflected in the official margin numbers. So many Chinese investors’ leverage in stocks exceeded 2 to 1. This double-edged sword not only amplifies gains, but losses. And most Chinese investors believed stocks couldn’t fall.

This dangerous notion was actively fostered by China’s government. It encouraged the Chinese to invest in stocks for patriotic reasons, to support their nation. Its official media outlets ran endless stories about the fortunes being won in the stock markets. This really resonated with the Chinese need for social status and upward mobility. And if the government was fully behind the stock markets, what was there to lose?

Western contrarians scoff at such a silly notion, but Chinese investors grew up totally indoctrinated to trust their immensely-powerful central-planning government. There is no other major government in the world that comes anywhere close to having the absolute internal power of China’s, both actual and perceived, to manipulate the markets and economy. And Beijing was pushing hard for the Chinese to buy stocks.

It was actually China’s government, via its central bank, that ignited this stock bubble. Beijing was very worried about the weakening Chinese economy last year. So in Late November, the People’s Bank of China made a surprise rate cut. It slashed its main interest rate by 40 basis points to 5.6%. This was a big deal, the PBoC’s first rate cut since July 2012. Chinese investors figured a new easing cycle was starting.

And just like all over the world these days in this era of epic central-bank money printing, that was seen as a green light to buy stocks. So capital flooded in, and in less than 3 weeks the Shanghai Comp had blasted 23.2% higher! The Chinese central bank provided the initial spark that ignited that popular stock mania, and continued to nurture it whenever it faltered. Beijing really wanted local stock prices to climb.

I suspect there were two primary motivations. First with China’s economy slowing, the wealth effect of higher stock markets would bolster consumer spending. China is trying to transition from an export-dependent economy to one largely supported by domestic consumption. Second, Beijing wanted to improve the international prestige and standing for Chinese stock markets. So it convinced countless Chinese to buy.

After the SSEC soared by nearly a quarter in a matter of weeks thanks to the PBoC, the Chinese people really took notice. The Chinese real-estate market was flagging along with the national economy, and gold languished down in the dumps. So many millions opened brokerage accounts, borrowed money, and rushed to buy stocks. Visions of fast gains clouded their judgement, the greed for quick wealth creation.

After this rally stalled in early 2015, the PBoC sought to rekindle the euphoria with another surprise rate cut at the end of February. And soon the Chinese were buying aggressively again, and the Shanghai Comp skyrocketed in March and April. As a speculator and student of the markets, I had been closely watching the Chinese developments with great interest. By late April, the SSEC looked like a classic bubble.

I wrote an essay warning about the extreme downside risk in the parabolic Chinese stock markets then. That was a hardcore contrarian position to take, very unpopular at the time. Even the vast majority of the Western analysts believed that the Chinese stock gains would continue indefinitely. The most common reason advanced was the ability of China’s powerful central-planning government to steer the markets.

But while governments can amplify market cycles, they can never eliminate them. History is chock full of examples of government-inflated markets collapsing. It’s ultimately popular greed and fear that drive market cycles! No amount of government jawboning or money printing can strike these overpowering emotions from human hearts. And not even the most-powerful governments can corral herd behavior.

So right at the end of April as the popular speculative mania in stocks looked on the verge of burning itself out and rolling over, we started actively betting against it. There are some US ETFs that track the leading Chinese stocks, led by Deutsche X-trackers Harvest CSI 300 China A-Shares (NYSE:ASHR)).

Indeed the Chinese stock markets dropped hard in early May, with the SSEC plunging 9.2% in 7 trading days! With the Chinese populace so heavily invested in the red-hot stock markets at Beijing’s bidding, it was terrified of the looming correction. So the People’s Bank of China made another surprise rate cut in early May, its third in 6 months. Convinced the PBoC would keep easing, Chinese investors stampeded back in.

As is always the case in popular speculative manias, people were far more worried about missing out on the next big upleg than any potential downside risk. So the social-status-conscious and wealth-loving Chinese continued aggressively borrowing to buy stocks. Within just 5 weeks by mid-June, they had succeeded in forcing the Shanghai Comp another 25.6% higher! Bullishness and euphoria were universal.

But that’s exactly when prices peak. Once all investors willing to buy Chinese stocks had deployed their capital, there were no buyers left. So in mid-June with little fanfare and no meaningful news, the SSEC finally peaked. And once that selling started, the unbridled greed of Chinese investors quickly turned to naked fear. Greed and fear are asymmetrical emotions, the former builds slowly while the latter flares suddenly.

After skyrocketing an astounding 110.8% higher in just 6.7 months thanks to 3 surprise rate cuts by the People’s Bank of China, the red-hot Chinese stock markets collapsed. The SSEC plummeted 13.3% in a single week, its worst since the 2008 stock panic. And there still wasn’t any significant news to drive this, it was purely emotional. Herd sentiment can turn on a dime at extremes, which is why they’re so dangerous.

With its stock bubble popping, the Chinese government entered full-on panic mode. It was terrified of the social implications of the wealth destruction from plummeting stock markets, fearing civil unrest in particular. So on the final weekend in June after the Shanghai Comp had cratered 18.8% in just two weeks, the People’s Bank of China tried to work its market-manipulating magic again with another rate cut.

And that fourth surprise rate cut since November was extraordinary. Not only did the PBoC again cut its benchmark lending rate, but it slashed banks’ and finance companies’ reserve-requirement ratios. The PBoC hadn’t done a dual rate and triple-R cut since late 2008 in the dark heart of the stock panic, which reflected the panicking in Beijing. The Chinese government was throwing the kitchen sink at the stock markets.

But it didn’t work, as heavy selling resumed in the week straddling June and July! This shocked traders all over the world, who had come to assume that central banks can control market cycles. All around the globe, extreme easing by central banks has levitated stock markets to lofty levels. The belief that central banks are omnipotent has led to unnaturally-low volatility, and thus epic complacency, in recent years.

No major government in the world has more control over its stock markets than China’s. And if not even the all-powerful PBoC could arrest a stock-market plunge, what hope is there for the Federal Reserve or European Central Bank or Bank of Japan? As the Shanghai Composite kept on plunging despite that panicked dual cut, the Chinese government got even more aggressive and desperate. It was amazing.

In just this past week, the Chinese government tried to reignite margin buying by allowing brokerages to accept real estate as margin-loan collateral. Chinese investors were being encouraged to literally bet their houses on plummeting stock markets! This was such an asinine idea that the brokerages balked, risking Beijing’s displeasure. Losing houses along with stock wealth would greatly exacerbate civil unrest.

After that, the Chinese government convinced major brokerages to collectively buy $19b worth of stocks. But that was a drop in the bucket compared to the $3000b or so lost as the SSEC plummeted by 32.1% in less than a month! These brokerages also pledged to not sell any shares as long as the Shanghai Comp remained below 4500. And the Chinese financial industry fought the bursting in other ways too.

Like in the US, Chinese companies can request halts in their stocks’ trading for news pending. But it’s being rampantly abused in China, with companies halting trading indefinitely to sit out this extreme selling. As of this week, about 1400 of the 2800 listed companies on China’s stock exchanges had their trading halted! So around 50% of the Chinese stock markets were effectively closed, yet the selling continued.

China’s government continues to get more desperate, entering the realm of the absurd. This week, major shareholders, corporate executives, and directors were banned from selling any stocks for 6 months. All new IPOs and share offerings have been suspended to reduce supply pressure. And the latest is the Chinese government is promising to arrest short sellers. Beijing is panicked beyond belief about this bubble burst!

Chinese investors are starting to realize that neither their government nor central bank is omnipotent, that stock-market cycles can’t be nullified. They are finding out that manipulated stock markets are like a roach motel, you can check in but you can’t check out! While Chinese were encouraged to take their lives’ savings and borrow way beyond that to buy stocks, they aren’t being allowed to sell when they want to.

This is horrifying, and extremely dishonorable on the part of Chinese government and market officials. The surest way to fan the flames of panic is to make investors feel trapped, unable to liquidate any of their positions whenever they want. That breeds the bearish sentiment that drives long declines after popular speculative manias. And as China’s last one in 2007 showed, today’s bust is only getting started.

After that 2007 mania peak, the Shanghai Comp plummeted 72.0% in just over a year! And the Chinese stock markets have never fully recovered since. I suspect they’d still be languishing near lows if the People’s Bank of China hadn’t ignited and nurtured this latest bubble. And all that manipulation got was a 7-month mania with illusionary gains that are rapidly vanishing, at the terrible cost of devastating private wealth.

With the Chinese stock markets half frozen, we liquidated one of our ASHR puts trades for a 151% gain for our subscribers this week. We’re holding another tranche, currently with a 207% unrealized gain, for lower Shanghai Comp levels. While this popular speculative mania and resulting Chinese stock bubble were blindingly obvious to contrarian students of the markets in late April, I’m really sad for the Chinese people.

They had faith that their all-powerful government wouldn’t lead them astray, that it could keep the stock markets climbing indefinitely. They believed their mighty central bank could cut rates enough, and print enough money, to eliminate stock-market cycles. Even the vast majority of Western analysts fervently believed this. Boy were they all dead wrong! The biggest global implication of this is psychological.

The US Federal Reserve’s extreme easing of recent years has radically levitated the US stock markets, while a similar thing happened in European stock markets recently thanks to the European Central Bank’s Fed-style debt monetization. Once these overvalued and greatly overextended US and European stock markets inevitably roll over decisively, traders are going to remember what happened in China.

If the PBoC with its extreme power, control, and measures couldn’t short-circuit Chinese stock-market cycles, how on earth can the Fed and ECB hope to? Today’s lofty global stock markets are nearly totally the result of excessive confidence in the ability of central banks and their easing to prevent material stock-market selloffs. While history mocks that foolish notion, China’s stock bubble burst vividly proves it false again.

There’s no doubt China’s popular stock mania failing so catastrophically is going to seriously erode traders’ recent total faith in central banks. Yes, their machinations can certainly amplify uplegs. But once herd mentality inevitably shifts from greed to fear, central banks are powerless to eliminate the normal stock-market cycles and truncate selloffs. The hard example of China will really exacerbate coming Western selling.

With US and European stock markets artificially inflated by central banks much like China’s was, it’s never been more important to cultivate great sources of contrarian market intelligence. That’s what we have long specialized in at Zeal. We buy low when sectors are deeply out of favor, then later sell high when sentiment inevitably shifts and investors return. This prudent contrarian strategy has led to big gains.

The bottom line is China’s red-hot stock bubble has burst. Chinese investors have lost nearly a third of their wealth, much more for the margin traders, in less than a month. And the same mighty government that fomented this popular speculative mania has been powerless to stop its failure. Beijing is panicking and trying ridiculous measures to halt the selling, but the fear-driven herd is still stampeding out anyway.

As Chinese investors are bitterly realizing far too late, central banks are ultimately impotent to eliminate normal stock-market cycles. While central-bank manipulations through jawboning and money printing can extend uplegs and delay selloffs, they will still always come eventually. Western investors’ blind faith in central banks’ abilities to levitate stock markets indefinitely is misplaced and dangerous, a reckoning is inevitable.