Market focus

Against the background of negative sentiment regarding the trade deal, more and more markets are involved in this "tornado". The United States announced that China had abandoned some previously agreed concessions, which fundamentally changed the basis for the agreement. Hopes for a deal were dashed, despite the formal assurance from China that they intend to arrive in Washington at the end of the week.

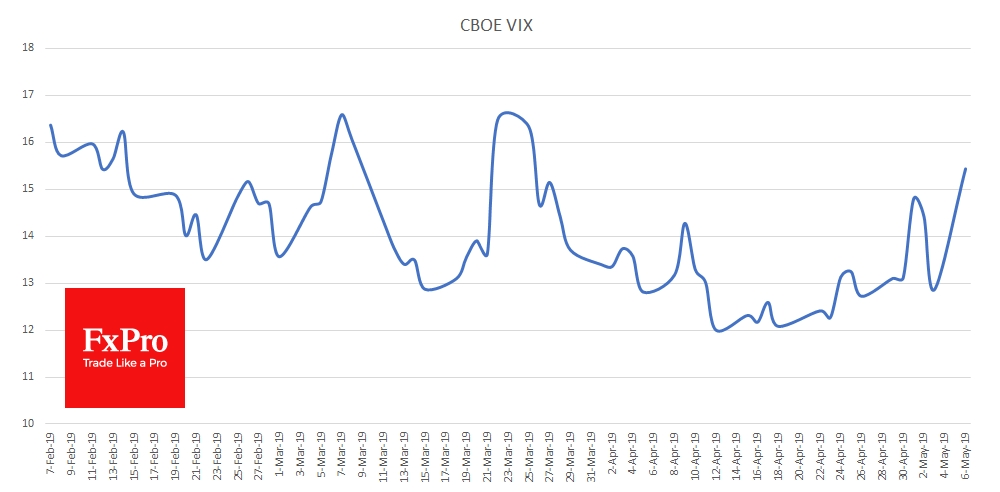

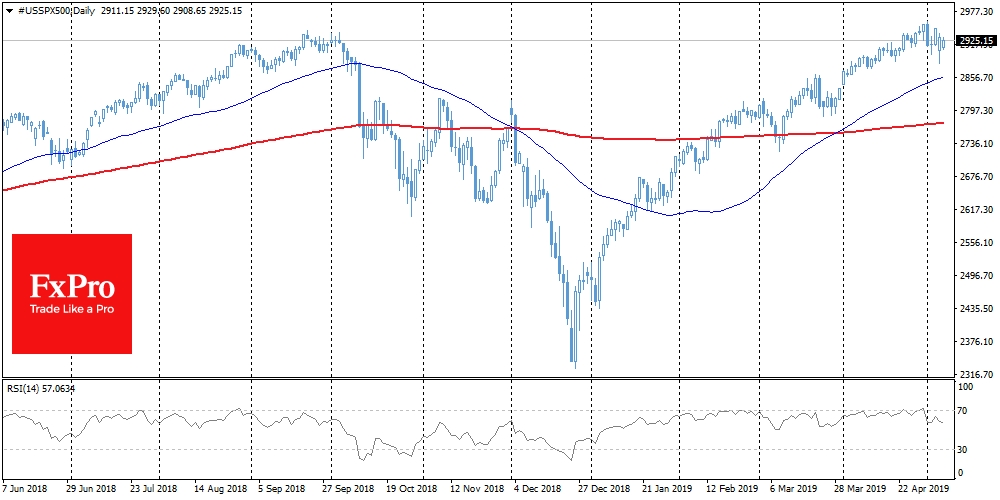

China A50 Shanghai Blue Chips Index declined, dropping by about 1% against Tuesday’s opening levels. Futures on the S&P 500 showed increased volatility since the end of last week, opening the day lower by 0.45%. The VIX index, or “fear index,” rose to 15.55, the highest level since the end of March, pushing off from levels near 12 at the end of last month. This is a moderately negative signal for the market combined with RSI decline from the overbought area, which increases the chances of a corrective pullback.

EUR/USD

Monday's PMI indices in the eurozone service sector exceeded expectations. There was also strong inflation data at the end of last week. As a result, the EUR/USD managed to return above 1.1200. Today, the focus of investors with positions in the euro will be the publication of the European Commission forecasts. Optimistic forecasts can further support the euro.

AUD/USD

The Reserve Bank of Australia decided not to cut the interest rate, which was expected by most of the surveyed analysts. As a result, AUD/USD jumped 0.6% to 0.7040. The recovery of the pair, however, is held back by concerns over the US/Chinese trade deal. Next on the agenda is tomorrow's meeting of the RBNZ. The economies of Australia and New Zealand are tied to exports to China, so the actual and planned steps of the PBOC related to monetary policy since the beginning of the year have somewhat relieved the pressure on the RBA and RBNZ.

The FxPro Analyst Team