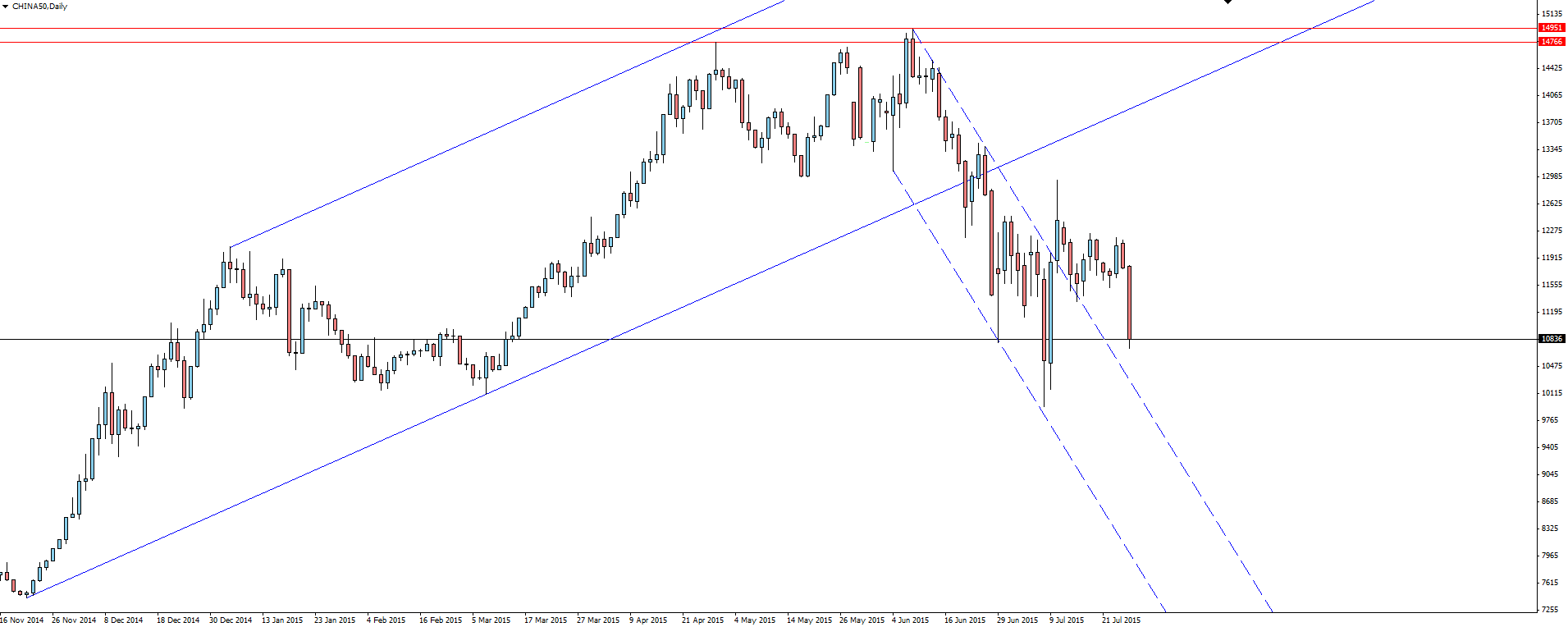

Chinese Stock Woes:

After what seemed like a settled week, Chinese stocks were back in the news overnight with some massive falls ripping through markets. The Shanghai Composite Index capitulated, suffering an 8.5% loss on the day, its worst performance since February 2007.

This drop was on the back of concerns that the Chinese government is faltering on its measures to artificially prop up the market.

“Investors are not confident that the bull market will return any time soon.”

Confidence in the market is completely shot and we are going to see a few more wild swings yet to come. The manipulation of the market that the Chinese government is undertaking, as well as the ever unreliable data releases described by some traders on social media as the government ‘spinning the random number generator’ has done nothing to ease concerns.

China A50 Daily:

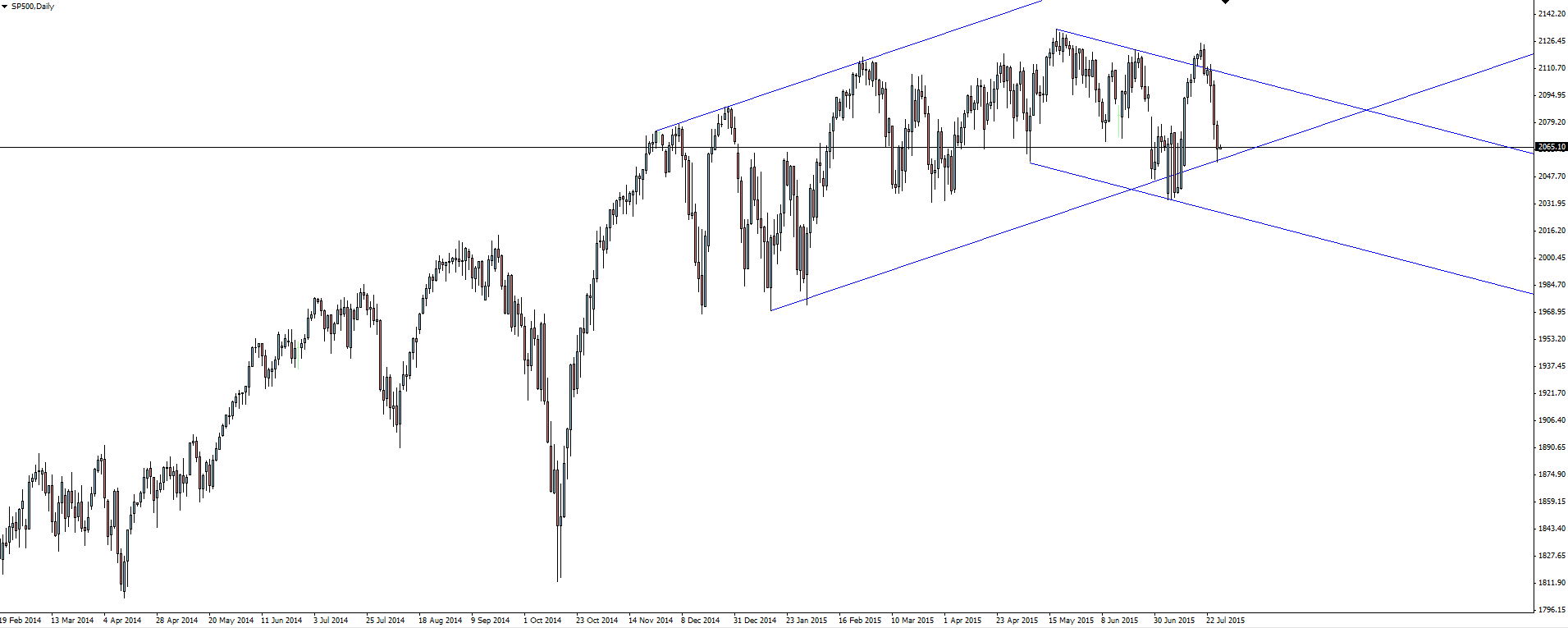

These sharp moves in China are also felt across the globe with US markets feeling the pinch. With FOMC jitters and corporate earnings spurring on the declines, a loss of confidence in China has not helped matters, sending the S&P 500 well off its highs down to significant channel support.

On the Calendar Tuesday:

GBP: Prelim GDP

USD: CB Consumer Confidence

———-

Chart of the Day:

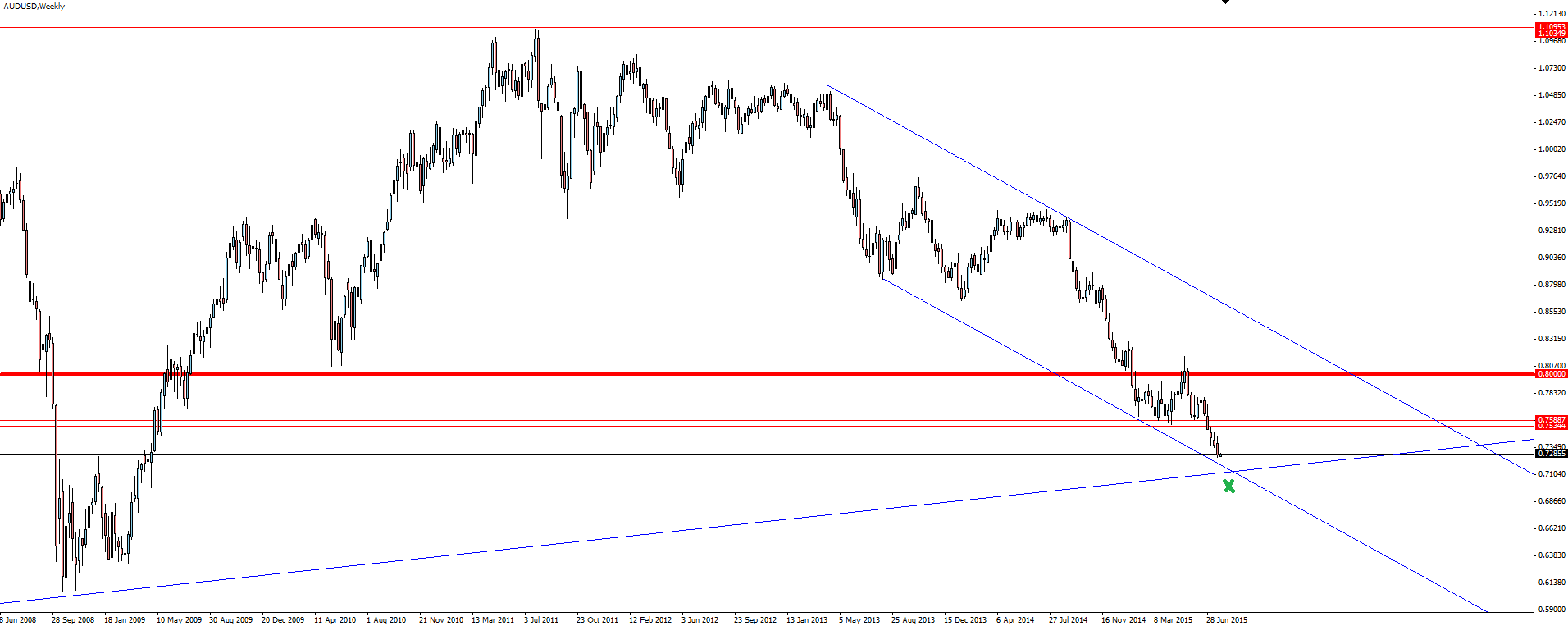

As it's FOMC week, we have been looking at the majors heading into Wednesday’s meeting. Its AUD/USD’s turn today as we take a look at the weekly and daily charts below.

AUD/USD Weekly:

What a fall from grace the Aussie has suffered. The good old days for Aussie tourists getting $1.10 in the US are certainly long forgotten.

More recently, price had a bit of a pause between 75 and 80c but that was short lived as yet another major support level crumbled to get where we currently sit.

This marked level that price is approaching is massively important, being both major weekly trend line support dating back 14 years to 2001, while also lining up with (relatively) short term channel support dating back to the change of trend when price came off its highs in 2012.

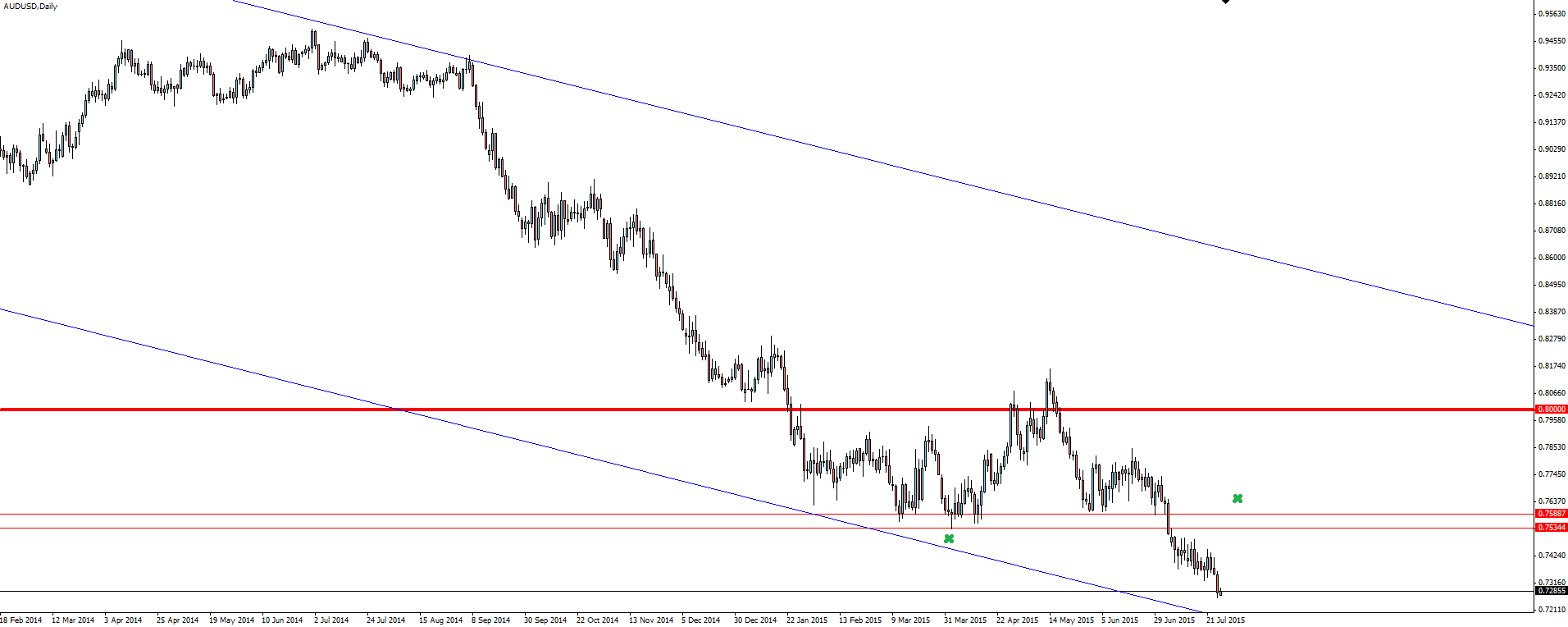

AUD/USD Daily:

Zooming into the daily, price is currently in a bit of a ‘no man's land’, sitting between trend line support and the marked horizontal support/resistance level that could be used to manage your risk from the short side.

If the Fed rhetoric isn’t as hawkish as expected and it looks like more delays on interest rate hikes, price will bounce and the horizontal resistance zone around the 75c level will come into play. If you’re still a USDX bull then this is a nice area to manage your risk around and possibly short into it.

However, if hikes are as imminent as many economists are predicting, then the major weekly support level could be in danger. I can’t stress enough just how significant this confluence of weekly support is and even on the back of a hawkish Fed, we could see a bit of 'sell the rumour, buy the news' come into play on AUD/USD.

What are your thoughts on trading the Aussie at these levels?

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd, does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this report should not be construed as a solicitation to trade. All opinions, news, research, analyses, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on the service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.