Markets enjoyed a week of strong gains, boosted by speculation of additional stimulus measures. Stocks took losses on Monday as concerns about new share sales and economic growth continued to haunt investors. The Shanghai Composite surged on Tuesday, as investors sought out shares, which have underperformed the benchmark.

Stocks gained on Wednesday, following optimism that government initiatives to encourage tech companies will lead to higher profits. The Shanghai Composite gained on Thursday following speculation that weak manufacturing data will spur the government to take additional stimulus measures.

Sina Corporation (NASDAQ:SINA) reported first-quarter 2015 loss of 18 cents per share, which compared unfavorably with the Zacks Consensus Estimate of a loss of 8 cents by 125%. In the prior-year quarter, the company had reported a loss of 50 cents a share. JA Solar Holdings (NASDAQ:JASO) posted first-quarter 2015 adjusted earnings of 15 cents per diluted American Depositary Share (ADS) in the quarter, missing the Zacks Consensus Estimate of 20 cents by 25%.

Last Week’s Developments

Last Friday, the Shanghai Composite declined 1.6% following concerns that IPOs would move funds away from older stocks. Fears that below-par economic growth may impact earnings also led to losses for stocks. These concerns were aggravated by poor economic reports released recently.

The CSI lost 1.8%. Nine out of its 10 industry groups declined. Sub-indexes of utilities, telecom and energy stocks decline by a minimum of 2.8%, becoming the day’s largest-declining industry groups. However, the tech-heavy Chinext index gained 0.1% after losing nearly 2.6%. The Hang Seng China Enterprises index ended flat while the Hang Seng moved up 0.5%.

The Shanghai Composite gained 2.4% over the week, posting its ninth gain in 10 weeks. A large number of economic reports, ranging from retail sales to new yuan lending came in below estimates during the week. Meanwhile, the country’s central bank increased rates for the third time since November in an effort to boost the economy.

Markets and the Economy This Week

Stocks took losses again on Monday as concerns about new share sales and economic growth continued to haunt investors. Financial and commodity stocks were the highest losers. The benchmark index declined 0.6% ahead of 20 IPOs, which were to debut between Tuesday to Thursday. Fears that these sales would lock up funds worth $451.1 billion dampened investor sentiment.

The CSI 300 declined 0.9%. Sub-indexes of material, energy and financial stocks lost a minimum of 1.4%. Meanwhile, new home prices moved lower in 47 out of 70 cities in April. This is lower than declines reported in 49 cities for March. Prices also declined in 69 cities on a year-over-year basis following declines in 70 cities during March.

The China H-Shares index lost 0.6% while the Hang Seng declined 0.8%. These losses were a result of the lack of fresh news about the trading link with Shenzhen. Officials said the exchange link would become operational only in the second half of the year, but failed to provide a date.

The Shanghai Composite surged 3.1% on Tuesday, experiencing its highest increase in four months. The index also emerged as the highest gainer among Asian benchmarks. Energy and brokerage stocks led gains as investors sought out shares which underperformed the benchmark even as IPO sales commenced.

Analysts were of the view that bank shares were cheap while brokerages had underperformed the broader market. They opined that the rally seemed to be driven by rotational buying.

The CSI 300 gained 3.4%. Its financial sub-index experienced its highest gain in four months, ending a four-day series of losses. The ChiNext, which is dominated by small caps, moved up 1.4% to a record level. The Hang Seng China Enterprises index advanced 1.95 while the Hang Seng increased 0.4%.

Stocks rose to their highest level in two weeks on Wednesday. A sub-index of tech shares climbed to a record high following optimism that government initiatives to encourage the sector will lead to higher profits. On Tuesday, the Xinhua News Agency said the government will intensify tax and fiscal measures to boost manufacturing across 10 sectors, including information technology. The Shanghai Composite advanced 0.7%.

The CSI 300 gained 0.5%. The CSI 300 Information Technology index increased and is currently the leading gainer among the 10 industry groups which make up the index. The information technology index advanced 1.5%, and has gained 105% year-to-date. The Hang Seng increased 0.4% and the Hang Seng China Enterprises index moved up 0.3%.

The Shanghai Composite gained 1.9%, rising to its highest level in more than seven years on Thursday. The HSBC flash PMI came in at 49.1 for May, indicating that manufacturing has contracted for a third successive month. Manufacturing declined to its lowest level in 13 months even as employment continued to fall. This report in turn increased speculation that the government will take additional steps to boost the economy.

The CSI 300 gained 1.8%. The H-share index slipped 0.7% while the Hang Seng declined 0.2%. The CSI 300 consumer-staples index jumped 3.6% to a new high. Market watchers took the view that weak economic data was only increasing speculation of additional monetary stimulus. Others took the view that earlier stimulus measures had not yet had their desired effect.

Stocks in the News

SINA Corp. reported first-quarter 2015 loss of 18 cents per share, which compared unfavorably with the Zacks Consensus Estimate of a loss of 8 cents. In the prior-year quarter, the company had reported a loss of 50 cents a share.

Revenues increased 7.6% year over year to $184.6 million, but lagged the Zacks Consensus Estimate of $186 million. Non-GAAP revenues of $182 million improved 9% on a year-over-year basis.

Advertising revenues moved up 11% from the year-ago quarter to $150.4 million. The year-over-year growth in online advertising revenues was driven by an increase of $27.3 million in Weibo advertising revenues, which was partially offset by a decline of $12.7 million in portal advertising revenues.

JA Solar Holdings Co. Ltd. posted first-quarter 2015 adjusted earnings of 15 cents per diluted American Depositary Share (ADS) in the quarter, missing the Zacks Consensus Estimate of 20 cents by 25%. In the year-ago period, the company had reported earnings of 32 cents per ADS.

Investors reacted negatively to lower-than-expected earnings with shares losing 7% from May 15, 2015 to close at $9.37 on May 19. JA Solar’s revenues in the reported quarter were $387.7 million, missing the Zacks Consensus Estimate of $399 million by 2.8%. Revenues jumped 5.6% year over year, mainly driven by increased demands in the European and Japanese markets.

CNinsure Inc. (NASDAQ:CISG) posted net income of 9 cents per share in the first quarter of 2015, missing the Zacks Consensus Estimate by 30.8% and declining 38.4% year over year. Increase in expenses due to higher investments in online initiatives was held responsible for the underperformance.

CNinsure generated total net revenue of $93.5 million in the reported quarter, growing 24.3% year over year and surpassing its own guidance. CNinsure’s total operating cost and expenses increased 27.7% year over year to $93.3 million in the reported quarter.

Alibaba (NYSE:BABA) has been accused by luxury brands maker Kering (PARIS:PRTP) of manufacturing and encouraging unchecked counterfeiting of its luxury goods in a lawsuit filed on Friday.

According to U.S.A Today, the suit, which was filed in a federal court in New York, accused Alibaba of “trademark infringement, counterfeit, false representation, trademark dilution and racketeering by marketing, processing payments for and shipping goods such as counterfeit Gucci watches, bags and shoes and Yves Saint Laurent shirts.”

Alibaba spokesman Robert Christie issued the following statement in response to the suit, “We continue to work in partnership with numerous brands to help them protect their intellectual property, and we have a strong track record of doing so. Unfortunately, Kering Group has chosen the path of wasteful litigation instead of the path of constructive cooperation. We believe this complaint has no basis and we will fight it vigorously.”

Yingli Green Energy Holding (NYSE:YGE) revealed in its annual report on Friday, May 15, that it may be unable to emerge from "substantial indebtedness." Yingli Green’s share prices plunged 12.35% to $1.49 on May 18, the most since Mar 25.

According to the filing, Yingli Green had about $1.6 billion of short-term borrowings along with long-term debt of $460 million as of Dec 31, 2014. Importantly, the company has failed to generate profits since 2011. In this scenario, the company will find it difficult, if not impossible, to pay down its outstanding debt, thereby resulting in cross-defaults putting it at liquidation risk.

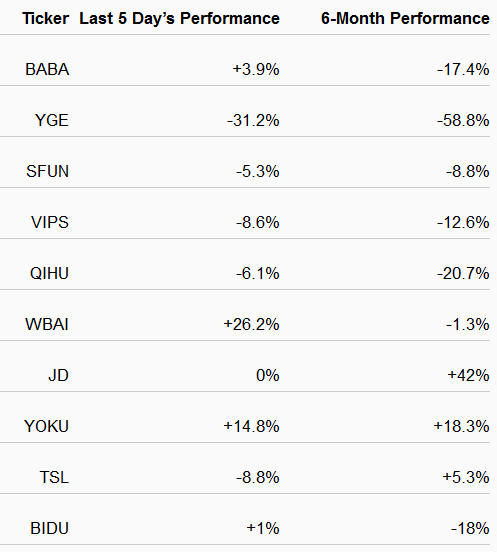

Performance of Most Actively Traded US-Listed Chinese Stocks

The table given below shows the price movements of 10 Chinese companies with the highest three-month average trading volume on U.S. exchanges. Price movements over the last five days and during the last six months have been included.

Next Week’s Outlook:

Stocks have gained significantly this week, boosted by speculation about additional government stimulus and rotational buying. But for Monday, the large number of IPO launches had little effect on the markets. Economic data on housing and manufacturing were dismal in nature. However, this has only increased speculation about additional stimulus, helping stocks chalk up gains.

Meanwhile, the record breaking Bull Run of China’s equity markets continues with stocks set to post another set of weekly gains. Next week is largely bereft of any major economic releases or scheduled market events. Going forward, it is likely that any news about steps being taken by the government to boost the economy will have a beneficial effect on stocks.