Markets experienced a strong run of gains, followed by a dramatic plunge on Thursday. Stocks gained on Monday following speculation that the government will intensify measures to boost the economy. The Shanghai Composite increased on Tuesday following optimism among investors that government measures to increase access to financial markets will boost fund inflows.

Stocks gained for the seventh consecutive day on Wednesday as the benchmark moved close to the 5,000 mark for the first time in seven years. The Shanghai Composite plunged on Thursday, marking the largest decline in four months.

Ctripcom International Ltd (NASDAQ:CTRP) has acquired a 37.6% stake in eLong Inc. (NASDAQ:LONG) from Expedia Inc. (NASDAQ:EXPE) for around $400 million. Trina Solar Limited (NYSE:TSL) reported first-quarter 2015 earnings of 13 cents per ADS, well above the Zacks Consensus Estimate of 9 cents but below year-ago earnings of 36 cents.

Last Week’s Developments

Last Friday, the Shanghai Composite gained 2.8% following speculation that the government will stimulate expenditure on technology. A rally from brokerages also helped the broader market move upward. These gains were a result of news and speculation that several prominent brokerages were planning IPOs.

The Shenzhen Composite advanced 1%. The index also advanced 12% over last week, the highest increase since Nov 2008. Market watchers opined that the Shenzhen exchange was notching up gains because it was made up of small stocks which represent the country’s new economy.

The CSI 300 increased 2.3%. The Chinext Composite declined 0.3% while the Hang Seng added 1.7%. The Hang Seng China Enterprises Index advanced 2.2%. A gauge of financial stocks increased 3.1%.

The Shanghai Composite surged 8.1% over the week, the best weekly gain since Dec 5. These gains were a result of speculation that soft manufacturing data will spur the government to provide additional stimulus to boost the economy. Tech stocks gained last week following the launch of Made in China 2025 which aims to improve the competitiveness of specific manufacturing sectors.

Markets and the Economy This Week

Stocks gained on Monday following speculation that the government will intensify measures to boost the economy. Additionally, investors took the view that cross-border sales of mutual funds will increase inflow of equity. Hong Kong and China have provided approval to cross-border sale of mutual funds starting Jul 1. It is expected that this decision will improve access to capital as well as financial markets.

The CSI 300 increased 3%, moving above the 5,000 mark for the first time since 2008. A sub-index of industrial stocks within the CSI 300 gained 4.7%, the highest among the 10 industry groups. The ChiNext lost 1.4% while Hong Kong’s markets were closed on account of a holiday.

Large-cap stocks also gained from Hong Kong and China’s regulators’ decision to allow cross-border sales of mutual funds. Meanwhile, China’s market regulator provided approvals for 23 more IPOs. It also said it will clamp down on irregular trading activity.

The Shanghai Composite increased 2% on Tuesday, marking its largest six day gain since Nov 2008. The 15% increase was the highest among all global benchmarks. Gains were fueled by optimism among investors that government measures to increase access to financial markets will increase fund inflows. Tech and consumer posted the strongest gains.

The CSI 300 moved up 1.9%. Sub-indexes of tech and consumer discretionary stocks advanced a minimum of 3.6%, the most among the 10 industry groups. The Hang Seng advanced 0.9% while the H-share index added 2.6%. The Shenzhen Composite surged 3.6%. Turnover on the Shanghai exchange was the second largest ever recorded.

Stocks gained for the seventh consecutive day on Wednesday. The benchmark index moved close to the 5,000 mark for the first time in seven years. Commodity and power stocks helped boost the broader markets. The benchmark index moved up 0.6%, swinging between gains and losses before ending the day in the green.

Meanwhile, profits of industrial companies increased 2.6% in April, following a 0.4% decline in March. The CSI 300 lost 0.3%. A sub-index of financial stocks moved down 1.2%. On the other hand, sub-indexes of utilities, energy and material stocks gained a minimum of 2%, emerging as the highest gainers among the 10 industry groups. The Hang Seng declined 0.6% while the Hang Seng China Enterprises Index lost 0.7%.

The Shanghai Composite plunged 6.5% on Thursday, marking the largest decline in four months. Losses were caused by the decision of brokerages to increase restrictions on lending. Meanwhile, the country’s central bank pulled out money from the financial system via the sale of repurchase agreements to specific financial institutions.

Financial and commodity stocks weighed on the broader market. Additionally, concerns over the launch of more IPOs also dampened investor sentiment. Analysts opined that another round of profit taking was taking place. The CSI 300 declined 6.7%. All its 10 sub-indexes lost in excess of 5%. Sub-indexes of material, financial and energy stocks declined by a minimum of 7%. The Hang Seng moved down 2.2% while the H-share index declined 3.5%.

Stocks in the News

Ctrip.com International Ltd. has acquired a 37.6% stake in eLong Inc. from Expedia Inc. for around $400 million. Expedia has said that it has offloaded its entire stake in eLong to Ctrip, among others, for approximately $671 million.

In 2004, Expedia had purchased a 30% stake in eLong before raising it to 62.4% in 2011. Ctrip.com ADRs gained 18% on Apr 22, the highest increase experienced since it was listed on the NYSE in Dec 2003.

In a separate development, Priceline.com Incorporated (NASDAQ:PCLN) has stated that it will raise its investment in Ctrip.com. Priceline will invest an additional $250 million in the Chinese travel booking website via the convertible bond route. This follows an investment of $500 million made last year. Following the new injection of funds, Priceline will hold 10.5% of the company’s outstanding shares.

Trina Solar Limited reported first-quarter 2015 earnings of 13 cents per ADS, well above the Zacks Consensus Estimate of 9 cents but below year-ago earnings of 36 cents. Revenues climbed 25.5% year over year to $558.1 million, beating the Zacks Consensus Estimate of $507 million.

Robust performance was credited to growing worldwide demand for solar panels and wider use of clean energy. Total module shipments during the quarter came in at 1,026.2 MW. Of these, shipments for Trina Solar power projects constituted 134.5 MW while external shipments made up 891.7 MW. This is significantly higher than year-ago shipments of 558.0 MW and exceeds company guidance of 840-870 MW.

JA Solar Holdings Co. Ltd (NASDAQ:JASO) has teamed up with Essel Infraprojects Limited ("EIL") for setting up a solar cell and module manufacturing joint venture (“JV”) unit in India. The two companies signed a memorandum of understanding (“MoU”) on May 16 at the India-China Business Forum in Shanghai, which was part of India’s Prime Minister Narendra Modi's China visit.

The facility will have a production capacity of 500 megawatts (“MW”). The forum’s agenda prioritized the construction of a photovoltaic park and underlined the importance of international partnerships in the photovoltaic industry.

Petrochina (NYSE:PTR) found over 100 million tons of tight oil reserves from the Changqing field, located in the Ordos basin. Most importantly, this is the first tight oil discovery – of more than 100 million tons of tight oil – in the history of China. However, there might technically be significantly lower recoverable reserves in the field.

According to the sources, the production capacity of tight oil in the Ordos basin is more than 1 million tons. It is to be noted that during first quarter 2015, total production from the Changqing field was 6 million tons of crude oil.

CNOOC Ltd. (NYSE:CEO) has made a mid-sized oil discovery in the Liuhua 20-2 block located in the eastern part of the South China Sea. The discovery was made in the LH20-2-1 well in the Liuhua 20-2 block at a water depth of around 390m.

The LH20-2-1 well extends to a depth of around 2,970 meters. Oil pay zones consisting of a total thickness of 35.2 meters have been discovered. According to tests, oil production of nearly 8,000 barrels per day is expected to be generated from the well. Crude oil density has been estimated at around 0.75.

China Unicom (NYSE:CHU) cloud division CU Cloud has formed a strategic partnership with Akamai Technologies (NASDAQ:AKAM). Per the terms of the agreement between the two companies, CU Cloud will align its cloud services targeted at global businesses with Akamai’s web performance, media delivery and cloud service products.

The partnership will enable CU Cloud to utilize Akamai’s content delivery network technology for its cloud services. This technology helps operators to utilize a composite content delivery network which has high scalability.

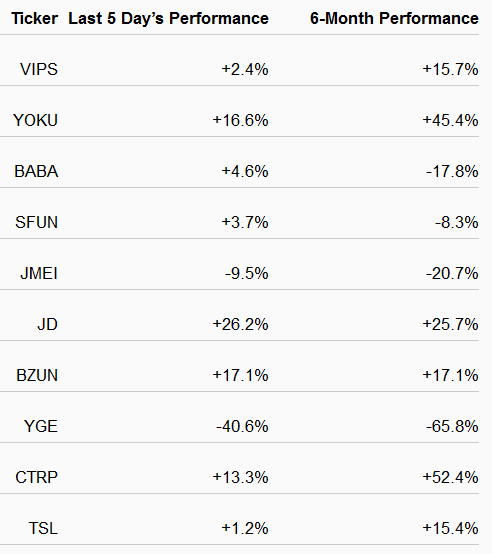

Performance of Most Actively Traded US-listed Chinese Stocks

The table given below shows the price movements of 10 Chinese companies with the highest three-month average trading volume on U.S. exchanges. Price movements over the last five days and during the last six months have been included.

Next Week’s Outlook:

Stocks plunged on Thursday following a record breaking run of gains. For most of the week and even earlier, markets were buoyed by hopes of further government measures to boost the economy. The decision to allow cross-border sales and optimism about further steps to be taken by the government to boost the economy were largely responsible for the benchmark’s record breaking gains.

But the dramatic plunge on Thursday indicates that further monetary stimulus may not be forthcoming. The prospect of further reductions in the reverse repo rate now seems dim. This effect of this move was compounded by restrictions on lending by brokerages and resulted in severe losses.

Crucial economic reports on manufacturing and services are lined up for release next week. It is likely that the nature of this data, along with further moves by the central bank will guide markets going forward. Any announcements to boost the economy by the government will go a long way in helping stocks return to their winning ways.