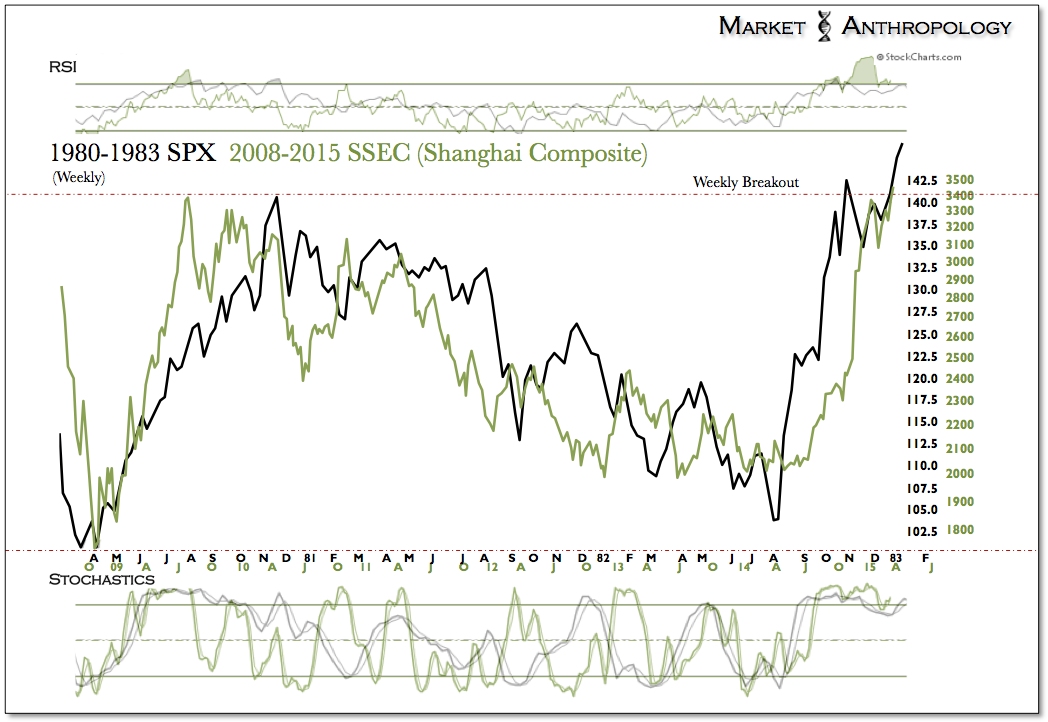

Heading into the end of last year, China's Shanghai Composite Index had become significantly extended, registering an unsustainable weekly RSI above 90. At the time (here), we expected the index to work off its overbought condition by churning with greater volatility as the market consolidated the massive move that began that summer.

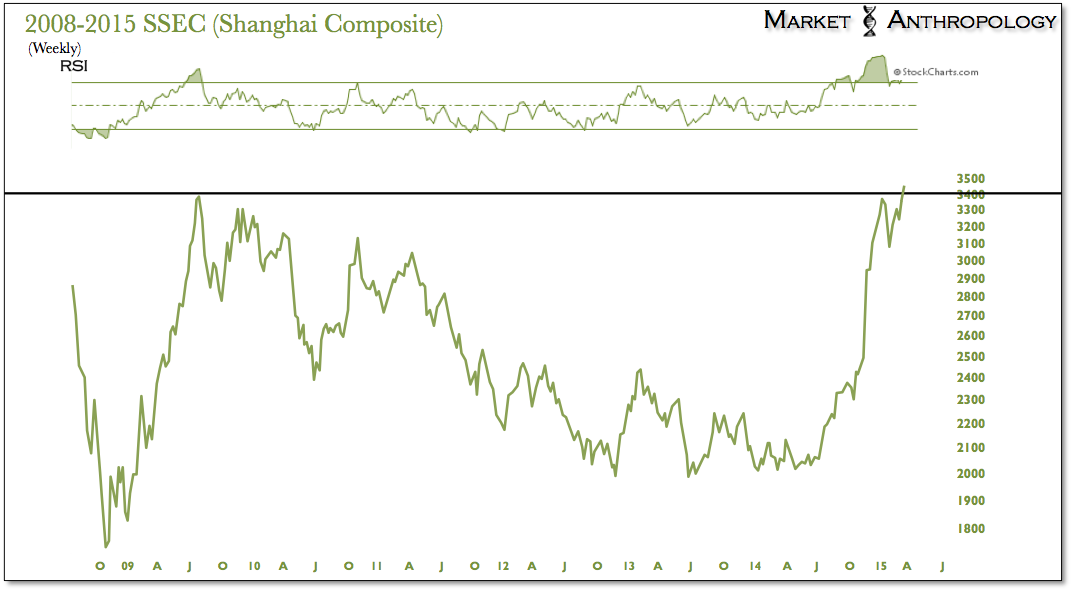

Over the past three months, the SSEC has traded in a wide ~10 percent range, working off the overbought condition as it prepared to challenge the previous highs from 2009. While the week is still young, Monday night the SSEC broke above its weekly benchmark high set in the summer of 2009.

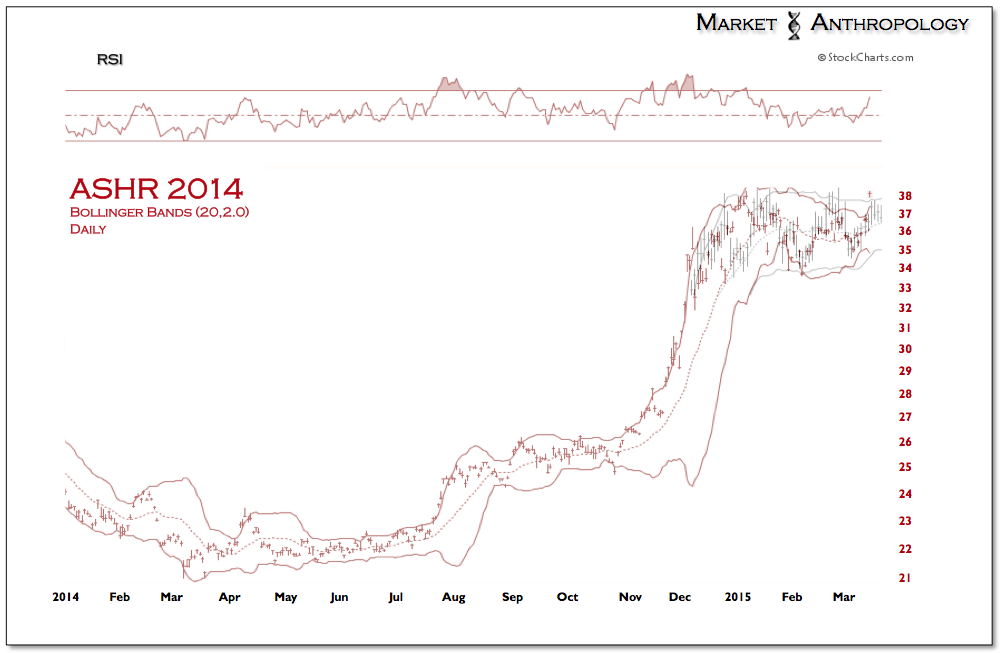

Taking its cue from the Shanghai, our equity ETF proxy - DB X-trackers Harvest China (NYSE:ASHR), made a 52 week closing high yesterday, loosely following the consolidation range of our historic breakout pattern.

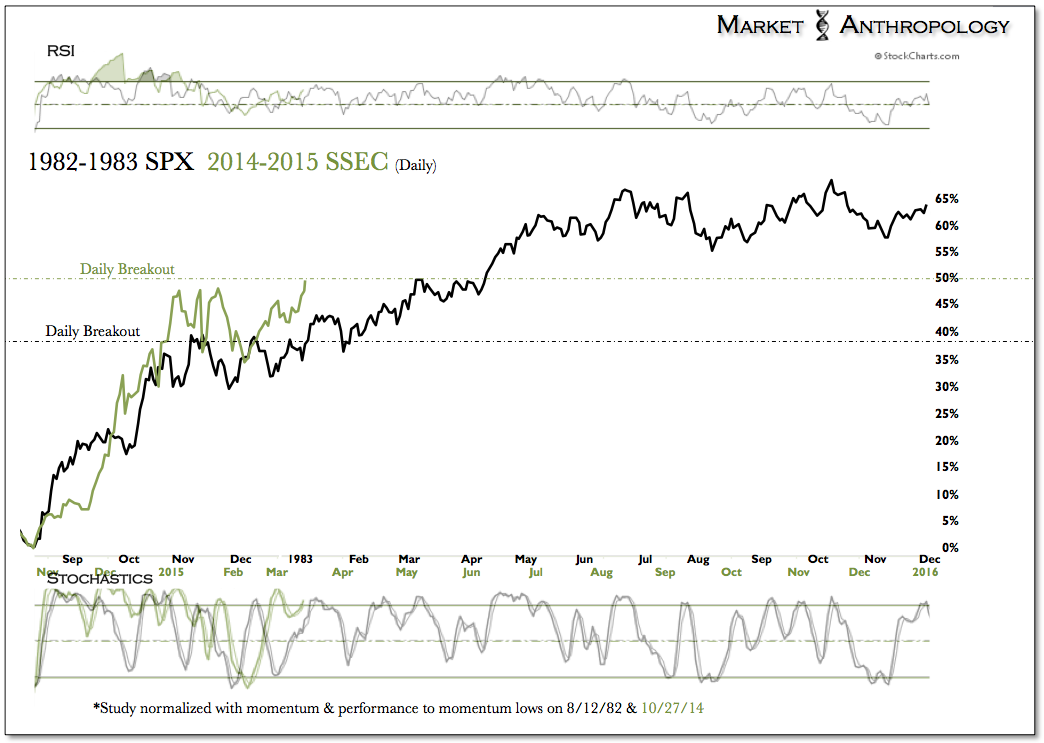

While the previous closing weekly high for the SSEC is ~3412, the daily close from August 4th, 2009 measures above that, to ~3471. Assuming the index continues the move higher over the short-term, similar to the breakout leg for the SPX in January 1983, it wouldn't surprise us to see the market retrace back later in the month and test the level one last time before continuing higher.

As a reference guide, we shifted the index marginally to match up with the breakout leg in the historic SPX comparative: