Market Brief

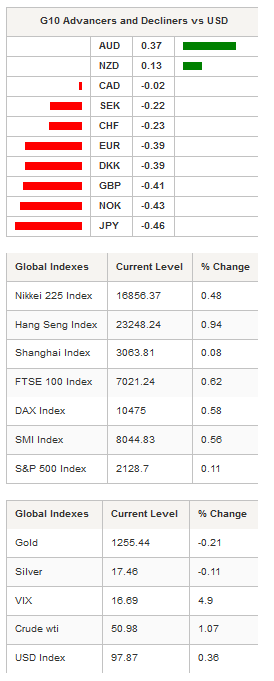

Risk appetite came back in the Asian session, supported by a better-than-expected cpi report. The stronger Chinese read lessened growing concerns, based partly on weak trade data over the health of the world’s second largest economy. Asian regional indices were mixed, with the Nikkei and Hang Seng rising rose 0.49% and 0.86% respectively, while Shanghai Composite lost earlier gains in the late session, falling 0.2%. The Thai stock exchanges index SET rose 4.18% (as we had expected). The positive risk sentiment sent the USD lower against G10 and EM currencies. Only the commodity currencies AUD and NZD were unable to gain against the greenback. USD/THB gained roughly 1%. However, overall THB selling pressure was significantly lower than anticipated as international investors did not abandon the kingdom due to the potential risk of political uncertainty.

Crude prices firmed above the $50 handle as reports indicated that supplies were tight in the US energy market. On the data front, data from the European Union indicated that new car sales rose 7.2% in September with a strong double-digit growth numbers in Italy and Spain. The solid report increases the likelihood that the ECB will keep policy unchanged next week.

In China, CPI inflation in September recovered 1.9% y/y, from 1.3% in August, supported by higher food prices (3.2% y/y), while PPI turned positive rising +0.1% y/y in September from -0.8% in August, the first positive read since 2012. The steady uptick in inflation indicates that the engine of global growth has likely bottomed out and is now heading higher. The rise in inflation also suggests that the PBoC will keep monetary policy uncaged while guiding the RMB higher.

In Singapore, despite deteriorating growth data the MAS maintained its neutral positions with a strategy of keeping SGD from appreciating within the NEER band. The fall in SGD against the USD had increased the probability that the MAS will ease. Singapore GDP growth increased marginally 0.6% from 2.0% prior read (yet q/q fell worryingly -4.1%), while retail sales contracted -1.0% from a revised 2.7%. The data released today suggest that investors should expect further weakness in growth and inflation dynamics. In addition, expectation for easing in 2017 have increase significantly. However, recovery in regional powerhouses and demand for yield will keep SGD supported against the USD.

In Australia, the RBA released its semi-annual financial stability review. The housing markets continues to dominate the bank’s attention and aggregate loan size indicates systemic risk. The RBA warned banks over the dangers of the current apartment mania and caution over the rise of bad debts. However, currently the central banks see the risk as manageable, yet it will influence monetary policy setting the future in our view.

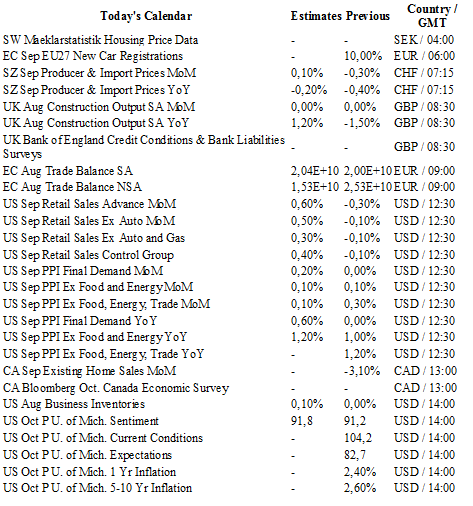

Traders today will be watching UK construction output, EC trade balance, US retail sales, PPI and University of Michigan.

Currency Tech

EUR/USD

R 2: 1.1616

R 1: 1.1428

CURRENT: 1.1113

S 1: 1.1046

S 2: 1.0913

GBP/USD

R 2: 1.3121

R 1: 1.2857

CURRENT: 1.2448

S 1: 1.2352

S 2: 1.1841

USD/JPY

R 2: 107.90

R 1: 104.32

CURRENT: 103.91

S 1: 99.02

S 2: 96.57

USD/CHF

R 2: 0.9956

R 1: 0.9885

CURRENT: 0.9825

S 1: 0.9522

S 2: 0.9444