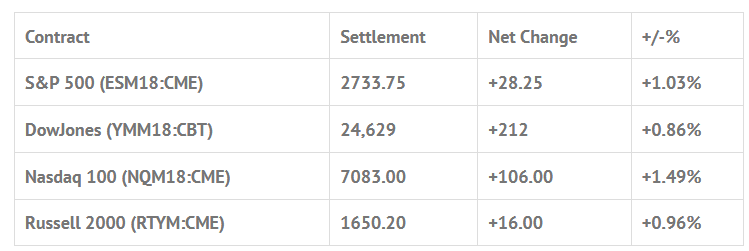

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 9 out of 11 markets closed higher: Shanghai Comp +0.52%, Hang Seng +1.66%, Nikkei +1.37%

- In Europe 11 out of 13 markets are trading higher: CAC +0.24%, DAX +0.03%, FTSE +0.66%

- Fair Value: S&P -0.27, NASDAQ +1.74, Dow +0.27

- Total Volume: 1.19mil ESM & 771 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Factory Orders 10:00 AM ET, and TD Ameritrade IMX 12:30 PM ET.

S&P 500 Futures: Goldilocks Jobs Report Sends S&P 500 Higher

Well, the markets go up, and the markets go down, and that’s what they did every day last week. Whether you like the markets or not, the S&P 500 futures held 2700.00 on Thursday, and Friday’s goldilocks jobs report catapulted stocks higher when U.S. nonfarm payrolls rose to 223,000 in May, above estimates, and the unemployment rate fell to 3.8%, the lowest reading since April 2000.

The day started with Asian markets closing mixed and European markets trading higher. European stocks rallied as a deal for a new Italian government helped ease investor concerns about eurozone stability.

In the U.S. the S&P traded higher overnight on Globex, jumped up to the 2722.00 area just before the 8:30 CT futures open, and then shot up to 2729.00 right after the bell. From there, the ES pulled back down just above the vwap at 2721.50 and then rallied up to 2733.75 at 9:23. After pullback down to 2725.00, the futures rallied up to new highs at 2737.00 around 12:30, up +37.50 handles from Thursday’s 2699.75 low.

After the high, the ES traded down to 2730.00, then back up to 2735.00, and then back down to 2728.25 as the MiM went from $333 million to buy to $267 million to buy. The ES traded 2732.00 on the 2:45 cash imbalance reveal as the MiM showed $762 million to buy. The futures then went on to trade 2733.00 on the 3:00 cash close, and traded 2733.75 on the 3:15 futures close, up +28.25 handles, or +1.03% on the day.

In the end, the day and the week were all about the ‘up a day / down a day’ price action. If anything is clear it’s that all the selloffs have done is get the funds to add protection and get traders short. A week ago last Friday the ES closed at 2713.00, and last Friday it settled at 2733.75. To further back up the idea that the ‘crowd’ is short, the CTFC released this last Wednesday :

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.