The selloff in the oil price overnight and the drop in Chinese equities yesterday seems to have put a bit of a pause on last week’s gains in US markets. This is setting Asia up for a weak open. China and commodity market concerns look like they’ll put pressure on the ASX today as it returns after a four day break. Currently, the ASX is looking to open down 0.2%. BHP Billiton's (AX:BHP) ADR is pointing to a -3% open, and it looks like materials and energy stocks will be in for a rough day.

WTI oil saw its first fall in five days yesterday after Iran emphasised that it plans to add 500,000 barrels a day of new oil exports a week after sanctions are lifted. WTI promptly lost 3.4% as oil traders were taken aback at the pace the Iranian government expects to see their exports pick up following the lifting of sanctions. Oil prices look likely to continue in their depressed state if Iran is able to ramp up its exports at such a rapid rate. Meaning the stresses in the high yield bond sector are far from over, and are likely to return with a vengeance in January. High yield bond ETFs iShares iBoxx $ High Yield Corporate Bond (N:HYG) and SPDR Barclays (L:BARC) High Yield Bond (N:JNK) both lost 0.5% in US overnight trade.

The Qingdao Iron ore price climbed to US$41.30 yesterday, rising 7.8% since its low on 11 December. However, iron ore stockpiles at Chinese ports have now reached their highest level in seven months. China’s Central Economic Work Conference (CEWC) rallied markets last week on plans for more stimulus. But markets seem to have ignored the statement’s commitment to cutting Chinese industrial over capacity. There are increasing reports of Chinese industrial factories shutting down, cutting output capacity and laying off workers at the moment. This in turn leads to less demand for raw materials such as iron ore. If this capacity cutting continues not only will port stockpiles continue to rise, but iron ore prices are likely to dip back below the US$40 level for an even more extended time and calls for iron ore in the US$20 handle do not look unreasonable.

The Australian Retailers Association are reporting that consumers spent roughly A$46.8 billion in the six weeks leading up to Christmas, and are forecast to spend A$16.8 billion more through to 15 January. If these numbers hold up, then Australian retail sales are set to expand by over 4% year-on-year in both November and December – a noticeable pick up from the slowdown in Q3. While consumption growth is far from cancelling out the ongoing decline in capex spending, the clear uptrend discernible in a range of consumer indicators is pointing to steady and expanding consumption in 2016.

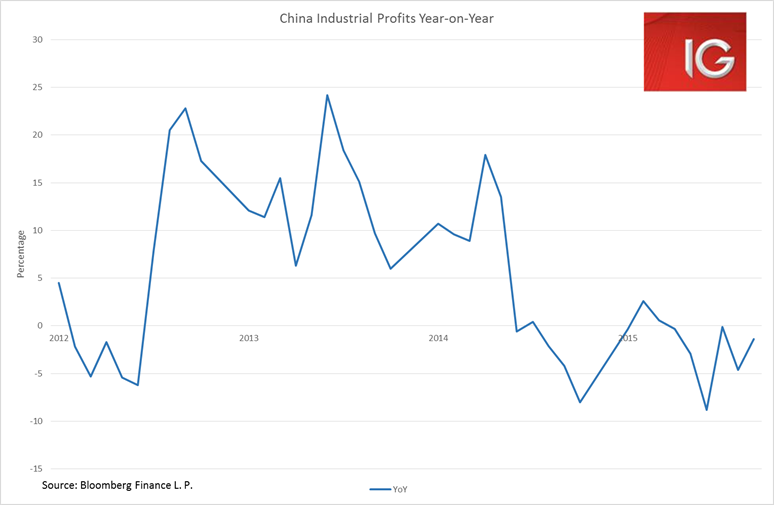

The Shanghai Composite fell 2.6% yesterday, its biggest fall in a month. Many media reports at the moment are pointing to yesterday’s industrial profits numbers as the causa proxima. However, a cursory glance over the industrial profits numbers shows that while November was still negative in year-on-year terms there was a noticeable improvement from the previous month. Industrial profits were -1.4% YoY in November from 4.6% in October, with profit growth particularly strong in the autos and utilities sectors. Given this, the selloff in Chinese markets yesterday was more likely driven by the ongoing concerns of the steady stream of new IPOs sucking up capital and the coming end of the lockup period for the stocks bought up in the July bailout by the ‘National Team’.