Market Brief

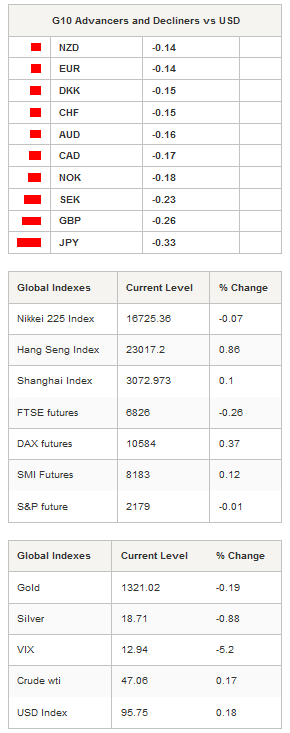

The US dollar gained continued strength on Tuesday as traders put their money on the Fed resuming its tightening cycle before the end of the year. The greenback extended gains against most of its peers as the dollar index rose 0.20% to 95.76 in Tokyo. Within the G10 complex, the Japanese yen was the worst performer as USD/JPY rose 0.35% to 102.25 in spite of unexpectedly strong economic data.

Japan’s jobless rate fell to a 21 year low, reaching 3% in July, down from 3.1% in the previous month. 200k jobs were filled in July, while the number of unemployed people fell by 70k as the total labour force rose by 130k. Separately, retail sales increased 1.4% m/m in July, beating expectations of 0.8% and were above an upwardly revised figure of 0.3% in the previous month. However, on a year-over-year basis, retail sales are down 0.2%, while the market was expecting a contraction of 0.9%. Initially, USD/JPY fell to 101.76 before bouncing back to 102.25 as traders discounted the positive news to focus on the mounting probability of more monetary stimulus from the Bank of Japan.

In Switzerland, USD/CHF continued to race toward the 0.9950 level as traders returned to riskier assets and sold their long CHF positions. The dollar is currently taking a breather at around CHF 0.98, slightly below the 0.9850 resistance level (multi high). Further north, a key resistance can be found at 0.9950 (high from July 27th), while on the downside a support can be found at 0.9650, then 0.9537 (low from August 18th).

Precious metals continued to move south as investors dumped safe haven and bought equities. Gold was down 0.20% to $1,320.75, while silver slid another 1% to $18.70. Palladium and Platinum were down 0.26% and 0.29% respectively. In the equity market, most Asian regional markets were trading in positive territory, with the exception of Japanese stocks, which edged down 0.07%. In mainland China, the Shenzhen and Shanghai Composites were up 0.10% and 0.13% respectively. Offshore, Hong Kong’s Hang Seng rose 0.86%. In Europe, equity futures are mostly higher, with the exception of the Footsie, which is down 0.26%.

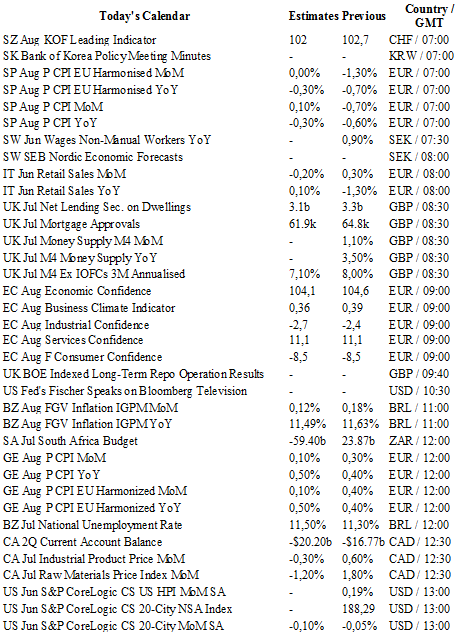

Today traders will be watching the CPI report from Spain and Germany; retail sales from Italy; mortgage approval from the UK; consumer confidence from the euro zone and the US; Federal Reserve Vice-Chair Fischer will also give an address.

Currency Tech

EUR/USD

R 2: 1.1616

R 1: 1.1428

CURRENT: 1.1172

S 1: 1.1046

S 2: 1.0913

GBP/USD

R 2: 1.3534

R 1: 1.3372

CURRENT: 1.3073

S 1: 1.2851

S 2: 1.2798

USD/JPY

R 2: 107.90

R 1: 102.83

CURRENT: 102.29

S 1: 99.02

S 2: 96.57

USD/CHF

R 2: 0.9956

R 1: 0.9844

CURRENT: 0.9795

S 1: 0.9522

S 2: 0.9444