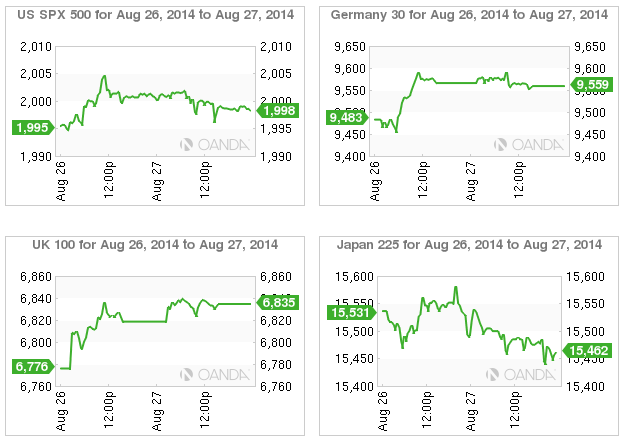

- Asian bourses consolidate before the release of the Chinese Industrial Profit tomorrow

- US Stocks rally pauses after the S&P breaks 2,000

- European stocks balance German negatives with Ukraine-Russia positives

The Nikkei is trading lower today. The retreat from the USD means a stronger JPY is not the best outcome for Japanese companies that are still struggling with the effects of the sales tax hike that was introduced in April and was just the first phase needed in order to get Japan back into fiscal health. The Chinese Industrial profit numbers will give insight to the market as there are China sized questions marks around the country’s ability to meet its growth targets. Global demand will suffer if further signs of lacking momentum are presented.

The Nikkei 225 seems poised to break through current resistance levels, but until the fundamental regional doubts are dispersed the technical move will have to wait until investors can get behind a move.

In Europe stocks are waiting an outcome from Russia-Ukraine. There are positive signs that the incident with Russian troops captured in Ukrainian territory will not escalate the issue as both leaders have been discussing the event. The Russians claim it was a mistake as the incursion was done as an error in directions. There is little in regards to company earnings to guide the market so speculation about German growth balanced with the situation that resulted from Crimea have been given more weight.

American markets have been steady. Without strong earnings the market is at the mercy of perception. The hope that the US recovery is sustainable could result in a earlier rate hike which in the current environment might not immediately translate to a lower stock market as investors are looking for signs of confidence. M&A activity has caused waves that have been pushed forward by a cooling geopolitical environment. Russian President Vladimir Putin has calmed markets with statements that he has reached out to his Ukrainian counterpart and have advanced on their talks to ease tensions in the area.