- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Cash Is King

It does not matter if stocks are insanely overvalued, as long as there’s a more foolish participant who is willing to pay a higher price. That’s the essence of the “greater fool theory.” And right now, there are more foolish buyers that want “in the game” than risk-reducing sellers who want to scale back.

It does not even seem to matter that corporate profits have slumped roughly 18.5% from their peak on 9/30/2014. Certainly, earnings per share growth has not been relevant for quite some time. In fact, if investors were paying the same reasonable valuation that they paid in September of 2014 when the S&P 500 traded near the 2000 level (TTM P/E 18.8), the S&P 500 would be trading near 1626 today. That represents a bearish 23% decline from 2115.

How can one surmise that a GAAP-based TTM P/E 18.8 is a more reasonable price to pay for S&P 500 stock? Take a look at where “buy lower” participants entered the market over the last two years. For the most part, trailing twelve month GAAP P/Es at 18.8 have been remarkable turnaround junctures. There is one instance closer to 18 and another closer to 20. Nevertheless, the major support has been in and around GAAP P/E 18.8.

From where I sit, there are plenty of bigger fools in the equity markets. They’re content to add more stocks to their portfolios, even with a GAAP-based P/E near 24.5. Some argue that there is no alternative to stocks (T.I.N.A.) when cash and bond yields are so low. (Note: I debunked the competing asset theory in Wednesday’s commentary.) Others maintain that as long as central banks all across the globe continue to “grease the wheels,” you’ve got to buy equities.

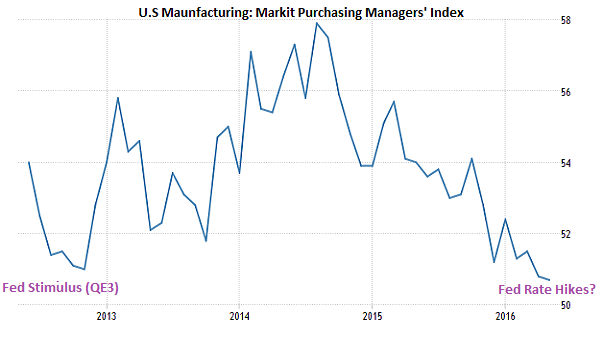

Granted, it does appear that central banks – the Federal Reserve, Bank of England, Bank of Japan, People’s Bank of China, European Central Bank – will collectively agree to stay accommodating for longer. Yet if the Fed can only achieve a single rate hike after a 10-year hiatus, what does it say about central-bank dependency on a stock, bond and real estate-generated wealth effect? What does that tell one about the true extent of economic weakness?

Unfortunately, history does have a way of making greater fools look exceptionally foolish, particularly when economic stagnation overrides the best intentions of central planners. Today, global trade is languishing. Earnings quality is deteriorating. Corporate sales are evaporating. Business spending outside of share buybacks is slumping. And corporate balance sheets are crumbling under the weight of preposterous debt levels.

Foolish stock and bond investors assert that nothing else matters beyond the fact that borrowers have easy access to cheap money. They make no efforts to analyze prices relative to traditional metrics. They are entirely price-insensitive. It follows that, in the absence of any plan to protect principal, they’re likely to experience big losses when central banks struggle to prevent the inevitability of a bearish turn of events.

Recently, a comment board participant expressed that he was more worried about holding cash because he will lose purchasing power. Another comment provider pointed out that his brokerage offers only 0.1% on cash in his money market, which represented the risk of loss as well. Here is how I responded:

The mistake that so many people make, in my estimation, is assuming that they must get a return on their cash right now. That’s not necessary. When you park money in cash, you reduce volatility today and await better asset acquisition opportunities tomorrow. Have patience.

I went on to explain that when risk taking is indiscriminate, my moderate growth clients have approximately 70% in a wide range of equity assets (e.g., large, small, foreign, momentum, dividend, etc.). Today, they have 45% in strong balance sheet large caps and dividend aristocrats only. Investors can consider the S&P 500 SPDR Dividend (NYSE:SDY), iShares MSCI Quality Factor (NYSE:QUAL) and Vanguard Dividend Appreciation (NYSE:VIG). Similarly, when risk taking is indiscriminate, my clients may have approximately 30% in a wide range of income producers (e.g., investment grade, cross-over corporates, high yield a.k.a. junk, domestic, foreign, convertibles, CEFs, etc.). Today, they have 25%-30% in municipal bonds and investment grade securities. My clients have benefited for several years in funds like SPDR Nuveen Capital Muni (NYSE:TFI), iShares 7-10 Year Treasury (NYSE:IEF) and Vanguard Total Bond Market (NYSE:BND).

The resulting 25%-30% in cash/cash equivalents is critical to reducing volatility today and it affords better asset price purchases in the near future. Low-yielding cash is a temporary position, so there is no need to think about its loss of purchasing power.

Buying stocks and bonds at better prices is a relatively important concept. And one needs cash to do it.

Consider the alternative of hoping-n-holding an excessive allocation to overvalued equities. In the current century, the inflation-adjusted returns for the S&P 500 is -1.2%. It is -29.6% for the NASDAQ. That’s pretty grim for nearly 16 1/2 years.

One would be accurate in pointing out that these results improve with dividends. The S&P 500 has annualized at 1.7% with dividends reinvested, though the NASDAQ is still quite negative. Of course, investors tend to spend 1% on expense ratios annually. Others pay asset management fees and/or commissions. Still others probably failed to do as well as the S&P 500 index since few funds ever do across 15-plus years. In other words, did investors really maintain their purchasing power in their portfolios? After expenses? Did they even hold through thin and thick?

The point? Don’t be the greater fool. If you experience capital losses – whether one realizes them or they remain unrealized – you risk an ability to maintain your standard of living in retirement. The time it would take to recover from the real risk of a repeat of 2000-2002 or 2008-2009 is too long for most retirees. Use a heavy dose of cash to insure against the possibility of a disastrous turn of events. Likewise, be ready to put the cash back to work at more attractive asset prices in the future.

Related Articles

Just recently, S&P Global released its 2026 earnings estimates, which, for lack of a better word, have gone parabolic. Such should not be surprising given the ongoing...

Trump threatens EU tariffs, creates confusion about Mexico and Canada duties Dollar rebounds but gold slides again Nvidia falls in after-hours trading as earnings fail to set...

Gold Consolidates Ahead of Key US Data Releases The gold (XAU/USD) price was relatively unchanged on Wednesday as markets remained cautious ahead of upcoming inflation data and...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.