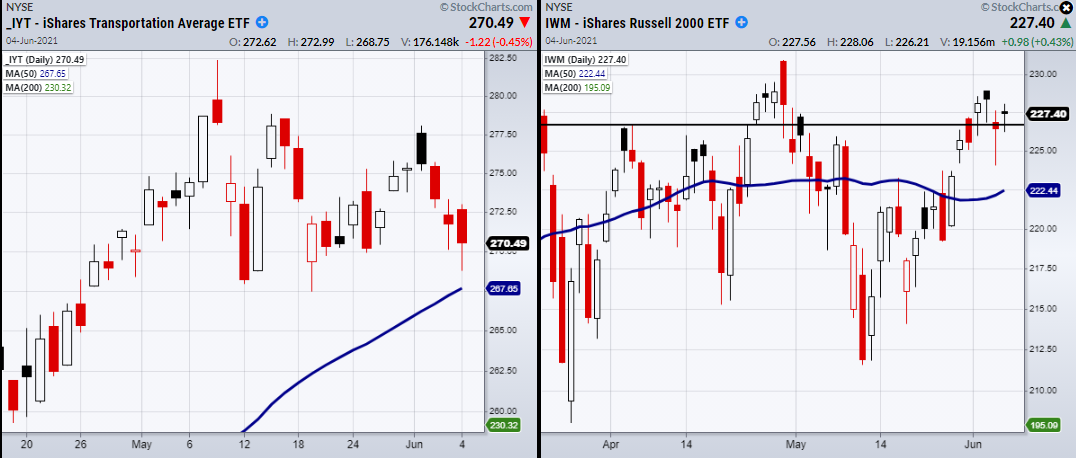

For the small-cap Russell 2000 iShares Russell 2000 ETF (NYSE:IWM), $226.69 is an important level to hold as it shows the index can sustain itself over its main consolidation range dating back to early April.

On the other hand, the Transportation sector—iShares Transportation Average ETF (NYSE:IYT)—along with Retail—SPDR® S&P Retail ETF (NYSE:XRT)—are not far from their 50-Day moving average.

This shows a potential divergence in the market if IYT and XRT decide to break their major moving average while the small-cap index holds or pushes higher.

Because IYT acts as an indicator for the underlying movement of goods, we can watch it for early warning signs that the market momentum is waning or speeding up.

However, with another 559,000 jobs added in May compared to the 278,000 in April, the economy could see an increase in demand for goods.

Furthermore, from the fundamental side, this could lead us to think that transportation might have another surge of support as we head into the second half of the year.

From the technical side, price action is always king, and therefore we should watch for $226 area to hold in IWM as well the 50-DMA to hold for both IYT and XRT.

ETF Summary

- S&P 500 (SPY) Resistance 422.82 to clear.

- Russell 2000 (IWM) 226.69 support area.

- Dow (DIA) 348.65 then 351 high to clear.

- NASDAQ (QQQ) Next resistance 336.65 with 331 support.

- KRE (Regional Banks) Holding 70.00 with 71.82 resistance.

- SMH (Semiconductors) 244 support.

- IYT (Transportation) 267.65 the 50-DMA.

- IBB (Biotechnology) 154 next resistance area.

- XRT (Retail) 96.16 resistance.

- Volatility Index (VXX) Needs to clear over 33.66.

- Junk Bonds (JNK) Watching to clear 109.12.

- XLU (Utilities) Support 64.49.

- SLV (Silver) 25.89 gap to fill.

- VBK (Small Cap Growth ETF) 278.97 level to clear.

- UGA (US Gas Fund) Needs to hold over 34.75 area.

- TLT (iShares 20+ Year Treasuries) 140.60 next level to clear.

- USD (Dollar) 89.54 support.

- MJ (Alternative Harvest ETF) Could not hold the 50-DMA at 21.16.

- LIT (Lithium) 69.75 next level to clear.

- XOP (Oil and Gas Exploration) 92.24 now support.

- DBA (Agriculture) 18.73 needs to hold as new support.

- GLD (Gold Trust) 177.97 gap to fill.