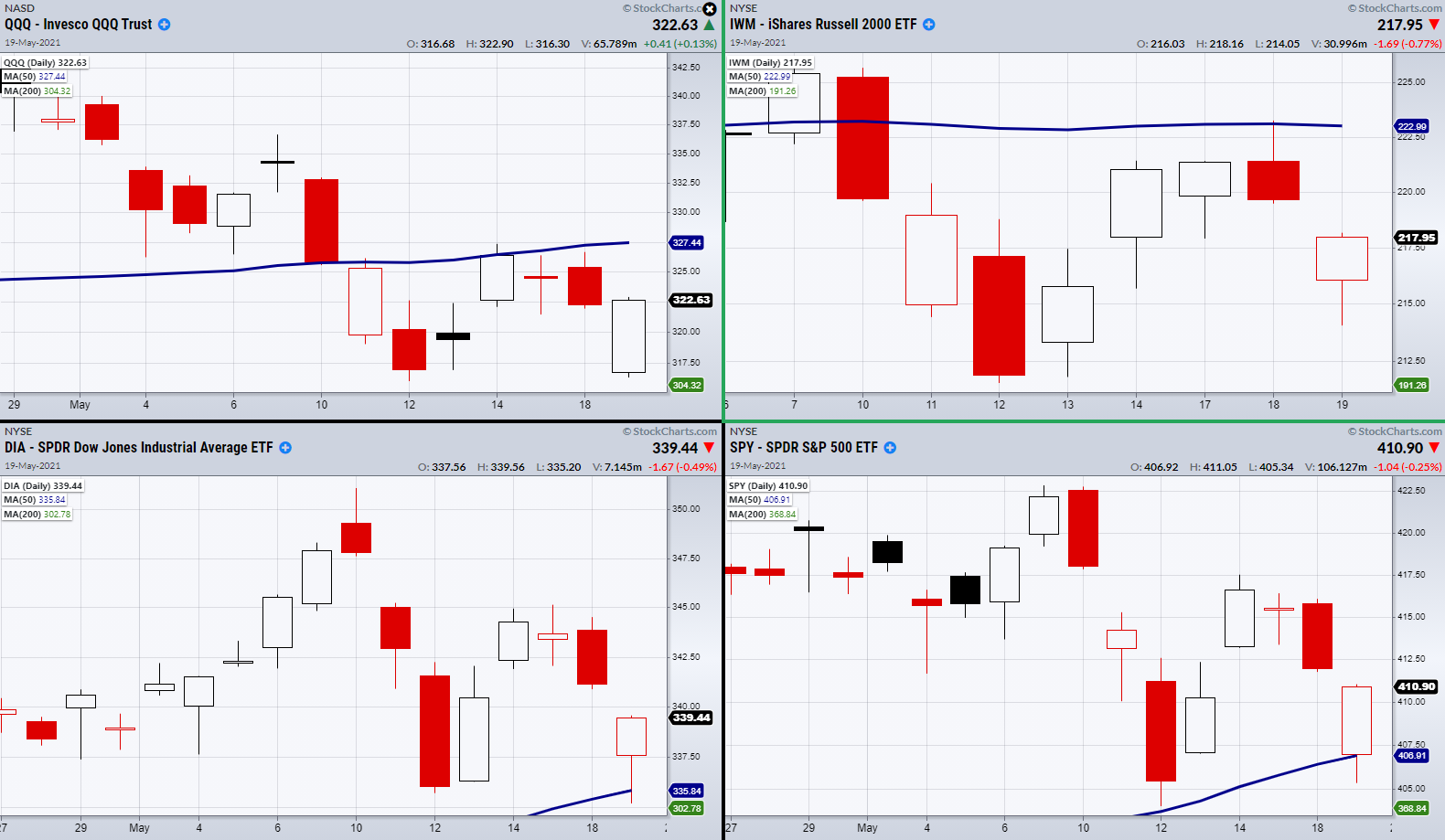

Wednesday, the four major indices gapped lower based on the failure of the Russell 2000 (IWM) and the NASDAQ 100s’ (QQQ) ability to clear resistance from their 50-Day moving averages.

However, IWM did not reach its next support level at $211, and the QQQs were able to bounce off support from the recent low at $316.

This is a good sign both are trying to stand their ground

With that said, the other major indices were also able to hold support.

The Dow Jones (DIA) and the S&P 500 (SPY) unlike the other two, have support from their 50-DMA.

This means that bulls did not get their way with a break over the key resistance in IWM and the QQQ. On the other hand, bears were also unable to claim victory since main support has held.

To add to the lack of victory, the High Yield bond ETF (JNK) broke its 50-DMA. We find tracking junk bonds reliable as any bond buying tapering by the FED shows up there.

Volatility also gained, but until we get a firm close over 25.00 in cash VIXX, that also adds to the uncertainty.

At this point, the main caveat is that even though support has held across the board, we have yet to see if buyers will continue to push the market higher.

Recently, there has been a huge amount of dip buyers (i.e., buying near lows after a significant price decline), but not much follow-through buying near resistance levels.

This leaves today as the next deciding factor.

Either we see more follow-through from buyers, or the bears take over and push the market below the nearby support levels.

ETF Summary

- S&P 500 (SPY) Held support 407.09.

- Russell 2000 (IWM) Support 215. Resistance 223.08.

- Dow (DIA) 335.99 support.

- NASDAQ (QQQ) 327.50 resistance. 316 support.

- KRE (Regional Banks) 71.82 resistance. 68.19 support.

- SMH (Semiconductors) 222.82 support. Closed over the 10-DMA at 232.68.

- IYT (Transportation) 282.40 resistance. 267.92 support.

- IBB (Biotechnology) 147.25 support.

- XRT (Retail) Needs to get back over the 50-DMA at 91.56.

- Volatility Index (VXX) 38.22 minor support. Did not close over the 50-DMA.

- Junk Bonds (JNK) confirmed a cautionary phase with second close under the 50-DMA at 108.59.

- XLU (Utilities) 64.86 support.

- SLV (Silver) Closed over 25.56 the 10-DMA.

- VBK (Small Cap Growth ETF) 258.32 support with main support the 200-DMA at 254.64.

- UGA (US Gas Fund) 34.68 resistance area.

- TLT (iShares 20+ Year Treasuries) 135.36 next support area.

- USD (Dollar) Support 89.68.

- MJ (Alternative Harvest ETF) 18.87 support.

- LIT (Lithium) 60.49 support the 50-DMA.

- XOP (Oil and Gas Exploration) 92.24 resistance with support at 80.31.

- DBA (Agriculture) 18.17 support

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.