If you asked a random passerby to name three Chinese cities, you’d probably hear “Beijing, Shanghai and Hong Kong.”

The southeastern city of Shenzhen doesn’t have much name recognition in the West.

But it should.

Shenzhen is the epicenter of China’s housing bubble. It’s home to 10.7 million people, and it’s a major center of industry, commerce and technology.

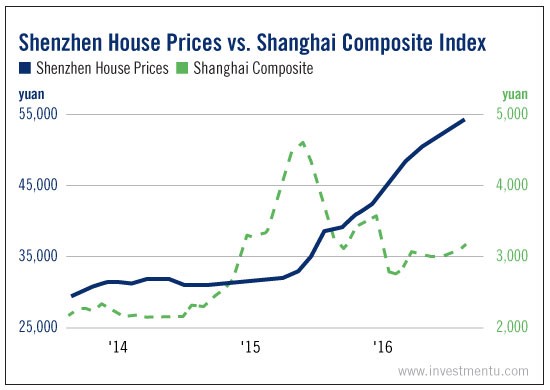

Housing prices in Shenzhen have risen 76% since the start of 2015. The average cost of a home there is now higher than London, San Francisco and New York.

But this isn’t just a regional housing bubble.

Nationwide, China’s real estate market is completely out of sync with the rest of the country’s financial sector. Just look at the Shanghai Stock Exchange Composite Index (SHCOMP) on the chart above.

The Shanghai Composite is the Chinese equivalent of our S&P 500. While Chinese equities have declined over the last two years, real estate has continued to soar. And now there’s a rapidly growing gap between the two.

Can the Chinese government stop the swelling? It’s hard to say, but the results thus far haven’t been promising.

Anatomy of a Housing Bubble

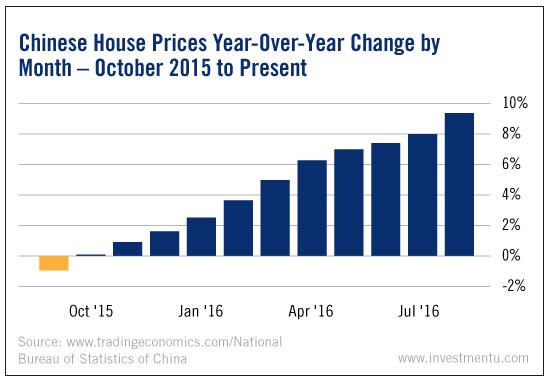

Chinese real estate investments have skyrocketed. Housing prices have grown by higher margins every month for the last year - despite slow GDP growth and a wayward stock market.

Runaway price growth isn’t the only source of China’s housing worries.

Millions of new houses and offices are sitting empty. That includes some 64 million empty apartments, too.

But the news shouldn’t surprise Chinese developers. In Shenzhen, the average mortgage is 70 times the average income.

What’s worse is that Chinese investors are starting to use three words reminiscent of the U.S. subprime mortgage crisis of 2008: credit default swaps.

China’s central bank recently approved the trading of these debt-protection contracts as levels of debt continue to rise.

A similar pattern played out in the lead up to the U.S. crash as the market for swaps on bad U.S. mortgage bonds grew quickly.

Can the Chinese Government Control This?

China’s government isn’t ignorant of the growing bubble. But up until now, the effectiveness of its anti-bubble measures has been questionable.

The government can control the availability of land for new construction. And it can also change the tax rate for developers.

Enforcing higher taxes and cutting supply would, in theory, temper the building craze. But recent efforts over the last year haven’t proven effective. And the credit default swap sales haven’t done much either... as of yet.

But the latest policies implemented to control the bubble are more hard-lined. So it could mean that they’ll get the job done.

For example, Chinese officials announced new limits on the number of properties investors can buy earlier this month. They also raised minimum down payments on mortgages and set minimum occupancy quotas for new developments.

Hopefully these new policies will attack the root problems of China’s housing bubble: risky real estate investments and low occupancy.

But given the momentum behind China’s housing market, it’s uncertain whether these reforms will control runaway price growth.

How to Protect Your Portfolio

When the bubble bursts, China’s GDP growth will slow. So it’d be wise to hedge your portfolio against Chinese real estate.

Slow GDP growth would be bad news, not only for the U.S., but for resource-rich countries like Canada, Australia and Mexico. All three export tons of raw minerals to China and have strong economic ties to the U.S.

Housing prices might fall slowly as part of a government-assisted “soft landing.” But they could also crash as the bubble bursts.

Either way, they can’t keep rising forever. So it may be a good time to bet against Chinese real estate.

You can do this by shorting a Chinese real estate ETF. Shorting the Guggenheim Invest China Real Estate (NYSE:TAO) or buying the ProShares Short FTSE China 50 (NYSE:YXI) are good choices.

The 2008 housing collapse was a dark time for American investors. But it taught us one simple lesson: Real estate is not an infallible investment.

Apparently China didn’t get the memo.

Shenzhen and many other Chinese cities are seeing housing prices soar... at a rate that would put the Las Vegas or Miami booms of the 2000s to shame.

Remember that what goes up must come down, and protect your portfolio accordingly.