- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

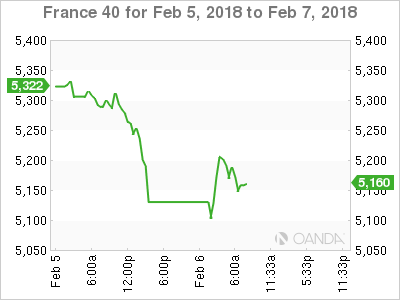

CAC Slides On Global Sell-Off

The CAC index has posted sharp losses in the Tuesday session. Currently, the index is at 5141.70, down 2.70% on the day. On the release front, there are no key indicators on the schedule. France’s deficit dropped sharply to EUR 67.8 billion, down from the previous reading of EUR 84.7 billion. This marked a 6-month low. Eurozone Retail PMI dipped to 50.8 in January, down from 53.0 in December. On Wednesday, France releases Trade Balance, which is also expected to show a smaller trade deficit.

Global stock markets are seeing red, and the CAC continues to slide. The index lost 3.1% last week and has declined another 2.9% this week. US markets took a tumble on Monday, with the Dow Jones posting its biggest loss in one day – at one stage, the index was done 1500 points. The Dow fell 4.6% on Monday, and the downward trend has continued in the Asian and European markets on Tuesday. As investors head for the hills, analysts are scrambling to find the reasons behind the massive sell-off. Some experts are pointing to the changing of the guard at the Federal Reserve, with Jerome Powell replacing outgoing chair Janet Yellen on Saturday. However, Powell is not expected to change current monetary policy, so it’s unclear how Powell would have rubbed the markets the wrong way after just one day at his new job.

More likely, the stock markets woes can be attributed to strong US nonfarm payrolls and wage growth reports, which were released on Friday. Investors fear that the sharp data could lead to higher inflation, which in turn would result in more rate hikes this year. Higher interest rates make the dollar more attractive for investors, at the expense of the stock markets. Adding to investors’ concerns, there are expectations that the ECB and possibly the Bank of Japan could raise rates late in 2018, which would push up the euro and yen and weigh on the stock markets.

Algo Trading Blamed for Monday’s Market Crash

Dow Suffers Biggest Ever One Day Points Loss

The French private sector has started 2018 on high note, as the services sector continues to expand at a brisk pace. January’s Services PMI was strong, as the indicator edged up from 59.1 to 59.2, just shy of the estimate of 59.3 points. Business confidence remains the strongest since 2011, as businesses are optimistic about strong global economic conditions. The manufacturing sector has also showed strong expansion, boosted by global demand for French products.

Economic Calendar

Tuesday (February 6)

- 2:45 French Government Budget Balance. Actual 67.8B

- 4:10 Eurozone Retail PMI. Actual 50.8

*All release times are GMT

*Key events are in bold

CAC, Tuesday, February 6 at 7:20 EDT

Open: 5,118.25 High: 5,224.50 Low: 5,113.50 Close: 5141.70

Related Articles

Nvidia’s muted reaction keeps tech on edge, with chipmakers in focus. Nasdaq’s 20980-21000 support holds—for now. A break could mean trouble. With Nvidia done, GDP today and...

Here’s where I see stocks now: Yes, we’ve got some legitimate concerns as some economic warning signs appear—and run up against the tech-driven optimism that’s powered stocks to...

Nvidia’s earnings beat didn’t erase investor concerns over slowing growth. Soft Q1 guidance and valuation worries may limit the stock’s upside. Weak network and gaming sales...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.