Investing.com’s stocks of the week

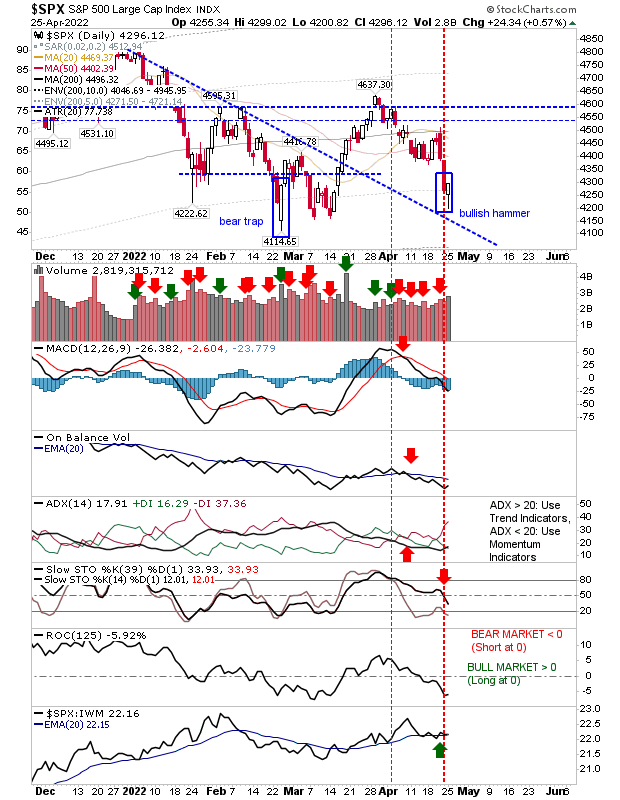

Monday's recovery has offered the potential for a bottom and the end of the decline from March highs, but it leaves lead indices vulnerable to the undercut.

One day's buying does not necessarily equate to a reversal, but yesterday's action will give aggressive buyers something to work with (using a loss of Monday's lows as a stop). Best of the action was the S&P as it ended with a bullish hammer, but reversal candlesticks need oversold momentum to strengthen their credentials and we don't have that here.

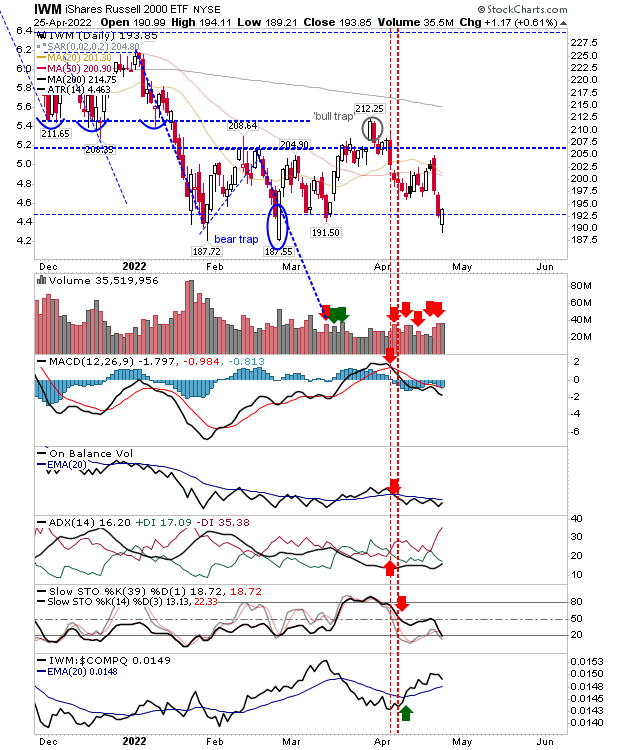

The Russell 2000 (via IWM) is the index I want to see do well to firm up a long term low. Yesterday's finish recovered support and offers an opportunity for a new long trade. On a momentum level, it's oversold, but in relative terms it's outperforming. Today is a new day.

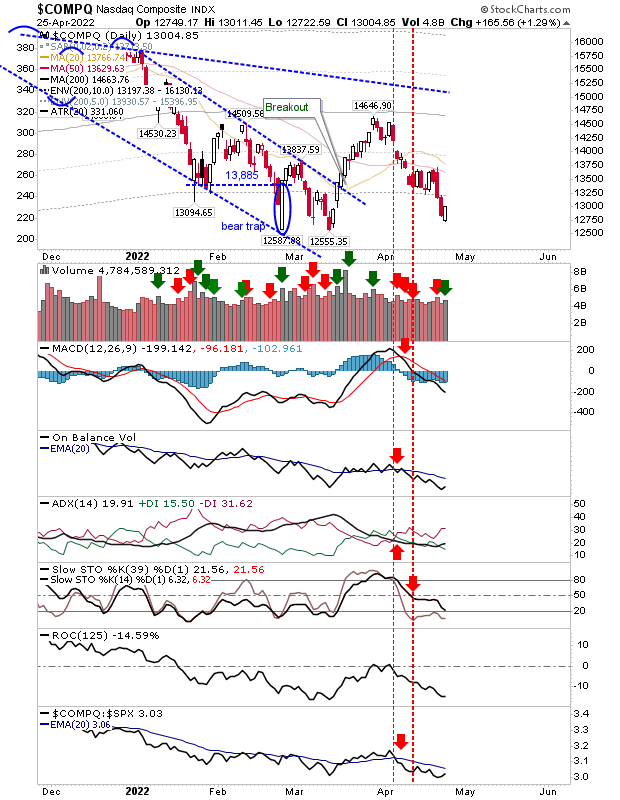

The NASDAQ closed yesterday with an accumulation day, although the index is underperforming relative to the S&P, it did close with a bullish piercing pattern. Of the three indices it's the weakest, but let's see what it can do.

One day's buying is no guarantee that the sell-off is done, but it was good to see bullish reversal candlesticks and the presence of price support. Aggressive buyers can look to trade this situation, but be ready to bail if things turn south.