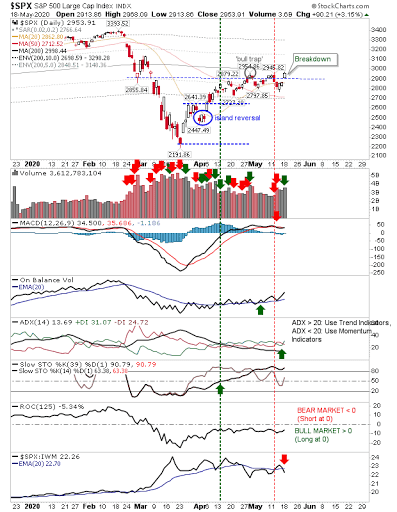

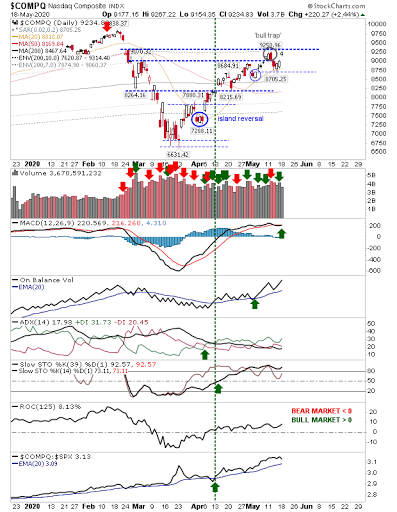

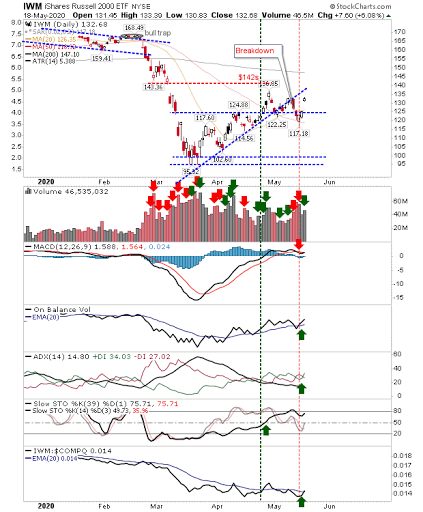

A strong start to the week yesterday, that was backed by bullish accumulation across indices. There is still overhead resistance to contend with but Monday's close was enough to see indices approach breakdown gaps from the COVID sell-off.

The S&P broke into the 'bull trap' zone but remained pegged to 200-day MA resistance. However, the breakout didn't reverse relative underperformance against the Russell 2000.

The NASDAQ edged a higher close but not enough to move into the February breakdown gap. There was a new MACD trigger 'buy' to negate the earlier 'sell' trigger. The index needs a little more to attract momentum buyers as the bulk of yesterday's gain was booked by market open and it wasn't able to achieve much after that.

The Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)) banked a 6% gain, but even this wasn't enough to challenge the April peak. However, the index did register an accumulation day and a relative performance advantage against the NASDAQ.

Can markets build on yesterday's momentum? The opening gaps banked most of the days gains but there was a lack of follow-through. The NASDAQ only has one obstacle left, the February gap down. The S&P and the Russell 2000 have more to do, but the NASDAQ may be able to drag them higher.