Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

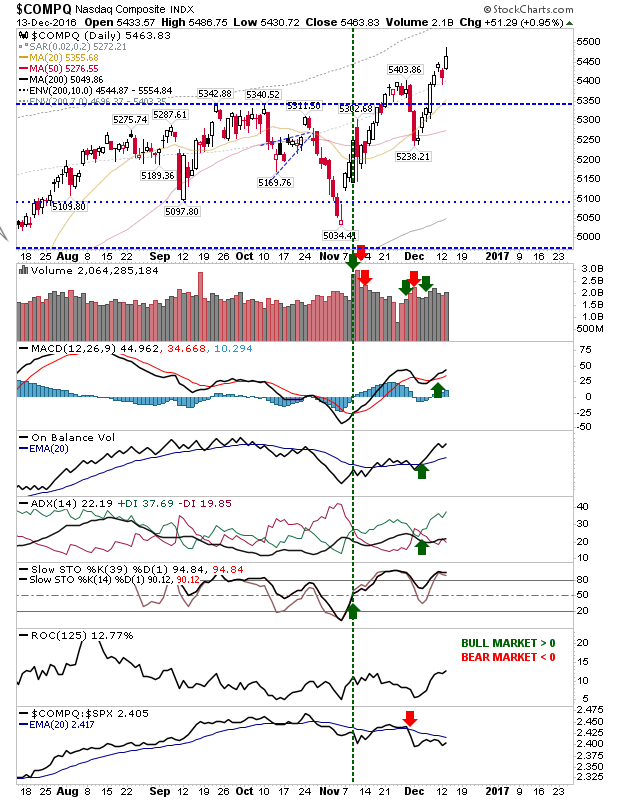

Well, that selling didn't last long. Yesterday the NASDAQ powered higher as leading tech companies like Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT) added over 1%. While the index is doing well, it remains a long way from tagging the upper band marking a profit taking opportunity, as had occurred in the Russell 2000 this month.

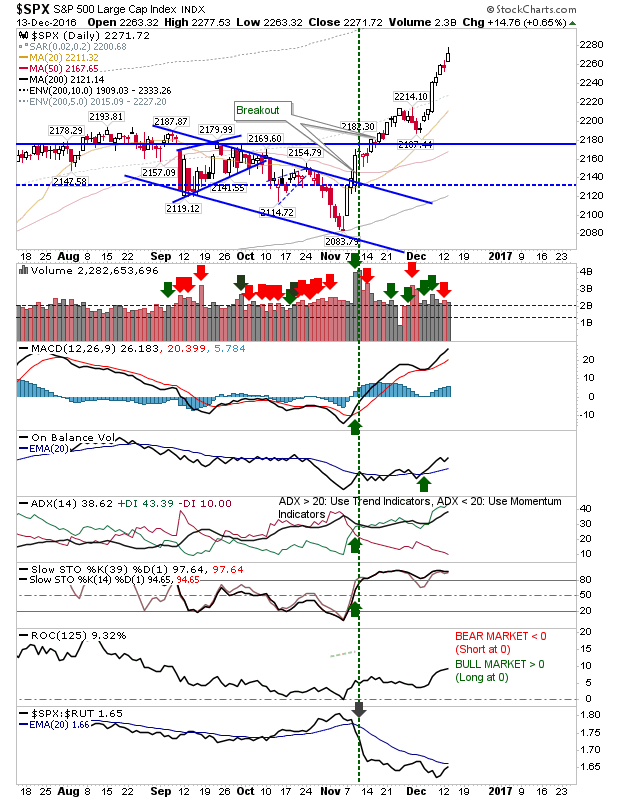

The S&P didn't quite get the Tech kicker, but it was a clear break above Monday's selling doji. Technicals remain positive.

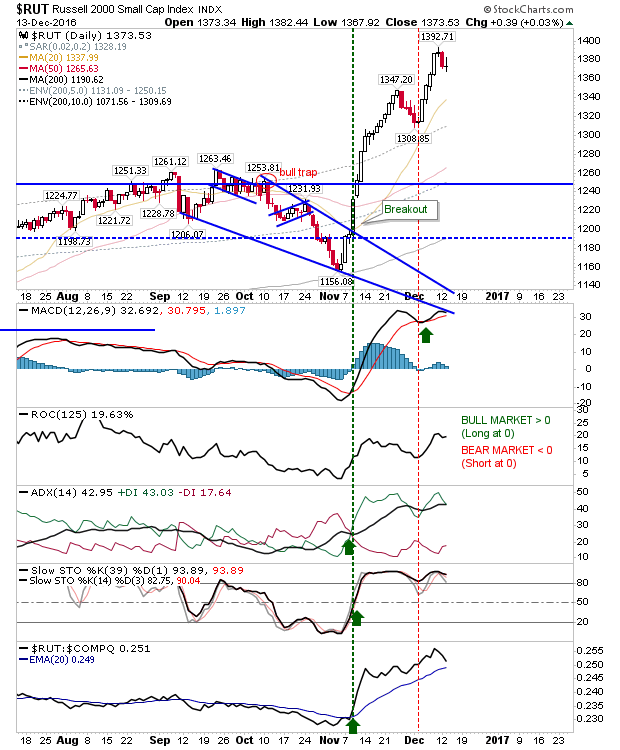

The Russell 2000 barely managed to challenge Monday's selling, and remained near Monday's lows. Profit taking remains the favoured action. The index is holding on to its relative out-performance, but this is likely to slip if current action continues - particularly as Tech and Large Caps continue to gain a strong footing.

The next step forward is to look for measured move targets across all indices, using the late November sell-off as the pivot point for the drive higher. To calculate the measured move target, add the November high/low swing to the late November low, and project higher.