I last wrote about the MSCI World Market Index in my post of December 24, 2019.

Since then, it surpassed its resistance level of 2340 and is sitting at 2470.05, as shown on the following monthly chart.

The Balance of Power lies in the hands of buyers on this timeframe, as price is set to break out above its high of 2500.32 to new all-time highs...provided that Momentum (MOM) continues to rise.

Its next major resistance level lies at the top edge of the Andrew's Pitchfork channel around 2600.

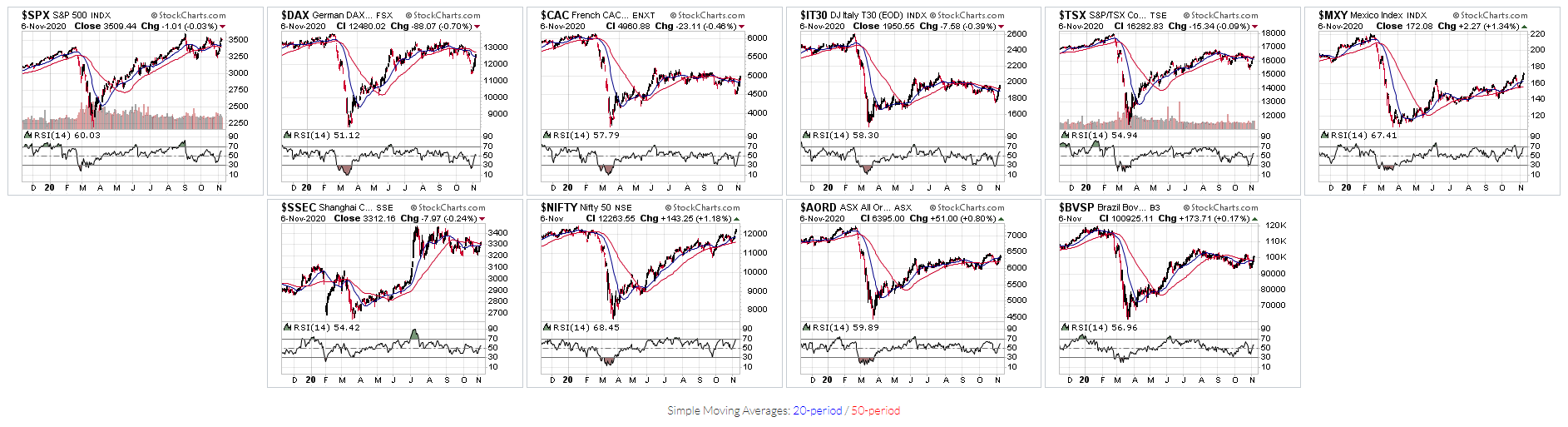

For clues on global market direction and strength, keep an eye on the RSI on the following basket of global market indices. As long as it keeps rising over the coming days and weeks, we may see the 2600 target achieved in the medium-to-longer term, or even by the end of 2020.

As well, the tug-of-war situation that I described in my post of October 26 between China's Shanghai Index (SSEC) and the S&P 500 Index (SPX) is worth monitoring, in this respect. The SPX is now sitting just above its former resistance level of 3500, while the SSEC remains around 100 points below its resistance price of 3400. Keep an eye on how this develops for the remainder of the year (and beyond) for additional hints as to the viability of further buying in the MSCI World Market Index.