This is an income fund, pure and simple. No, it doesn’t offer high yields with the commensurate high risk. No, you won’t double your money owning it.

But if your goal is to protect what you have with a portion of your portfolio, here is a rock-solid base for your investing pyramid. In times like these a solid base may be your best friend

The Holbrook Income Fund (HOBEX) is a new fund, begun in July of 2016. There is one disadvantage to all new funds and that is their expense ratio may seem high. Of course they do! In relative terms, the management team will initially have high expenses spread over fewer shareholders.

I respect portfolio managers who established their reputation via successful investment leadership at the big funds, but are then willing to give up the big salary and perks to strike out on their own.

Since “too big an expense ratio” seems to be the reason many investors sniff disdainfully and never get to buy these little gems, let me compare and contrast the “cheaper” low expense ratio funds with the ones I often prefer.

First of all, most of the index behemoths don’t earn a big percentage of assets under management because, well, they don’t really do much of anything. It is an index fund, for heaven’s sake. When the benchmark changes by deleting a company, the index mutual funds and ETFs delete the company. When a new company is added to the index, the index mutual funds add it.

If ever there was a job that cried out for Artificial Intelligence, even the slow kids in the AI universe can learn to copy off the other guy’s paper. Can you imagine how boring a meeting of the Investment Committee of an index fund must be?

“Gentlemen, let me call this meeting of the Investment Committee to order. Bill, what is the first order of business?”

“Well, Bob, there was only one company added to the index this time around so I’m going to go out on a limb here and recommend we copy the index.”

“I don’t know, Bill, that’s pretty radical isn’t it?”

“Well, Jim, we are an index fund so I’m just not sure how else we can slice and dice this thing.”

“Good point, Bill, good point. So – do I hear a motion to add the new company to our fund?”

“So moved.”

“Thank you, Chauncey.”

“Seconded.”

“Thank you, Dave.”

“All in favor?”

“So ordered.”

“Well, I don’t know about the rest of you but I’d say have another successful meeting under our belts. See you all in 6 months!”

Duh.

Second, the fees are assessed on a massive amount of money. And let’s face it, what can one typical capitalization-weighted index fund do to differentiate themselves from another typical capitalization-weighted index fund? Expenses are about the only way they can get noticed. The steady drumbeat of “Don’t try to do better than the market. Just buy and hold an index fund through all the ups and downs” from academia and the fund industry has reduced intelligent investing to this mantra.

An example: the biggest index fund, Vanguard 500 Index Admiral Fund (VFIAX), charges a rock-bottom 0.04% to run their index fund. They have $434 billion in shareholder funds. To copy the index as it changes, at 0.04%, they are being paid a whopping $173,600,000 per year.

Contrast this with a new fund like Holbrook Income. HOBEX has just $16 million in assets under management. Their assets are less than 10% of what VFIAX charges in fees! So while the expense ratio at Holbrook Income seems high at 1.8%, the fund needs to pay rent for its offices, salaries for its (small!) staff, trading costs, etc. out of the whopping $288,000 the fund receives from its fees. I have no doubt that, as HOBEX and its institutional offering HOBIX gather more assets the expense ratio will drop markedly.

Remember, too, that all performance figures you see for traditional mutual funds and ETFs are net-after-expenses returns. I say again, as I have in so many previous articles, that if I compare two very similar funds, one with a 0.015% expense ratio that returns, say, 9% per annum, with a different fund that has a 2.00% expense ratio but returns, after all fees and expenses, 12%, I am buying the one that gives me the greatest real return. (That would be the 12%-er.)

I suggested the AlphaCentric Income Opportunities Fund (IOFIX / IOFAX) here for readers back in February.

Since that time it has done precisely what I bought it for. Whether the Dow is up 300 points or down 300 points is irrelevant to IOFIX. It has proven to be a calm protected bay in a violent ocean. It pays a steady-Eddie distribution every month and has a Beta of basically zero to the stock market.

Yet many of the comments received reflected the groupthink of “High expense ratio always bad, no matter how new or small the fund. Low expense ratio always good no matter so-so performance or no protection from downside” mantra.

I preface my remarks about Holbrook Income so I can save those inclined to repeat this mantra the time and trouble of reading further. If you have no interest in reducing risk via asset class diversification, my suggestion here is not for you!

If, on the other hand, you believe it is possible, just possible, that someday, maybe someday, the markets may decline, you might enjoy the benefit of a fund like HOBEX that will give you steady returns while protecting your assets during a time when may investors will be giving back all their hard-earned gains.

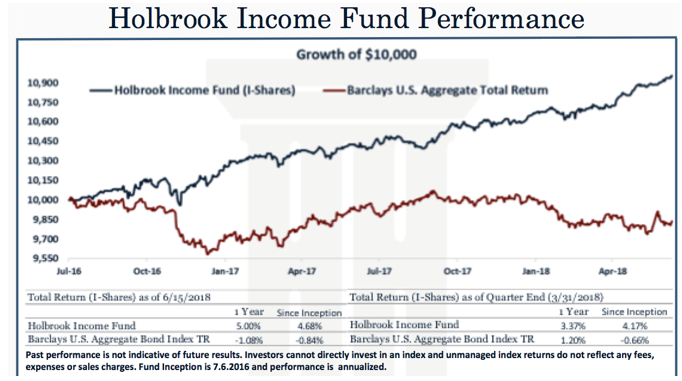

Holbrook Income, year to date as well as over the past year, has the best performance of any short term bond fund (as ranked by Morningstar.) The Barclays US Aggregate Bond Index (NYSE:AGG) was down -1.8% over this time period. Holbrook was up 5.0%.

Diversification and Active Management

How does Holbrook Income manage to so thoroughly tromp the bond benchmarks? Diversification and active management.

Scott Carmack is Holbrook’s founder, CEO, and Portfolio Manager (and chief cook, bottle-washer and Guy That Pays The Bills, just like all new funds!)

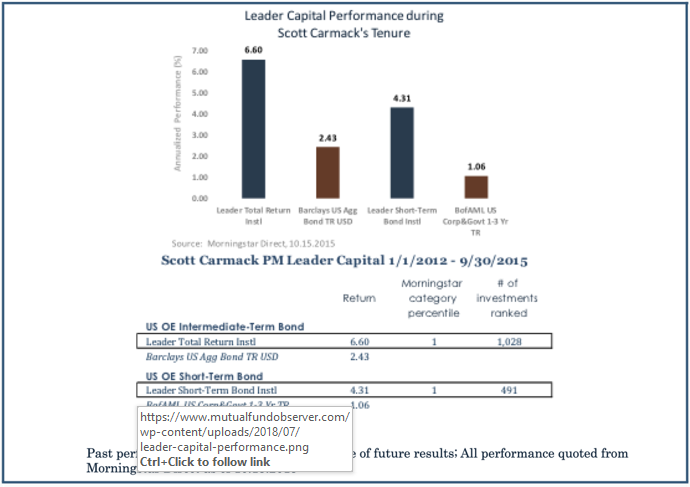

Mr. Carmack was previously President and Portfolio Manager of Leader Capital Corporation. During his time there, his performance and the efforts of his right-hand man, Michael Burs, saw assets under management (AUM) indrease from $340 million to over $1 billion. Morningstar ranked his fund in the 1st percentile for return performance during his tenure. Mr. Carmack describes his investment in Holbrook Income as all of his retirement savings and the majority of his family's savings. This man has skin in the game.

Mr. Carmack gets diversification from owning TIPS (expecting, as I do, that inflation and interest rates will rise more robustly than most analysts believe, this year and next). The fund also gets great current income as well, thanks to its holdings in business development company (BDC) "baby bonds" (bonds that sell for less than the more typical $1000 face value bonds). As regular readers know, I am a fan of BDCs in the current market environment. Almost all BDC's loan money to smaller, usually private companies at floating, rather than fixed interest rates. This means that if (or when) rates rise the interest paid also rises.

These baby bonds are rated investment grade but are typically too few in number to get the big banks' and big mutual funds' attention. I like them because they carry an investment grade rating and because the regulatory restrictions for these companies mandate an asset coverage ratio of 150%. If it declines below 150%, they are ordered to stop distributions to shareholders or buy back their baby bonds until they are again in compliance.

Rising Rates

If rates were to jump 1% over a of couple months, that would be great for my inverse Treasury ETFs (a good-sized holding) but probably terrible for my investment in BDCs. If rates rise too fast, many of the firms BDCs lend to wouldn’t be able to plow money back into their business because they would be paying so much more in interest on their borrowings. I don’t see that happening, however; the Fed is committed to slow, steady increases and I imagine inflation will advance in a similar pattern.

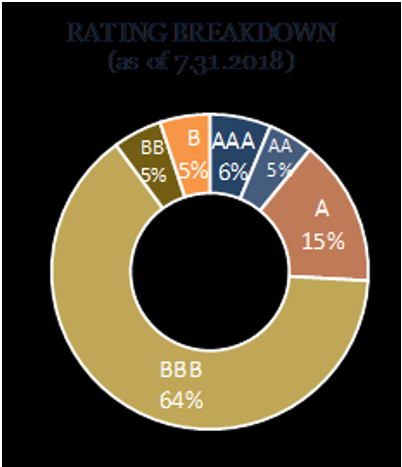

In addition to the inflation protection from TIPS and the high and likely to grow yield from BDCs, HOBEX also invests in short duration (and mostly short maturity) corporate bonds. Mr. Carmack is an active manager. He currently sees the greatest discrepancy between value and price in the lower investment-grade tier, hence that is where most of the corporate bond holdings of the portfolio are positioned today:

Tough to Pigeonhole this Fund

This is one of the big reasons why I like it. Excellent diversification and an opportunistic active management style mean that, within the parameters established by HOBEX of seeking income, protecting assets and benefiting from a rising rate environment, Mr. Cormack has tremendous flexibility to choose the investment products that best get that job done. That’s why, while Morningstar tries to fit this approach into their Short Term Bond Fund category, I see it as simply a flexible income fund that will seek value and returns wherever it is found. Sort of like Bach, who composed and played within his own narrow—in comparison to later composers—range, managed to wrest the most from it, making music that will outlive us all.

This income fund fills a niche in my overall investment strategy. Mr. Cormack has no holdings in mortgage-backed or residential mortgage-backed securities. Does he not like them like I do? That isn’t it. He just believes this is not his area of expertise so why get involved in them when he can create exceptional value in the areas he is expert in.

I already hold, and have placed in our subscribers-only model portfolio, AlphaCentric Income (IOFIX), Semper MBS (SEMPX) and Voya Securitized Credit (VCFAX) because I believe that the commercial and residential mortgage lenders and servicers these funds hold are superb apres le deluge positions. (Well, during the deluge, I expect as interest rates rise and most bonds tumble, this fund will prove its value. And, considering how well they have all of the above have done since I bought them, I guess pre- the deluge, as well!)

What I need, to avoid pain from some factor as yet unidentified by anyone, is to ensure I diversify. HOBEX adds that essential diversification for me.

There is no guarantee that Holbrook Income will earn 5% this year with virtually no volatility, like it did in the past year. But I expect the exterior interest rate and inflation environment will provide that return or more. Here is what that performance looked like graphically versus the universe of US bond fund competitors:

Every day there are scores or hundreds of newly-touted stocks that are going to make you amazingly rich – according to the author of those articles, anyway!

Holbrook Income is the quiet professional in all this hubbub. The fund sets its parameters, determines the strategic core of its decision-making, then is opportunistic in pouncing on discrepancies between price and value. If you are looking to add stability to the base of your own investing pyramid, I think Holbrook Income is a rock-steady choice.

Good investing.

Disclosure: Do your due diligence! What's right for me may not be right for you; what's right for you may not be right for me. Past performance is no guarantee of future results. Rather an obvious statement, but too many people look only at past performance instead of seeking the alpha that comes from solid research and due diligence.