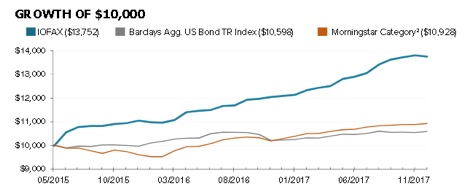

If I were to show you the chart below without identifying the product you’d say 37.5% was a pretty great return for less than 3 years in existence.

You might be even more impressed if you were to discover this is an income fund.

How about if I told you that since February 2, as the Dow plunged 1,800 points and bonds were devastated, the NAV of this fund is unchanged?

Here’s the chart:

Source: AlphaCentric Income Opportunities Fund website and presentation

IOFAX is the symbol for the “A” (load) shares of the AlphaCentric Income Opportunities Fund. (I favor the A shares because, as Registered Investment Advisors, we tend to reach the zero load level for our clients. As a result, we pay no load and no commission.) However, there are two other classes of shares, including the no-load IOFIX which has actually out-performed the A shares since inception.

What does IOFAX (I’ll use this symbol when discussing all three classes) do that is so special that they have earned these equity-like returns in the bond business? In a nutshell, they buy junk that no one else wants. Before you think I am referring to merely high risk junk bonds, nope. Scores of funds do that. Before I offer the specifics, let me tell you a true story of someone who made me, many years ago, far more receptive to people who find a niche and are the very best at profiting from it.

Back in 1975, when discount brokerage became legal, I started my own discount broker that I later sold to Chuck Schwab. In those early days anyone who wanted to come in and use our office as his research office was welcome. When starting a new business it helps to have customers there. One gentleman in his early ‘80s would shuffle in every day with reams of paper under his arm and in his briefcase. I’ll call him Harry, because that was his real name, and I will never forget Harry.

Harry never bought a single share of stock. He did, however, sometimes buy my staff lunch and pestered us with requests for arcane (in those pre-Internet days) information about bankrupt railroads. No one just looked up a quote back then; brokers with Bunker Ramo or other machines had to buy the feed from the various exchanges. But Harry didn’t care about that. Harry was more interested in the pink sheets and having us call New York and Chicago to see where all these busted railroad bonds were trading. (Phone calls weren’t cheap back then either but I liked Harry!)

Source: Old Stock Yard Stocks and Bonds

The answer was pretty much always the same. 15 cents on the dollar, 18 cents on the dollar, 13 cents on the dollar. But every now and then some big institution holding these pennies on the dollar bonds would grow disgusted with them. This happened more often than you might think. A new CEO or department head would come in and see an embarrassing array of a bunch of holdings that were unlikely to ever see the light of day and instructs the staff to “sell this junk. Get it off the books.” When that happened Harry would pounce.

It seemed awfully dumb to me as a 20-something to be buying bankrupt railroad bonds at 8 or 9 cents on the dollar. Surely if the big institutions were dumping these bonds, they must have known a lot more than me or an 80-year-old guy who brought his lunch to my brokerage office. But Harry just keep researching and asking us to obtain settlement agreements and offers to buy and prospectuses and all the other paraphernalia that accompanies the winding down of a once-successful business fallen on hard times.

Toward the end I began to take pity on Harry for buying (in size) worthless railroad bond certificates that The Smart Guys were dumping for 9 cents and then buying more when they declined 50% to 6 cents. I suggested he buy some good Blue Chips to augment this losing procession or maybe some of that new-fangled science and technology stuff.

That’s when Harry took me aside and said, “Next week PennCentral bonds will go up on the order of 300%, Joe.” Now I really began to worry about my new friend. He not only believed this stuff was going to go up but believed he knew by how much and when.

He did, and they did. That’s when Harry told me he was bored at home so he decided to take advantage of the knowledge he had gained in the years before he retired. You see, Harry was a bankruptcy lawyer, then a bankruptcy judge, then retired for a few years, then bored. Harry was far too removed to have any inside information. He just knew what the real in the ground, on the ground, on the warehouse floor, and scrap value was for every rusting hulk out there.

Harry was buying the bonds that hot-shot younger guys were selling off as too boring or CEOs were ordering sold off because they were embarrassed to have them in the portfolio or more senior players even at the biggest names on Wall Street were tired of carrying when they could use that money for day-trading.

Harry is long gone now but the lesson stuck with me. Before you discount something (or someone) out of hand, consider that it may be possible they understand a niche everyone else has given up on or just doesn’t believe in.

That brings us to the AlphaCentric fund family’s Income Opportunities Fund. Specifically it brings us to the sub-advisor, Garrison Point Capital, LLC. The principals at Garrison Point may or may not be as smart as my old friend Harry or they may be smarter, but they are certainly ready to go where angels fear to tread. They have managed their strategy via separate managed and other accounts prior to the formation of IOFAX on May 28, 2015. What could be worse than the 1970s’ bankrupt railroad bonds?

Today that would have to be subprime and non-agency-backed Residential Mortgage Backed Securities (RMBS) and other asset-backed securities (ABS) that met their comeuppance in the 2007-2009 kerfuffle. A simple back-of-the-business-card explanation is that IOFAX buys and trades bonds backed by pools of individual mortgages.

“Non-agency-backed” means that these are not mortgages held in tranches by a federal agency. That’s a good thing. The best opportunities come from the fractured markets below most funds’ radar or scope of competence.

IOFAX primarily selects mortgages from the pre-2007 era. Working in IOFAX’s favor even further is that most of these mortgages have floating-rate coupons so the income from them will actually increase as interest rates rise. These have since been aggregated and re-formed in various geographic, demographic, life of loan, and other iterations are complex in the extreme and hard enough to source that it just isn’t worth it for most firms. Like Harry, they really have to know what they are looking for to separate the wheat from the chaff.

Strangely enough, given what investors thought of these securities 10 years ago in the midst of the housing-market collapse, this asset class is now becoming quite desirable because of their good strong yields, a better loan-to-value profile, almost no correlation to typical fixed income, and improving credit worthiness of the individual holders that comprise these tranches.

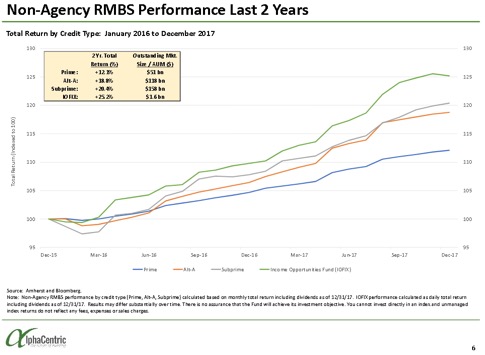

Source: AlphaCentric Income Opportunities Fund website and presentation

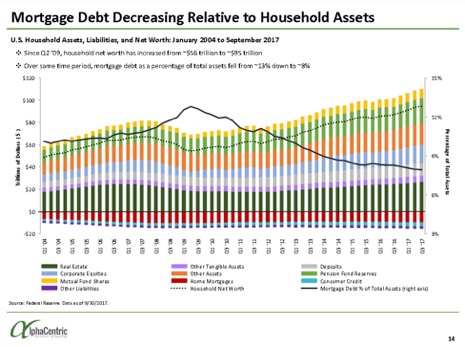

Indeed, average loan-to-values were as high as 110% as recently as 2011. (In other words, a home valued at $150,000 still carried a mortgage of $165,000.) Today that figure is closer to 70%, so that same notional home now valued at $200,000 has a mortgage of $140,000. (This would include early payoff, of course.)

Mortgage delinquencies, almost 12% of all homes in 2009, are today almost back to historical levels of 3-4%. Mortgage rates, even as rates rise, are likely to stay below the median of the past few years.

I think the best news from Garrison Point’s perspective, and thus for our IOFAX, is that lower priced homes have actually outperformed more expensive ones thanks to inventory shortage in nearly all of the biggest metropolitan areas. Inventories remain historically low.

Also, as one of the principals, Tom Miner, has said, “Even if housing prices stop increasing, amortization pays down the debt, reducing loan to value every month.” So these mortgages benefit from increasing prices, a better loan-to-value ratio every month and – my conjecture – since the owners have been paying these mortgages for 10 years or more, they themselves are no longer considered subprime borrowers.

Source: AlphaCentric Income Opportunities Fund website and presentation

Garrison’s managed portfolio for IOFAX is comprised of some 300,000 individual mortgages with an average loan balance of just under $160,000. They are in continuous contact with a couple dozen of the biggest dealers in this field and are willing to add more – if the price is right.

Given that the area in which they choose to specialize trades about $1 billion per day, it is big enough for IOFAX to be able to pick and choose but too small for your typical $100 billion Wall Street trading desk.

While the fund was launched at the end of May 2015, this is not a new strategy for Garrison Point. The firm has for a longer period of time also employed a similar strategy called Garrison Point Enhanced Yield for separately managed accounts as well as a smaller hedge fund (Garrison Point Opportunities) which is in the same vein but focused on a different asset class. The firm also manages assets for an insurance company.

IOFAX is not a one-trick pony. While the best thing on the menu right now is RMBSs, the fund is always on the lookout for other specialized markets too small for the big boys but incredibly profitable for thee and me. The fund’s charter allows it to invest wherever management finds value. These will likely be in other niche areas where they can add special value.

If after your due diligence you decide to join me in purchasing shares of IOFAX you are buying a fund early in its life. However, given the remarkable pace of its growth thus far (in returns as well as in assets under management) you will be getting in before it gets so big the managers would be forced to close it.

I extend this thought as both kudo and caveat… While the subprime market segment is huge (almost $400 billion), it will over time become harder for IOFAX to find bonds at a price it is willing to pay. (In which case we still have all those return possibilities from the existing portfolio but Garrison Point will have to identify other niche markets from among other types of asset-backed securities.)

The other reason I mention a potential closure to new investors this early in a fund’s history is that on Jue 1 of this year IOFAX will have been open three years. That means it will qualify for rating coverage from Morningstar. Given that so many investors consult Morningstar as they review possible funds for purchase, and given IOFAX’s excellent performance, that event will likely engender even greater demand.

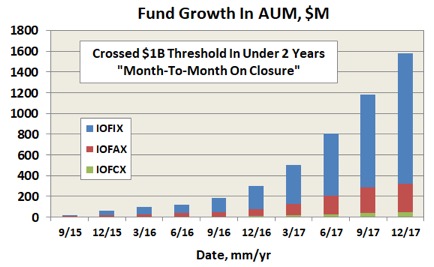

Here’s how they have grown assets under management (AUM) thus far:

Source: AlphaCentric Income Opportunities Fund website and presentation

As of this writing, IOFAX pays just under a 5% annualized dividend. The dividend is paid monthly. Last year its total return was 14%, after fees, to investors. It isn’t just these fine returns that have attracted me to IOFAX, however. It is also the consistency of the returns. This fund is in a real sweet spot and I believe will be for years to come. Its principal assets, seasoned subprime mortgages, have returned just over 20% over the past two years (out-performing prime mortgages, which returned just 12%.)

Excess future return can come from a number of sources. Sometimes RMBS’s will be called at par resulting in a profit. There might be legal actions that make them more valuable. There could be more prepayment of the mortgage balance by more owners. Or the variable rate on the coupons might kick in, which would increase cash flow markedly.

The expense ratio is higher than most funds but then the returns thus far have been “much” higher. As they grow these expenses may well come down. Currently, IOFIX charges 1.5%. IOFAX is actually higher, at 1.75%, and the front-end load is waived for any purchase over $50,000.

Again, I have used IOFAX as the exemplar for the other asset classes. For most individual investors, it will likely be most appropriate to consider IOFIX, the Investor class. For those with more than $50,000 to invest with a custodian broker who does not charge an in-house commission as well IOFAX probably makes the most sense – as it does for most investment advisory clients. A caveat! Each custodian broker makes its own rules. Know what you are paying before you buy.

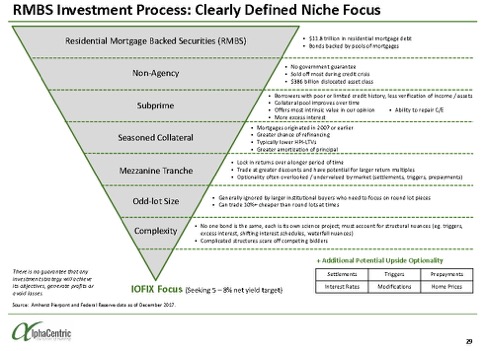

The fund’s minimum purchase is $2,500. Subsequent investments may be made in increments of as low as $50. While the fund’s prospectus allows for a broader mandate of asset-backed securities, IOFIX currently maintains a clearly defined RMBS niche, summarized here and depicted below: smaller, seasoned, subprime, mezzanine securities with improving underlying collateral, uncorrelated to broader market with less interest rate risk, producing a high income strategy yielding 5-8% annually. Its total return, however, since inception has been much higher.

Source: AlphaCentric Income Opportunities Fund website and presentation

P.S. As I sometimes will, I showed a first draft of this article to our Investor’s Edge® Marketplace subscribers a couple days ago. One long time subscriber came back and said Harry was not the only one to figure out that “busted railroad bonds” niche. Reprinted with his OK, my subscriber and friend – also named Harry -- said:

“Great story, Joe. Let me back it up with one that actually happened to me and my dad. Around 1970, I got him to buy bankrupt Erie Lackawanna bonds that hadn't paid interest since the early '50s.

“They were, however, convertible into something called 'Dereco' (that stood for Delaware and Hudson, Erie Lackawanna) which was itself convertible into Norfolk and Western. They sold at a discount to the N&W share price because bond holders didn't get the N&W dividend. After a few years, N&W dividend went up and we converted [some.]

“Fast forward to the creation of ConRail. Almost all the bonds had been converted. Those that weren't were paid out at par plus cumulative accrued interest. I believe it was around $1300 per $100 par value (for which we had paid 15 cents on the dollar) i.e. each $15 bond was redeemed for almost 100 times its cost. Best, Harry”

Thinking outside the box clearly has its rewards!