There is still work to be done but on Tuesday, indices tried to make back lost ground from last week. If there is a concern it's that buying volume wasn't great.

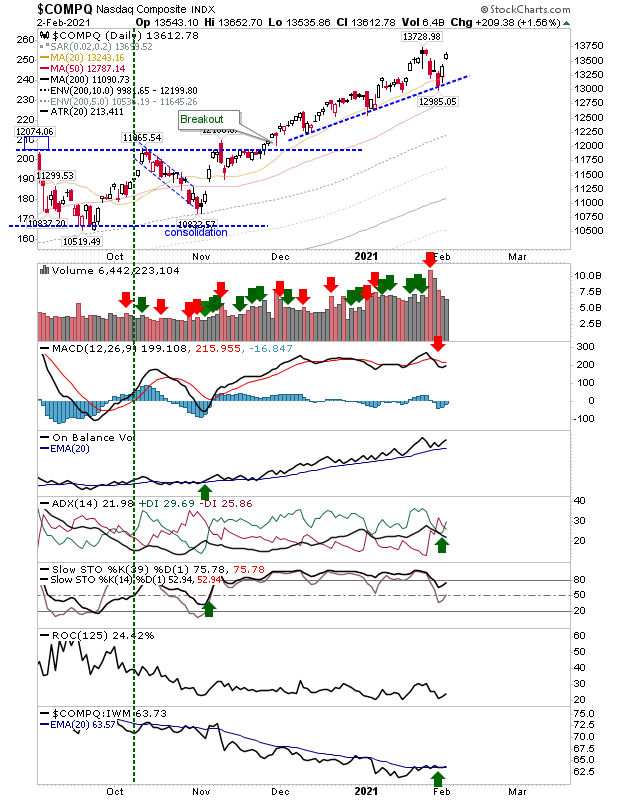

We will start with the NASDAQ. Friday's selling drove price action into the rising trendline, while Monday delivered a recovery. The swing high from January hasn't yet been challenged. Only the MACD is on a 'sell' trigger and it will take more than a couple of days of buying to bring this back into net bullish territory.

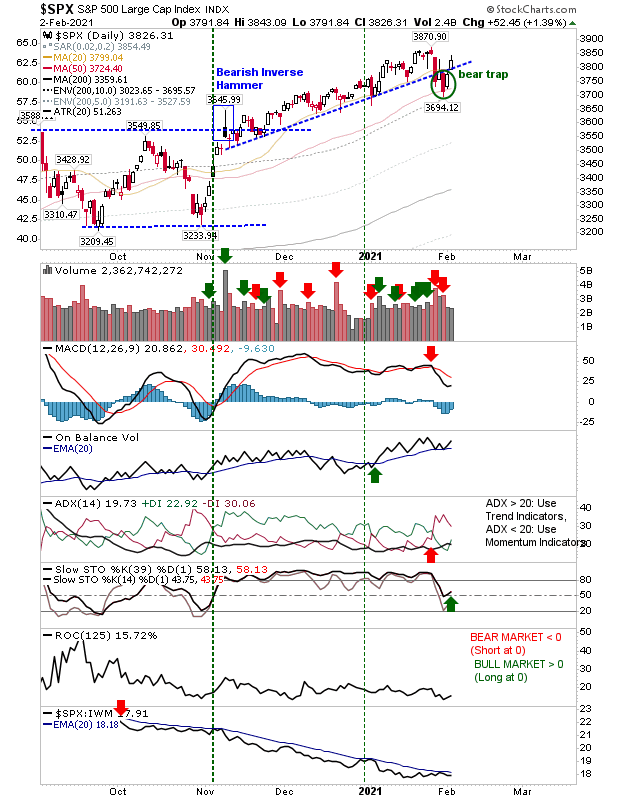

While the volume wasn't great yesterday, the S&P did manage to stage a sufficient recovery to register a 'bear trap' and return the index above its trendline. Technicals are a mix of bullish and bearish signals, although relative performance is slowly making up lost ground (vs the Russell 2000) and is on the verge of a new 'buy' trigger.

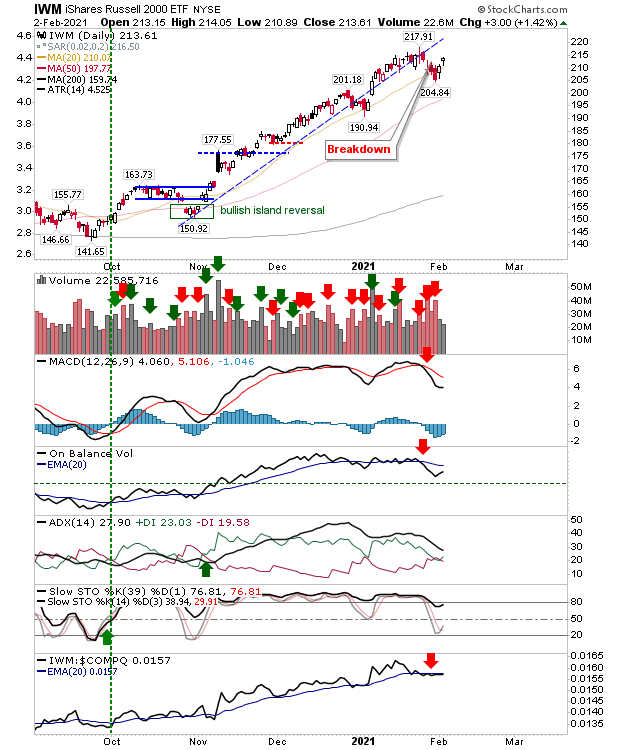

The Russell 2000 (via IWM) didn't have the momentum to make it back to resistance, but it did return above its 20-day MA. Selling volume since the break of the rising trendline has delivered a large move down in On-Balance-Volume, and the buying of the last couple of days barely made a dent in that trend. Relative performance against the NASDAQ has flat-lined. Which side will come out on top?

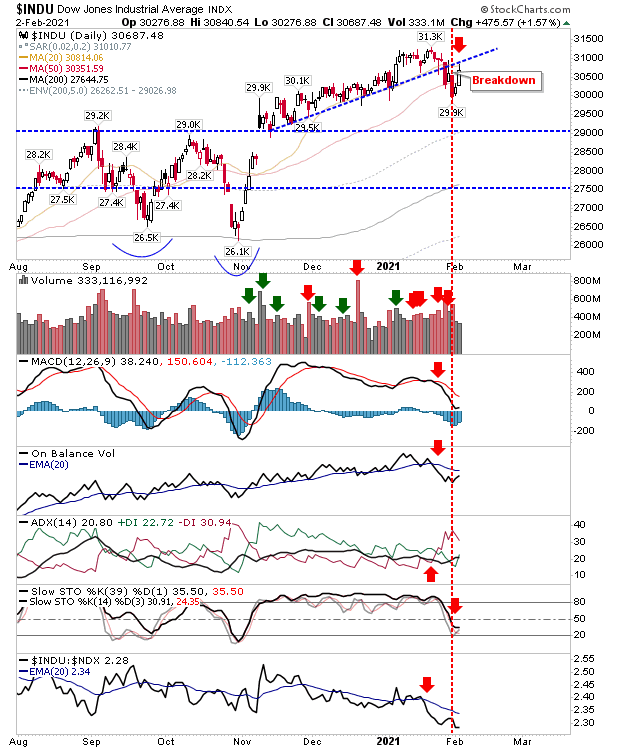

The index which may be of interest later today is the Dow Jones Industrial Average. Yesterday it tagged the rising trendline in what could be a potential reversal signal. Technicals are net bearish.

Let's see if bears have control (Dow Jones Industrial), or bulls (S&P and NASDAQ).